In this article, I am giving an update on a previously covered biotechnology company.

Back in 2019, I wrote an article covering an almost unknown company called BioXyTran Inc. (BIXT:OTCMKTS), which at the time was focusing on developing a very interesting and promising asset called BXT-25 for the treatment of ischemic stroke. The drug is an acellular oxygen carrier (AOC) that has unique properties which enable tissue oxygenation in hard-to-reach places like brain tissue during a stroke. That potential remains, but now there is a more pressing need.

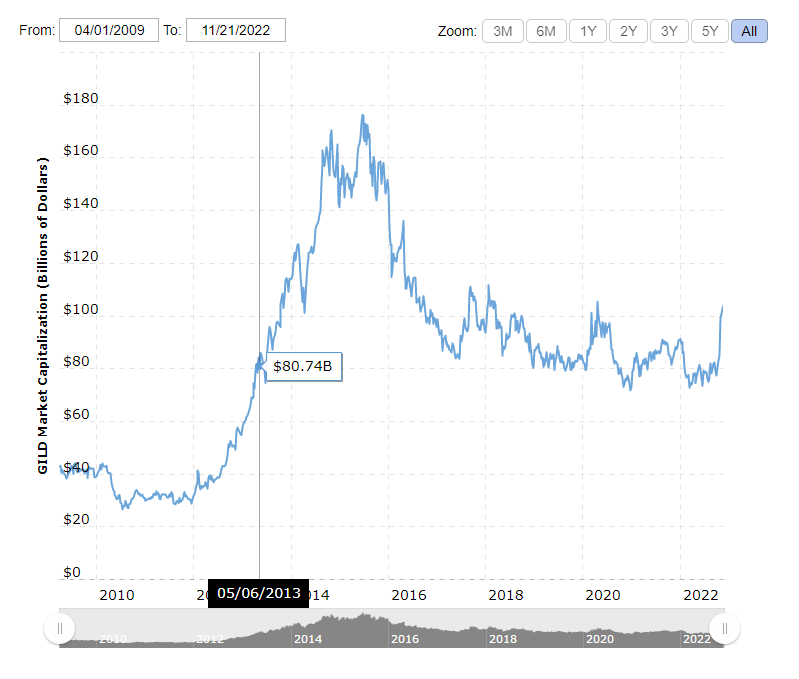

Last week BioXyTran Inc. achieved a once-in-a-decade type event with their announcement of a perfect Phase 2 clinical trial outcome with a 100% response rate by day seven. Only when Gilead Sciences Inc. (GILD:NASDAQ) announced results of their Hepatitis C treatment in May 2013, which went on to become a cure for HCV, did a trial last achieve a perfect response rate status and then increase the company's market value by US$80 billion in the process.

The question on investors' minds is how did an obscure oxygen carrier company turn into a potential pandemic-ending therapeutic company. The answer is that the therapy wasn’t a repurposed drug; it was developed from scratch.

During the pandemic's start, the company made a hard pivot into COVID-19, where a predominant number of biotechs shifted toward COVID-19 treatments.

Clinical trials in chronic diseases slowed to a halt while healthcare facilities focused solely on the pandemic. The company’s deep expertise in carbohydrate chemistry presented a unique opportunity to do what nobody else was doing — design a carbohydrate-based antiviral for COVID-19 that might act as an entry inhibitor as opposed to blocking viral replication from the inside.

The genesis of the idea was started in March 2020, when the focus of the world's researchers was on getting a compromised immune system to respond better and faster to clear the viral infection. The oral version of the antiviral they developed, ProLectin-M, is an unconventional antiviral since it doesn’t interfere at the intracellular level; instead, it blocks viral docking of the virus to the target cell by binding to galectins and a conserved site on the spike protein. Most antivirals work inside the cell.

Overcoming Adversity - David vs. Goliath Struggle

The company successfully jumped through hurdles that other companies did not have placed in their path. They were one of 38 companies suspended by the SEC in a blanket of COVID-19 enforcement actions that temporarily suspended the company and effectively forced them to reregister the company in order to achieve trading status via a 15c211 filing. To survive, the company had to raise money as essentially a private company and negotiate with debtors they were in default to.

If the SEC was using the premise of “survival of the fittest” during the COVID halts, then BioXyTan might have emerged as a new life form because, as you will see, its drug not only works but has pandemic-changing potential.

They found the backing of a private equity firm and high-networth individuals and went through an almost two-year process in order to regain trading status while cleaning up all their toxic debt. They were the only company to return to trading status as an OTCQB-listed stock from the SEC COVID trading halts. If the SEC was using the premise of “survival of the fittest” during the COVID halts, then BioXyTan might have emerged as a new life form because, as you will see, its drug not only works but has pandemic-changing potential.

Helping drive the need for new therapeutics is the fall off of vaccine effectiveness, along with COVID-19 becoming an endemic problem. However, it doesn’t seem quite endemic yet, as deaths in the United States are still averaging over 2000 weekly. Ongoing infections and hospitalizations, as well as antivirals proving effective, are going to help validate the long-term stability of a market for antivirals. Thus, this story has become pretty compelling.

BioXyTran’s Value Inflection

On Wednesday, BioXyTran released topline results from its lead asset, ProLectin-M, an orally administered COVID-19 antiviral candidate, in patients with mild-to-moderate COVID-19. The drug exceeded all expectations with the following:

- Complete elimination of viral load in 100% of patients at day seven vs. 6% in placebo (p=.001)

- Complete elimination of viral load in 88% of patients at day three vs. 0% in placebo (p=.001)

- Treated population experienced no viral rebounds within the 14-day observation period.

When looking at these results, investors have to keep in mind that BioXyTran achieved these pristine-looking results despite enrolling patients 1) with high viral load (Ct<25), 2) regardless of vaccination status (unvaccinated and vaccinated), and 3) with any medical conditions — no limits. This is noteworthy because current COVID antivirals aren’t technically indicated for patients who are otherwise considered healthy and vaccinated — Merck (MRK) and Pfizer (PFE) excluded vaccinated individuals in their Phase 3 studies to help them achieve their endpoints.

New data BioXyTran released arguably puts it in the lead in the COVID-19 antiviral field with respect to viral load data. It seems that no other company could compete to this degree.

In the case of Paxlovid, there are many contraindications for Paxlovid, which limits its market, which is enormous anyway; Pfizer expects US$22 billion in 2022 Paxlovid sales.

It’s a bit of an apples-and-oranges comparison to try to compare these results to Paxlovid because of methods and materials differences and data availability. But by all available measures, it sure looks like ProLectin-M is overthrowing Pfizer’s Paxlovid as the superior COVID-19 antiviral.

The company released data a while ago in a small Phase 1 study which suggested that the drug would work fairly well, but issues in gathering data on placebo patients made it difficult to confidently draw solid conclusions.

However, the new data BioXyTran released arguably puts it in the lead in the COVID-19 antiviral field with respect to viral load data. It seems that no other company could compete to this degree if they wanted to use their antiviral as a prophylactic, which could be especially useful in, for instance, travel or healthcare situations since the viral load can have a great effect on transmissibility.

These two clinical trials denote what looks to be an unstoppable trend that could culminate with regulatory approval.

ProLectin-M Likely Eliminates SARS-CoV-2 More Effectively

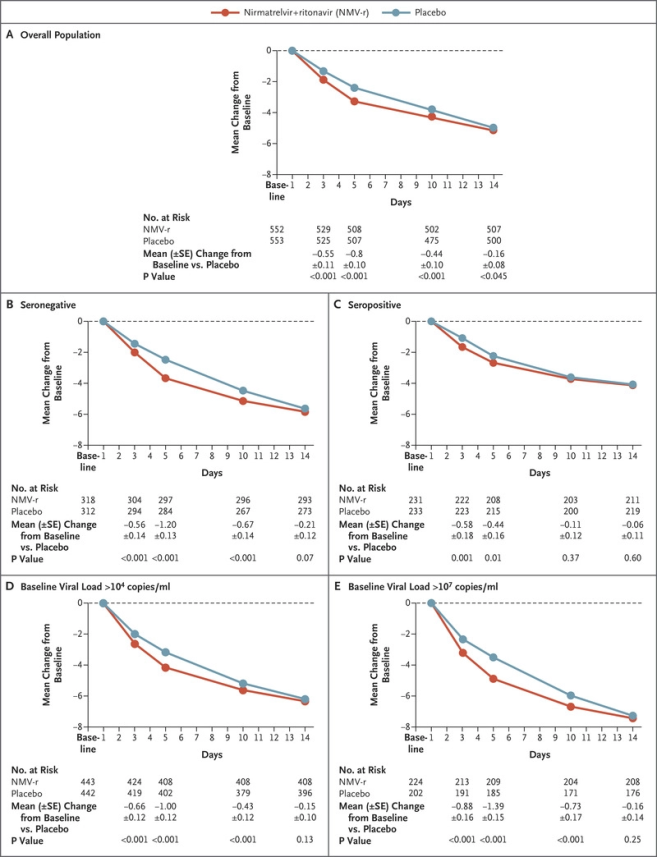

This is where the red-apple-to-green-apple comparison sets in. It looks like ProLectin is much more effective at quickly bringing the viral load down since it prevents viral entry while helping mop up the existing viral load. However, the only way to really compare the rate of viral elimination (by time-to-Ct≥30) is through two different studies with two different PCR tests and heterogeneous populations.

Despite that, the drastic difference between time-to-undetectable viral burden is so different between the groups that it paints a pretty clear picture of which antiviral likely works better.

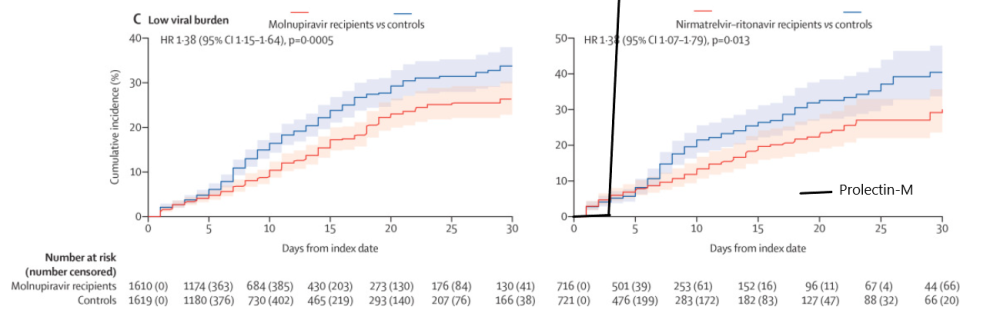

A real-world study of Paxlovid (Pfizer) and Lagevrio (Merck) was done in a hospitalized group of patients, where key endpoints measured were time to achieving low viral burden, or Ct≥30. The real-world study showed that the antivirals were highly effective in getting patients’ viral loads down, with cycle threshold values increasing over placebo by ~3 by days 5-7.

However, the antivirals failed to cause a large portion of patients to have a low viral burden by days 5-7; if one looks at the excerpted charts below, ~4-5% of patients on those two antivirals had low viral burdens vs. ~1-2% in the match controls. Compare this to BioXyTran’s 100% of treated patients reaching Ct≥30 vs. 6% of the placebo group reaching Ct≥30.

Adapted from https://www.thelancet.com/journals/laninf/article/PIIS1473-3099(22)00507-2/fulltext

BioXyTran’s treated patient data outperforms the real-world Paxlovid/Lagevrio data to the extent that when it is superimposed on the journal’s graph of the antivirals’ performances, the Prolectin curve doesn’t even fit on the chart, which is cut off at 50%.

Note that in BioXyTran’s trial, the placebo arm reached a mere 6% Ct≥30, so the placebo line would basically look flat up until day seven. Does it even matter that the compared populations are heterogenous when Prolectin-M outperforms by such a large margin?

We can further compare with Paxlovid and see that after day seven, Paxlovid mustered a mere ~-1log10 change in viral load over placebo (about 1/10th the viral load). This is good but when compared to Prolectin-M it falls short. Prolectin-M, which is showing about an average Ct value of ~+8 versus placebo on day 7 (which translates to over 1/100th the viral load in my estimation).

The picture starts becoming clearer; Prolectin clears the virus really quickly.

The last drug to achieve such a high responders rate for viral load was Gilead’s drug Harvoni which is a cure for Hepatitis C. This drug supplemented Gilead’s HIV business and helped bolster its market capitalization by US$80 billion in the course of one-and-a-half years.

It’s true that Hepatitis C was an incurable chronic condition that isn’t the same as an acute infectious disease like COVID. But they both have enormous economic burdens. And COVID-19 can lead to Long-COVID.

Long-COVID, however, is also a chronic condition with an immense burden to the person and the overall economy. It is likely that with a lack of viral rebound seen in BioXyTran’s COVID-19 Phase 2 and some symptom measurement in the anticipated Phase 3 trial, they would be making a great case for Long-COVID.

The biggest risk with BIXT is its ability to attract capital because the risk of the medicine failing is just not realistic, and it may seem too good to be true.

And in terms of economic burden, Long-COVID is estimated to be much greater (US$3.7 trillion) than Hepatitis-C, especially when one considers the fact that every time COVID mutates and reinfects patients, it has the chance of causing Long-COVID again. Hepatitis C doesn’t really pose the same issue since it’s not airborne.

Two of the leading theories for Long-COVID include viral persistence and the persistence of the spike protein S1 subunit in monocytes. Prolectin-M targets this part of the spike and therefore could theoretically address Long-COVID from either perspective.

In fact, when looking at a viral rebound after therapy, Prolectin-M exhibited no patients with the viral rebound, whereas it is documented that “Paxlovid has significant rebound issues: 3.53% and 5.40% for COVID-19 infection, 2.31% and 5.87% for COVID-19 symptoms, and 0.44% and 0.77% for hospitalizations.”

So when considering these facts, it isn’t a stretch to expect BioXyTran to measure viral rebound in its upcoming Phase 3 and potentially even start to pursue Long-COVID.

Financials

BioXyTran has maintained about a US$2 million cash burn for the past two years but only has about US$0.37 million of cash in the bank. The company will need an estimated US$2.7 million outlined in its latest presentation, to run its pivotal acute COVID-19 trial. If it wants to pay off its convertible notes, it will need an additional US$2.2 million.

While this picture makes it seem like BioXyTran is insolvent and unable to finance a Phase 3 trial, its cost structure is extremely lean, with officers forfeiting accrued salaries and benefits. The biggest risk with BIXT is its ability to attract capital because the risk of the medicine failing is just not realistic, and it may seem too good to be true.

This assumes that the peer review goes off without a hitch and doesn’t turn into a Theranos scandal. While a risk, it is important to characterize it as a very low risk since their journal article included the Mechanisms of Action (MOA) deduced from Nuclear Magnetic Resonance (NMR) imaging. The NMR tests show binding to the spike and arguing against that conclusion is equivalent to saying 1+1 is not equal to 2.

There is also the traditional regulatory risk, but the company is going after approval in the United States and India, so its dual track offers investors a plan B should any barriers present themselves. The Indian regulatory climate makes it very tough to get a drug into trials because, unlike the U.S. FDA, all the manufacturing needs to be done beforehand.

However, it's a dual-edged sword because if the study meets its endpoints in India, approval happens swiftly, whereas, in the United States, there is a lot of back and forth on the safety and manufacturing of the drug.

The risk of dilution is very high given that they filed an S-1 on April 12, 2022, but it has not gone effective. It's reasonable to assume that BioXyTran got a "no comment" S-1 which means all they have to do is mark in a price and resubmit it for effectiveness.

The fact that they didn’t complete a raise in light of these Phase 2 trial results suggests that the valuation levels might not be high enough or that they might have another plan.

Valuation

The quickest way to figure out what kind of value these homerun Phase 2 results brings to BioXyTran is to compare the market potential to existing antivirals on the market and in development. From a sales perspective, Pfizer’s antiviral Paxlovid pulled in sales of US$7.5 billion just this last quarter, which met the company’s expectations for US$22 billion in the full year.

There is a significant market opportunity for new market entrants with differentiated products; a Fierce Pharma article stated that “more needs to be done to convince doctors that Paxlovid is a good option for patients, said Angela Hwang, chief commercial officer and president of Pfizer’s global biopharmaceutical business."

‘The one area of education that we need to emphasize is: Who are the eligible people for Paxlovid,” Hwang said. “There are 22 risk factors for who should be eligible, and those include those who are over 65 — age-related risks — but equal risks like mental health illness, inactive lifestyle, risks you may not be aware of. I think that’s where we want to focus now."

BioXyTran probably doesn’t expect to sell its drug with a large sales force. What is more likely is that the company pursues a licensing deal with pharma or sells directly to governments, like when Pfizer sold 10 million courses of Paxlovid to the U.S. government for US$5.3 billion.

As with all clinical-stage biotechnology companies, there are management, funding, and clinical trial outcome risks that, in general, put biotech companies like this in a very high-risk category, which balances against the high reward.

With respect to stock market value, we can compare to a company that lost billions in market capitalization when its Phase 2 results for a COVID-19 antiviral flopped. BioXyTran isn’t the first company to design a Phase 2 trial to measure viral load. Well-backed Atea Pharmaceuticals (AVIR) released topline results from its Phase 2 trial of its own COVID-19 antiviral about a year ago.

Atea Pharmaceuticals Inc. (AVIR:NASDAQ) lost over US$2 billion in market capitalization the day it announced that its oral RdRp inhibitor called AT-527, intended to be an improved version of Gilead’s remdesivir, failed to meet its primary endpoint, and the company cited that in a subset of patients, the viral load went down (a little bit): “In high-risk patients with underlying health conditions, a reduction of viral load of approximately 0.5 log10 at day seven was observed at 550 mg (prespecified subgroup analysis) and 1,100 mg BID (exploratory subgroup analysis) compared with placebo."

The drug failed to meet its primary endpoint in the overall population of patients with mild-to-moderate COVID-19, where BioXyTran passed with flying colors. Compare Atea’s subgroup 0.5log10 reduction in viral load vs. placebo at day seven to my estimate of BioXyTran’s reduction: 2log10 reduction at day seven for ProLectin vs. placebo.

Prolectin even compares favorably to Paxlovid’s ~1log10 change vs. placebo). So we can speculate that BioXyTran’s results, in the heat of COVID-19, might have been worth $2 billion. While the pandemic fear has subsided, these results are still highly valuable, and it's likely safe to say that an antiviral with robust viral clearance, such as Prolectin-M should be worth at least a few hundred million.

In a hypothetical situation where BioXyTran completes its Phase 3 trial successfully and secures an order to a government organization in 2024 for 1/5th of what Pfizer did, we can discount that value to the present using a modest P/S multiple of 2.5x and a WACC of 30%, as well as a risk factor of 50%.

The resulting value is US$784 million. Accounting for some additional dilution, using 150 million shares outstanding, we arrive at US$5.23/share. This valuation is well below the US$2.2 billion AVIR lost when posting negative Phase 2 results, and it is significantly less than the total revenue Pfizer posted for Paxlovid in this latest quarter. From about US$0.50 for BIXT shares, this would be a 10-bagger, hypothetically.

Risks

Primary risks at this point include funding; the company needs money to run its Phase 3. The company may also have to compete with big pharma to sell their antiviral, though, at this point, the patient populations do not necessarily overlap much. Lastly, the endpoints currently set in its planned Phase 3 trial are primarily seropositivity and, secondarily, symptoms, time to discharge, duration of hospitalization, and mortality.

Other key antivirals have been approved based on time to resolution of disease/alleviation of symptoms (Tamiflu - Roche (RHHBY)) and reduction in hospitalization and death (Paxlovid - Pfizer, and Lagevrio - Merck), all of which are clinical endpoints rather than biomarker endpoints (serum positivity). However, BioXyTran is still measuring clinical endpoints; they’re just listed as secondary endpoints at this time.

As with all clinical-stage biotechnology companies, there are management, funding, and clinical trial outcome risks that, in general, put biotech companies like this in a very high-risk category, which balances against the high reward. BIXT also trades on the OTC, where volumes are lower, and investments can be more speculative, in general.

Conclusion

Bioxtytran is fighting the mindset that COVID is over and that there is no way a little pharma is capable of producing a pandemic-ending therapeutic. The prevailing thought is that the world has entered the endemic Phase and that we all have to find ways to live with the virus. The facts tell a different story.

Although there are no head-to-head comparisons of ProLectin-M to Paxlovid, BioXyTran’s Phase 2 results appear superior in every metric. There is no known toxicity or drug-to-drug interactions compared to the 40+ known drugs that Paxlovid interferes with. The efficacy results are unprecedented because BIXT had almost a 90% response rate by day three and no viral rebounds within 14 days, like those that are reported with Paxlovid use.

ProLectin-M has the potential to be one of the biggest hits of all time.

The company also proved their MOA that their drug attaches to the spike protein and galectins to prevent viral entry — these results are not expected to be a fluke.

Their journal article BIXT published harps on the idea of reducing infectivity and introduces the idea that by treating the disease early, we can potentially prevent Long-COVID. ProLectin-M is a drug designed for the masses and would likely have broad appeal given its currently-observed tolerability profile.

BIXT has about a US$65 million market cap despite its completion of Phase 2, and the price attempted a readjustment on the day of the release, but it appears that profit takers have other plans, and the stock just isn’t quite well-known yet.

Given the high insider ownership of 75% and the low float of 12 million shares, it takes some time to get the word circulated. Some may speculate that this could be a cure for COVID because there are two clinical trials that denote a very favorable trend, but what's arguably more important is counteracting the increased infectivity as the variants have mutated to become more transmissible or evade existing anti-spike antibodies from mass vaccination.

The time spent quarantining as well as the productivity lost before returning to work or feeling better, is all calculus in the future pricing of the drug. In all likelihood, with governments buying bulky contracts, the governments will set the pricing and take these factors into account.

ProLectin-M has the potential to be one of the biggest hits of all time, like Pfizer's US$22 billion Paxlovid, though this claim might seem ridiculous in light of BioXyTran’s market capitalization. Having a small amount in a portfolio could dramatically improve its performance as word of the clinical breakthrough starts to spread.