Inflation generally drives smart investors into tangible assets, and few assets are more tangible than ore-bearing ground. Hard to steal and easy to profit from, rich mining claims often provide the perfect, slow-but-steady appreciation to counterbalance the bipolar nature of the equities market.

In-ground zinc-lead, in particular, has become a prized commodity among investors seeking to diversify around the vagaries of commercial exchanges.

Zinc-lead "is among the most important of base metals, constituting an essential requirement of a country’s industrial development,” explained analyst Rick Mills on November 22, 2022.

Zinc-lead "is among the most important of base metals, constituting an essential requirement of a country’s industrial development,” explained analyst Rick Mills on November 22, 2022. “The two metals keep us powered and sheltered, yet the zinc-lead sector has not seen a major discovery in over two decades, leading to concerns over resource depletion.”

Reporting on November 17, 2022, Echelon Capital Markets stated that BCA Research’s Chief Commodity and Energy Strategist Robert Ryan “noted that risks to the global demand picture have prompted a continued decline in copper prices year-to-date, with inventories at exchanges extending their downtrend prompting expectations for tight supply over the coming decade.”

The report goes on to explain funds raised for base metals increased 17% month-over-month to US$262,000,000 in October on rapidly expanding transaction volume. Currently, zinc is sitting at around US$1.38 per lb and lead at US$0.97, which is quite rich for the metals, and one company, in particular, to keep watch on is Slave Lake Zinc Corp. (SLZ:CSE).

Slave Lake's name comes from the lake itself, and the company’s large claim lies somewhat south of this eponymous feature of the northern Canadian landscape.

The claim is in an area briefly mined for lead and zinc at the end of the second world war, but the owners at the time halted production after the market for the metals cratered in the 1950s.

American Yellowknife Mines, which operated the mine then, identified 67,950 tons grading 7.64% Zinc, 3.12% lead, 0.13% copper, and 8.22 grams per tonne (8.22 g/pt) silver near the Shaft Zone, an area that includes a headframe and underground drifting of over 400 meters into various smaller pits.

This zone includes drilling down to 200 meters, with complete mineralization found the whole way down. Samples from the pits contained 10% to 27% zinc plus lead. The existing 55-meter deep three-compartment shaft has a drift station at 45 meters providing access to a seam assayed at 55% lead, 13.5% zinc, and 84.4 g/t silver.

The Catalyst: Zinc Growing in Popularity

Unlike in the 1950s, zinc is now a money metal. It’s used to make pennies, is an important element of nutrition, and is a prime candidate to replace lithium in batteries as part of the green revolution.

Technical analyst Clive Maund opined that “with the company looking set to move forward, the move looks like the beginning of a new uptrend following the tedious downtrend from the highs of last April, and it is viewed as a speculative Buy here.”

Of course, these uses are all somewhat niche compared to the metal’s primary industrial use in the galvanization process. Zinc is important enough that governments in both the U.S. and Canada designate it as a critical material.

Currently, Slave Lake is fully permitted with a has a Type A Land Use permit and Type B Water license to have a 49-person, 3-drill operation to begin with, which allows it to move forward immediately, further de-risking the company’s plans moving forward. Funding-dependent, the company could potentially start drilling tomorrow.

However, as it stands, Slave Lake Zinc Corp. is not producing any materials for sale.

Instead, the company is continuing to expand its claim as it does further geological work to map out the footprint of a large, high-quality hydrothermal formation.

“At this stage, we are highly focused on diminishing risk,” explained Slave Lake Zinc Corp.’s CEO, Ritch Wigham. He’s recently overseen the company’s expansion from a 600-acre claim to one that’s over 18,000 acres or 76.25 sqkm and has been busy acquiring permits and developing a strong “right of first refusal” working relationship with members of the local community.

Positive Relationships and ESG

Slave Lake Zinc Corp. is one of only two companies that have successfully negotiated the multi-year, international process required to allow tribal lands in Canada to revert to Crown ownership and be claimed by commercial producers.

“We can confirm that Slave Lake Zinc and the NWTMN have a positive working relationship, as provided for in the Collaboration Agreement between the NWTMN and Slave Lake Zinc,” explained Dr. Ronald Yaworsky of KHL Consulting, speaking on behalf of the nation itself. “Slave Lake Zinc has been respectful and proactive in [its] engagement

In addition to the considerable goodwill and rich in-ground reserves he has ferreted out, Wigham says the claim’s close proximity (about 37 miles) to the Taltson hydroelectric plant will allow for an ESG-forward, hydrocarbon-free operation once the mine is up and running.

Wigham’s strategy is to continue building the claim's value by mitigating the risks any processor would face when taking on the site and ramping up to full production.

As it currently stands, Slave Lake Zinc Corp. is a basic buy-and-hold play for those interested in buying unexploited base metal reserves to hedge against either inflation or an equities market downturn. The company plans to start a comprehensive drilling program early next year to quantify in-ground reserves better and explore claim expansion opportunities.

On November 9, 2022, technical analyst Clive Maund opined that “with the company looking set to move forward, the move [up on Nov 8th, 2022] looks like the beginning of a new uptrend following the tedious downtrend from the highs of last April, and it is viewed as a speculative Buy here, and especially on any near-term dips.”

Ownership, Coverage, and Share Structure

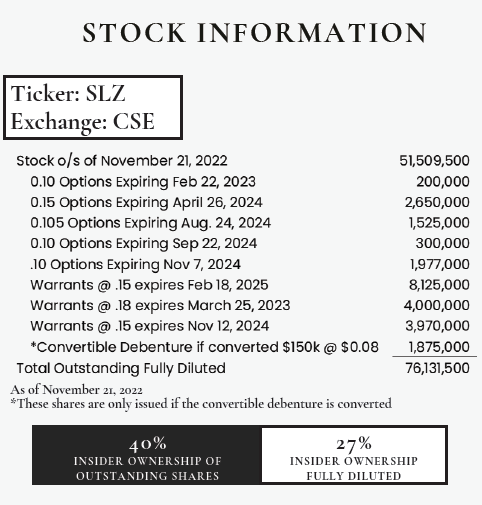

Company management owns approximately 20.8 million shares — 40% of outstanding shares, or 27% on a fully diluted basis. There are no institutional investors on record, and all of the outstanding stock is retail except for the CA$150,000.00 balance of the debenture outstanding.

Technical analyst Clive Maund of Clivemaund.com follows this stock. Click See More Live Data" to view more of what he is saying.

The company has roughly CA$300,000 in the bank and is burning CA$25,000/month at current operating levels.

Slave Lake also has 6,652,000 options in the CA$0.10 to CA$0.15 price range expiring between Feb 22, 2023, and Nov 7, 2024, as well as 16,095,000 warrants ranging from CA$0.15 to CA$0.18 expiring between March 25, 2023, and Feb 18, 2025.

An additional CA$150,000 in CA$0.08 convertible debenture financing adds another 1,875,000 potential claims. The total outstanding fully diluted share count is 76,131,500.

Slave Lake Zinc Corp. has a market cap of around US$3.153 million, with 51,509,500 shares outstanding, and it trades in the 52-week range of US$0.0115 and US$0.1429.

| Want to be the first to know about interesting Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Owen Ferguson wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Slave Lake Zinc Corp. Please click here for more information.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Slave Lake Zinc Corp., a company mentioned in this article.