If he wanted, Deepak Varshney, the CEO and President of Usha Resources Ltd. (USHA:TSX.V; USHAF:OTCQB), could put his company’s pitch, “Junior lithium explorer with a $6.5 million market cap offers a 20% nickel dividend,” on a billboard in huge type with room to spare.

Usha is a North American mineral acquisition, and exploration company focused on the development of drill-ready battery and precious metal projects. The details behind Varshney’s story present an opportunity spanning the American West to Northwest Ontario that runs the periodic table from lithium and nickel to gold and copper.

In a recent interview with Streetwise Reports, the CEO (also a professional geologist for over a decade) elaborated on what he believes sets Usha apart.

“We have done a lot of work at Lost Basin and will drill in the next couple of months. That will be an important catalyst from what we believe is becoming a really hot camp.”

—Usha CEO and President, Deepak Varshney

First up is Usha’s share structure. “We have a very tight float; about 70% of our stock is owned by management, insiders, associates, and institutions,” he said. “This gives us a strong foundation because they all believe in our potential and are committed to our growth.”

Second, Varshney noted that Usha is “the only company I know of with an under-valued, $6.5-million market cap with a drill-ready lithium brine project in Nevada. Yes, Acme Lithium’s Clayton Valley project is at roughly the same stage of readiness as our Jackpot Lake, but Acme has a market cap of around $60 million, 10 times ours. From an investment perspective, I would say that puts us a step above.”

Finally, there is Usha’s intention to spin out its Nicobat nickel property, located in Northwest Ontario, into a subsidiary, Formation Metals. Usha shareholders get a 20% dividend in Formation Metals.

“When you put it all together, we are an explorer with a $6.5-million market cap, an outstanding lithium brine project in Nevada that gives everybody a 20% bonus in nickel,” Varshney summed up. “You can't find that anywhere else in the market today.”

Fast-Moving Lithium Brings Projects to Nevada

Usha received approval and acquired 100% of the Jackpot Lake lithium project, located in Clark County, Nevada, in late March 2022. The property—which was highly sought-after by a number of successful exploration companies—comprises 140 mineral claims that total 2,800 acres within a playa. The geologic model is similar to that of Albemarle’s Silver Peak lithium mine, which has operated continuously since 1966, and Iconic Mineral’s Bonnie Claire property, which recently released a PEA (preliminary economic assessment) that indicates a 40-year mine with an after-tax net present value at 8% of $1.5 billion.

“Jackpot is our flagship project, and an acquisition of this caliber required a creative and compelling bid to win that focused on our excellent cap structure and experienced management team. In a lithium brine project, you have to drill only a few holes to demonstrate the presence and the consistency of the mineral. As both a trained geo and the company’s primary decision-maker, I believe we are looking at something very special, and I want to move expeditiously,” Varshney said.

“With a brine project, you can get to a resource much faster than with a clay or a pegmatite project,” he added.

He also noted that lithium brine projects have lower CAPEX and operating costs once they are in production. What’s more, according to Varshney, advances in DLE—direct lithium extraction—technology is on Usha’s side.

DLE is faster than evaporation, uses less water, and has higher rates of lithium recovery than conventional processes. “I think you will see more companies investing in technology to make brine projects more economical and environmentally friendly,” Varshney said.

The next catalyst at Jackpot Lake is the start of an aggressive exploration program and drilling in summer 2022, with the goal of completing a 43-101 resource estimate by Q4 2022.

Nickel Play for Formation Metals

Nicobat, the project that will be Formation Metals’ flagship, is a nickel-copper-cobalt project in the Rainy River District in Northwest Ontario, Canada. According to Varshney, it has a historic resource of 5.5 million tonnes at the same grade that Canada Nickel Co. has in the Timmins mining camp, with over 19,000 meters of drilling to date.

Formation’s first activities will focus on updating the historic resource and exploration of high-grade areas of the property, particularly in the vicinity of a modern drill hole approximately 64 meters from the surface of 1.05% Ni that includes almost 10 meters of 1.92% Ni, and a potential feeder zone at a depth that could contain higher grades.

“If, as we suspect, a near-surface mineral zone opens up at depth into a higher-grade zone, it will improve the economics considerably,” Varshney said.

The same management and advisory teams will lead both Usha and Formation. As Varshney quipped, “We are cloning the company. This allows us to minimize dilution and reward our shareholders.”

Copper-Gold Catalyst in Arizona

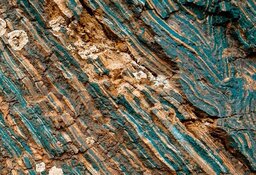

Usha’s name—shared by the Hindu goddess of the dawn and Varshney’s mother—was inspired by the rosy-gold colors of gold and copper and the sky at dawn, which is what you can expect to find at the company’s Lost Basin project.

Located in Mojave County, Arizona, Lost Basin is a gold-copper project comprised of 133 claims in an area that boasts significant gold production dating back to the 1870s. Historical non-compliant results on the property include:

- 8 grams per ton (g/t) gold from the area of the Golden Hill Mine

- 77 g/t gold from the area of the Climax Mine

- 7 g/t gold from the Wall Street Workings

- 1% copper from the area of the Copper Blowout

The project is in good company.

Its neighbor, Gold Basin Resources, includes a member of the Discovery Group, which of course, sold Great Bear Resources Ltd. to Kinross in February 2022 for CA$1.7 billion. 20,000 meters will have been drilled next door by the end of 2022.

“We are very happy to have such a strong group backing our neighbors, who are working so aggressively next to us,” Varshney said. “We have done a lot of work at Lost Basin and will drill in the next couple of months. That will be an important catalyst from what we believe is becoming a really hot camp.”

“Being at Lost Basin is important to us. We love gold. But we also value the ability to provide opportunities in battery metals, which for the coming decades give us an opportunity to stand out in the marketplace,” Varshney concluded.

Raises Cash in Private Placements

Usha recently raised slightly more than $1.11 million in two non-brokered private placements.

The first one was announced on April 4th and was slated to raise CA$300K by issuing 1 million units at CA$0.30.

Once that was done, Usha completed a second.

The second private placement, which was oversubscribed, issued 2,934,998 units at CA$0.30 apiece, a premium to Usha’s current share price.

Each unit consists of one Usha share plus a transferrable share purchase warrant that can be exercised at CA$0.45 for up to two years from the date the placement officially closed. Once the two-year window expires, so do the warrants.

Warrants from the first tranche must be held for four months, plus a day, before they can be exercised.

The TSX Venture Exchange has given Usha until June 13th to close the final tranche of the private placement.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Diane Fraser compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. They or members of their household own securities of the following companies mentioned in the article: None. They or members of their household are paid by the following companies mentioned in this article: None. Their company has a financial relationship with the following companies referred to in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Usha Resources Ltd. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional, and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice, and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees, or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in the securities mentioned. Directors, officers, employees, or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Usha Resources Ltd., a company mentioned in this article.