Fully integrated lithium company Livent Corp. (LTHM:NYSE), which manufactures lithium products for use in lithium-based batteries, specialty polymers and chemical synthesis applications and electric vehicles (EV), announced financial results for the first quarter of 2022 ended March 31, 2022.

The firm indicated that in Q1/22 it continued to see further improvement in the overall lithium market and added that it benefited from strong customer demand and higher realized prices than expected at the start of the year.

Livent stated that during Q1/22 total revenue increased by 56% to $143.5 million, compared to $91.7, million in Q1/21.

The company reported that in Q1/22 it posted GAAP net income of $53.2 million, or $0.28 per diluted share, versus a net loss of $0.8 million, or a net loss of $0.01 per diluted share in Q1/21. The firm highlighted that GAAP net income was up 609% sequentially over Q4/21.

Livent advised that in Q1/22 adjusted EBITDA was $53.3 million, or $0.21 per diluted share, and noted that this represented a 94% sequential increase over the previous quarter.

Livent Corp.'s President and CEO Paul Graves commented, "Strong lithium demand growth has continued in 2022…Published lithium prices in all forms have increased rapidly amid very tight market conditions and Livent continues to achieve higher realized prices across its entire product portfolio."

The company advised that it remains on track with its plans to expand capacity for both its lithium carbonate and lithium hydroxide production to meet rising demand from its clients.

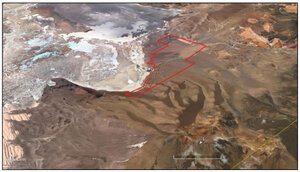

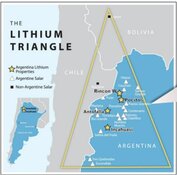

The firm stated that it is on schedule with its plans to add 20,000 Mt of lithium carbonate capacity in Argentina by the end of 2023, which would equate to a doubling of the volume produced in 2021. The company added that as it previously announced, it has commenced engineering work on a second capacity expansion program in Argentina that will be capable of delivering another 30,000 Mt of lithium carbonate capacity by year-end 2020. Livent noted that it is now also evaluating the potential for a third longer-term expansion project in Argentina that would add still another 30,000 Mt of lithium carbonate capacity, and if realized, would bring the total capacity at all its operations in Argentina up of 100,000 Mt by year-end 2030.

Livent said it is also expanding its lithium hydroxide production and plans to add 15,000 Mt of capacity at a brand-new location in China by year-end 2023. The firm mentioned it is now considering building a new plant in Europe or North America that would be capable of processing recycled material from batteries into lithium hydroxide. The company listed that expects to expand its lithium hydroxide capacity at all of its operations to 55,000 Mt or more by year-end 2025, not including its investment in Nemaska Lithium Inc.

Livent noted that two days ago it announced that it issued 17,500,000 shares of its common stock and agreed to double its ownership interest in Nemaska Lithium to 50%. The company stated that Nemaska is located in Québec, Canada and is capable of producing 34,000 Mt of lithium hydroxide annually. The firm indicated that the transaction is pending subject to various conditions and regulatory approvals.

Livent advised that it is significantly increasing its forward revenue and adjusted EBITDA guidance for FY22. The company stated that while its estimates for total product volumes remain constant, it is raising its estimates to account for higher expected realized prices across all lithium products.

The company stated that it now expects FY/22 revenues of $755-835 million and adjusted EBITDA of $290-350 million. The firm highlighted that the midpoint of the revised estimates represents a projected 89% increase in revenue and 360% increase in adjusted EBITDA over FY/21 results.

Livent is a fully integrated producer of high-quality finished lithium compounds. The company has a wide range of lithium products that are used to meet rising demand for green energy and the modern mobile economy. The firm produces battery-grade lithium hydroxide for use in high performance lithium-ion batteries and supplies butyllithium for use in manufacturing polymers, pharmaceutical products, and other specialty lithium compounds. The company has manufacturing operations in the U.S., Argentina, China, England, and India.

Livent Corp. started the day with a market cap of around $3.5 billion with approximately 161.8 million shares outstanding and a short interest of about 13%. LTHM shares opened 23.5% higher today at $27.07 (+$5.15, +23.49%) over yesterday's $21.92 closing price. The stock traded today between $25.65 and $27.78 per share and closed at $28.55 (+$6.59, +30.01%).

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.