Trending Now

Contributed Opinion

Technical Analyst Clive Maund shares an update on BioLargo Inc. to explain why he believes it is an Immediate Strong Buy.

Research Report

Verona Pharma Plc. recently is gearing up for a potential FDA approval of its twice-daily ensifentrine, according to a Jefferies & Co. research note.

Research Report

Utilities could use this technology, which reduces PFAS in water, to meet the new standards for public drinking water, noted an Oak Ridge Financial report.

Contributed Opinion

Ron Struthers of Struthers Resource Stock Report takes a look at the hundreds of M&A agreements recently signed, the current state of copper as it is breaking out, and Zonte Metals, a company that recently made an important discovery.

Research Report

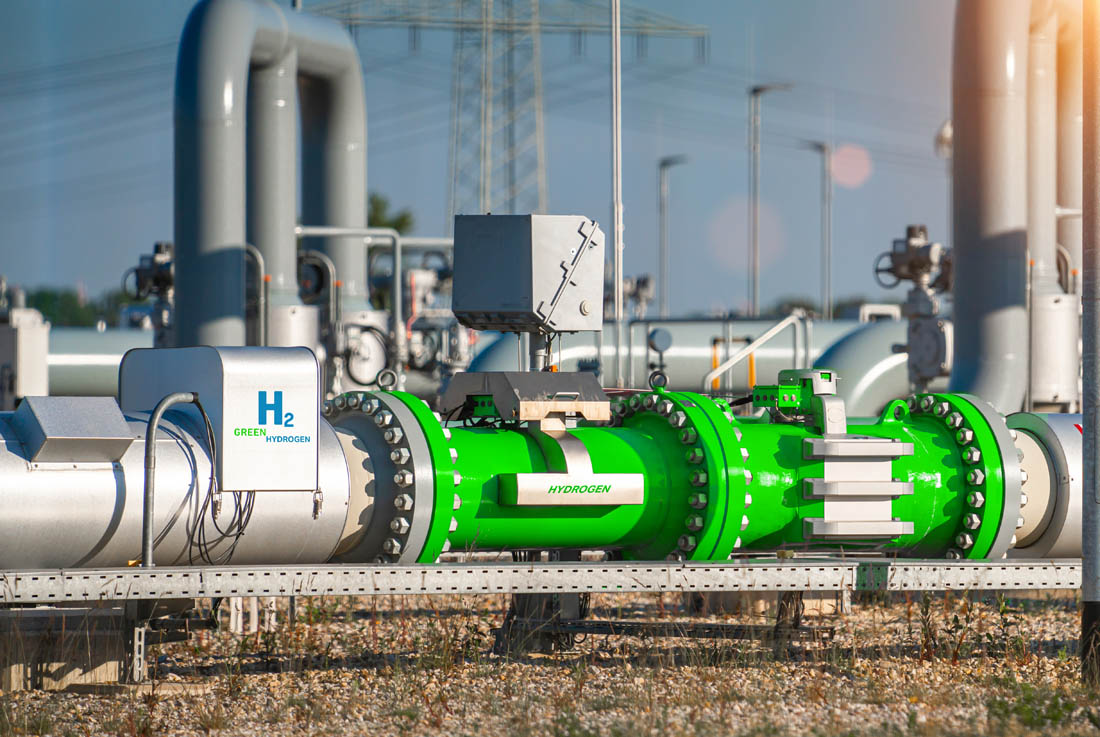

In light of Jericho Energy Ventures Inc.'s recent news, Atrium Research analysts reiterated their Buy rating and CA$0.50 target price.

Contributed Opinion

In light of this morning's news, Technical Analyst Clive Maund takes a look at NevGold Corp. to explain why he believes it is an Immediate Strong Buy.

Contributed Opinion

Michael Ballanger of GGM Advisory Inc. shares his thoughts on Vortex Minerals Inc. to explain why he believes it is currently a Buy.

Contributed Opinion

In light of Silver North Resources Ltd.'s 2024 drilling program, Technical Analyst Clive Maund takes another look at the company to explain why he believes the stock is an Immediate Strong Buy.

Company News

Gold Silver Copper Platinum Palladium Zinc Oil Gas Natural Gas Battery Metals Coal Uranium Pharma Biotech & Life Sci

Significant Gold Discoveries Reported at K2 Zone

New Found Gold Corp. has reported gold intercepts from its K2 Zone at the Queensway project in Newfoundland and Labrador. Read on to see what some experts are saying about this gold stock.Franco Will Increase Production Without Cobre Panama

Contributed Opinion

Global Analyst Adrian Day looks at first-quarter results from three resource companies, as well as recaps Francos annual "investor day." Overall, he believes the results were positive.

LA Biotech's Lower Revenue Will Be Short Lived

Research Report

While Ontrak Inc. may have had a loss in revenue in 2023, this will be short-lived, according to a Roth MKM research note.