What a difference sixteen days make.

I departed Canada for the United Kingdom on March 26 with every intention of forgetting about the investment landscape in favor of a magical tour of the Cornwall region of England, where my maternal grandparents were born and raised before they emigrated to Canada at the turn of the 19th century.

The afternoon of departure the price of gold closed at $3,052.30, but by the following Tuesday, amidst the total unraveling of the U.S. bond market, gold had touched $2,970.30 as the scramble for liquidity forced gold investors to dump their positions to meet margin calls on stocks and in the case of the hedge fund community, massive cash calls leading to forced liquidation of one of those "financial weapons of mass destruction" — the "basis trade."

Always designed by the "smartest guys in the room," the basis trade uses massive leverage in bonds, sometimes as high as 20:1, which means that a 5% move against these rocket scientists can totally vapourize positions — which is exactly what happened once Donald Trump announced the surprisingly-harsh tariff rules that spooked everyone from the lowly odd-lot day trader to the biggest hedge funds on the planet. As we always see when leverage gets unwound, the margin clerks did not wait around for the "best bid possible" but instead sought out "every bid possible" and blasted those bond positions into the stratosphere.

The yield on the 10-year treasury, which had collapsed under the weight of the crashing stock and crypto markets, suddenly spiked from a 3.85% low on April 4 to a high of 4.592% as I was flying back across the Atlantic six days later.

To have the conservative, historically-dependable U.S. treasury bonds crash 12.4% in six days only to reverse higher by 19.2% five days later is volatility of the "Armageddon" variety. Volatility such as the likes of this are symptomatic of a financial system under duress and, in this case, extreme duress, and if there is one thing that can kick the bank-owned Federal Reserve into full panic mode, it is an event like the one we just witnessed last week.

What surprised me was that all of the media coverage was centered on the White House while the Fed and Jay Powell remained eerily silent. With rumors of margin troubles haunting hedge funds like Citadel and ExodusPoint, what the bubbleheads at CNBC refused to divulge was where these funds source the leverage to place 20:1 leveraged bets on T-bonds. Of course, we all know that big money-center banks like JP Morgan and Bank of America extend the loans, and it is usually their compliance and risk managers that lower the liquidation boom.

Now, you all recall my analogy of the "pigs in the barnyard" from past missives. There are pink ones and brown ones and even a few black and white ones, but when the farmer's wife begins to ring the triangle to signify that the trough has now been filled with all kinds of slop, every pig, regardless of age, creed, or color comes waddling across the yard to partake of the feast.

Well, that is no different from those big, waddling money-center banks. The fees they earn on loans to the hedge fund community are extremely lucrative, and when the U.S. bond market begins to ring the triangle each time another big treasury financing needs to be placed, the banks waddle over to the trough for the frenzy. This is why I found the silence so deafening, with literally no comment whatsoever from Powell and Co. In the post-FOMC meeting interviews that we see every six weeks that are telecast all over the world, Jerome Powell has mentioned "systemic risk" as the only condition other than "maximum full employment" and "price stability" that can alter the Fed's monetary policy. I might submit that a 12.4% crash followed by an immediate 19.2% spike might be construed as a "systemic event" worthy of at least a one-line statement. However, they said nothing.

Also contributing to this maelstrom of volatility was the action in the U.S. dollar index.

Dollar bulls have been riding high on a wave of complacency for the better part of the past 14 years, although the actual top in late 2022 above 115 was undoubtedly a secular top despite all the ramblings about "American exceptionalism" and "milkshake theories."

The fact that the dollar index gave up over 1.8% on Friday alone is a testimonial to a global exodus from U.S. assets, which includes stocks, bonds, and real estate, as investors look to repatriate their funds away from the hostility of U.S. tariff rules and potentially confiscatory measures as experienced by Russia after their invasion of Ukraine.

Trump and his lieutenants better have engaged in extensive "game theory" exercises when they elected to embark on this campaign of trade-related murder and mayhem. As anticipated, the global investment community is casting its judgment in a most exacting manner.

Stocks

From the perspective of the professional trader, the lows of last week on Monday turned out to be the lows for the current decline. Subscribers were told on Monday:

"This <adding to positions> is what I am doing with my cash. I am not "buying the dip" because the Fed has my back; I am adding to grossly undervalued positions that have great teams shepherding my money."

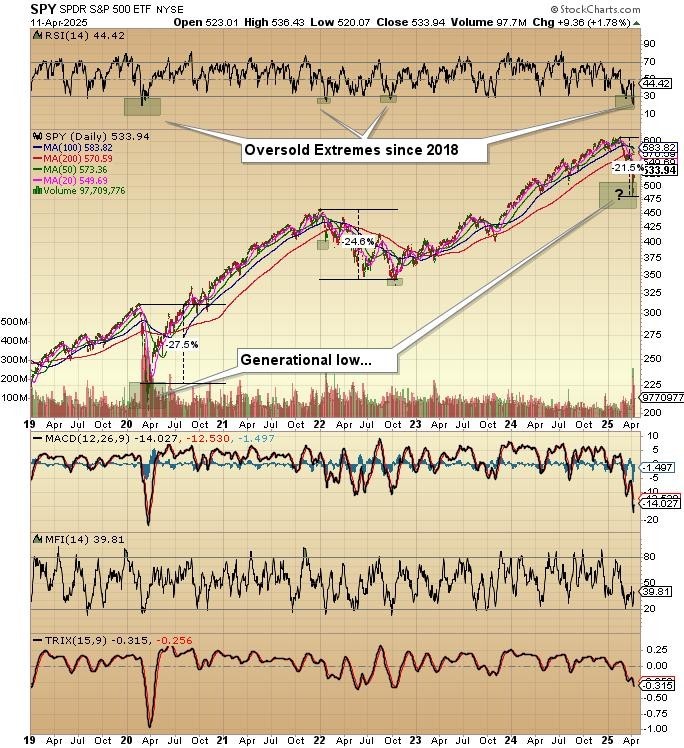

As convinced as I am that 2025 high at $613 for the SPY:US will prove to be the high for the current bull market, technically it was only into bear market territory for only the briefest of moments. At the intraday low of $481.80, the SPY:US was down 21.4% from the top, but at Friday's closing bell, it was only (tongue-in-cheek) down 12.9%, so for the decline, it is still in "correction" territory having recovered from the same amplitude of decline that we saw in the period of 2022-2023 (∞ -24.5%).

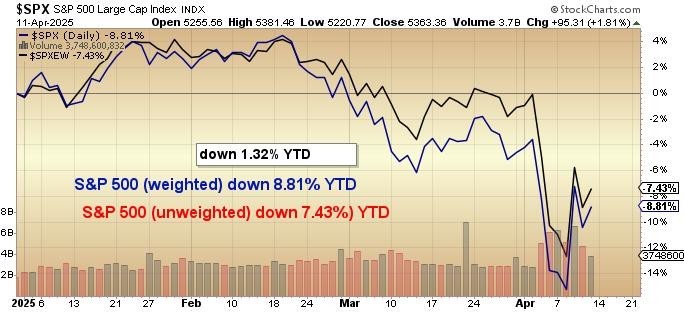

The damage in the U.S. equity markets has been severe enough to have the weighted S&P with all of the overweighted Mag Seven stocks now underperforming the unweighted S&P. The "AI" bubble has now popped, and as I have been writing for a few months now, whenever a bubble as drastically over-owned and over-hyped as the AI bubble pops, they rarely (if ever) resume leadership when the ensuing bottom finally arrives.

For a metal investor such as I, this crack in the bubble should cause a stampede into the hard asset, safe-haven type stocks that I believe will closely resemble the Stagflation ‘70's which means that the metals led by gold and copper and energy will be the preferred points of sanctuary for portfolio managers the world over.

In the near term, I think stocks can rally for a while longer. Perhaps up to as high as the 200-dma for the SPY:US at around $570.59. That is a 6.4% advance from current price levels, and while it sounds like it is a very real possibility, I think that the violence of this past two weeks in not only stocks but bonds and the U.S. dollar makes a re-test of the lows at $481.80 a strong likelihood.

Importantly, it will be the behaviour of the market in terms of breadth and leadership that sets up either a longer duration recovery rally or a resumption and re-emergence of the bear market that snarled ever so briefly on Monday of last week. With an RSI approaching 20 and CNBC anchors all downing valiums like chocolate raisins at a child's birthday party, calling the lows from lovely Selsey, England was about as seamless as it gets.

I added to my two favorite junior issues early last week with fortuitous pick-offs in Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) (at CA$0.215 and below) and Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) (at $0.20 and below). I also added to my beloved Freeport-McMoRan Inc. (FCX:NYSE) (at $30 and below), which had the audacity to get jumbled together with everything else not nailed down and despite firm copper and screaming gold prices. It hit a forced liquidation low on the Monday crash day of $28.50.

Sporting an RSI well under the magical oversold 30 level, I was a buyer all day long on both Monday and Tuesday. What prompted me to get so aggressive was the action in copper, which grabbed a foothold above the $4.00/lb. level on both days before rallying to close near its respective highs again on both days.

As the copper futures were getting scooped up aggressively, I sent a note to subscribers suggesting that "someone or something is getting blown up," meaning that it looked, felt, and smelled like either a large investor or a fund was going through a forced liquidation where everything in it was getting tossed summarily overboard. By Wednesday, with the average daily volume shrinking down to its normal level, the stock embarked on a decent rally and went out on the week at $33.35, up sharply from the Monday crash low but still nigh on $10 below where it was the day before L departed for the U.K. For the record, I would still be a buyer and still think the market is short-changing FCX by completely overlooking the 30% of revenues from gold production.

One last chart to show for the SPY:US includes a look at the looming convergence of the 50- dma and 200-dma moving averages, which, once completed, takes on the ominous moniker of the all-encompassing "death cross," a truly powerful technical signal and one that historically confirms the arrival of a bona fide bear market.

I called for the arrival of the "Papa Bear" back in the GGMA 2025 Forecast Issue, thanks largely due to my concern over fiscal austerity and the threat of tariffs. Like the first term of the Reagan years, it took until May 1981 for investors to lose the enchanted glow of "Morning in America," while it took not quite as long for them to jettison "American Exceptionalism" and its ability to "Make America Great Again" in 2025.

Watch for that "death cross" in the upcoming sessions, and it if arrives, be sure to put back the hedges that we were holding when I left for London two weeks ago.

Gold

What can I say about the price of gold?

When I was writing the forecast issue back in mid-December, gold was at around $2,700. To the left is the graphic that laid out my price targets for all of the major asset classes that I follow.

In that time frame, since I published the GGMA 2025 Forecast Issue, gold has surpassed my target while the DJIA, the S&P 500, and the NASDAQ have all crumbled below my bearish price targets. I called a low for the yield on U.S. 10-year treasury bonds back in December at a time when they were quoted at a 4.50% yield.

They hit 3.85% on April 4, leaving only two of my forecasts to be realized before I take the proverbial victory lap.

To be completely honest, the only asset that is yet to be achieved, but nevertheless, that belongs above my 2020 forecast, is copper. The mainstream narrative in the crash to $4.00 after "Liberation Day" shocked the world was that copper was going to suffer in the impending recession that would be triggered by those dastardly tariffs.

However, I refute that wholeheartedly because the tariffs are not going to prevent China from expanding its electrical grid to accommodate those 50-plus new modular nuclear reactors currently under construction. They also cannot prevent the degradation of the global copper supply through exploitation without replacement, which is the function of WOKE and/or DEI anti-mining policy regimes in many of the copper-rich producing regions.

The world is going electric whether or not the White House, either by legislation or executive order, demands and promotes the "Drill, baby, drill" campaign while it last week came out in favor of coal, which most certainly will have the leftist global warming drum-beaters up in arms and in need of Prozac, Jack Daniels, and a frontal lobotomy.

Back to gold, if there is one commanding attribute that gold holds, it is that it has always been a harbinger of cataclysmic change and/or strife. As if it had a built-in radar screen, gold bolted through the $3,000 level days before "Liberation Day," having started the advance in late February even as stocks were still mesmerized with the Republican landslide and investor class love affair. While the CNBC anchors were all enjoying smug little "group hugs" and "wink, wink, nudge, nudge" nods of collective patreonism, the gold market was being groomed for its ultimate utility as a very safe place to have one's wealth in light of a broken bond market and insanely-overvalued stock market.

The White House did not see it coming; the Fed elected to take a "wait and see" approach; the Wall Street strategists did not see it and were actively advising a "long and strong" portfolio approach, and the financial media led by the carpetbaggers at CNBC did not see it either but still remained living, breathing embodiments of the word "complacency."

The one entity that "got it" in spades was gold. With my second largest holding in a junior developer with a sizable resource (2.317 million ounces in Nevada) trading a little over $12 per ounce of in-ground gold, Getchell Gold Corp. (and many others like it) is poised to enjoy the fruits of gold's labor as it resides $4 per ounce above my 2025 forecast price of US$3,250 per ounce. As this golden bull gathers momentum thanks largely to the impending rotation away from paper and into hard assets, junior gold developers will be valued closer to $150-200 per ounce of in-ground gold versus the ridiculous levels under $25 per ounce where they are being valued today.

It will take time but it IS coming.

Since the U.S. dollar has finally succumbed to an "Emperor's New Clothes" type of revelation brought about by the abrupt and shocking revelation that America has a sovereign debt problem, the break of the century mark for the dollar index marks the start of a secular unwinding of the "dollar supreme" era where foreign investors kept buying day in and day out into the "cleanest dirty shirt" impression of the American Treasury bond.

The investor class that has used treasuries to comprise the 40% portion of the 60-40 portfolio model is now being forced kicking and screaming to use something other than U.S. treasuries, and that, for many, is now gold. I am obviously going to need to re-think my strategy on gold as to not only the target price but also whether this explosion in price is event-driven or not. Just as easily as the stock price rallied nearly 3,000 points on a pause in the tariffs last Wednesday, the gold price rallied over $200 in three days alongside stocks, which is somewhat of a departure.

In the end, I own gold for all of the reasons I laid out when I launched this service back in January 2020. The only way the U.S. Treasury can refinance the $7 trillion of new debt is to collateralize it with portions of that 8,311 metric tonnes of gold currently held on behalf of the treasury, and that does not work at USD $3,254 per ounce. At 10% coverage, they would need a gold price of $12,627 per ounce to act as a protective buffer, and that would use only the $37 trillion of national debt without provision for entitlements like Medicare and Social Security.

With a backdrop like that, of all the sub-groups and sub-sectors, the junior gold developers are the most highly leveraged to the current gold price, followed by the explorers. Non-producers with an economically viable resource (like Getchell) will provide investors with a low-risk method of recovering the substantial losses they are incurring (or have incurred) in technology or crypto thus far in this most challenging Year of Our Lord 2025, a year that has brought entirely new meaning to the word "shrinkage." One look at most non-gold portfolio statements is worth more than a long swim in the North Sea in June.

GGMA 2025 Portfolio Account:

No new positions were taken. The correction of the past two weeks knocked portfolios back after a superb month of March with the absurdity of the pullbacks in both Getchell and Fitzroy. I sold none of either.

GGMA 2025 Trading Account:

I added to 300,000 FTZ/FTZFF and 100,000 GTCH/GGLDF as well as 1,000 FCX and 50 additional FCX June $30 calls at $3.00 (now long 100). I sold the VIX April $25 calls for $8.20, having paid $2.50 back in February and riding them underwater until last Monday. By Wednesday, of course, they were at $16.50, but with everything whipping around like a headless chicken, I took the trade and left another $8.00 (US$40k) on the proverbial table.

With gold at $3,254, Getchell is a cinch to see higher prices over the next year or so. These juniors need capital flow, and that will come as funds trickle down from seniors to the intermediates and then ultimately to the juniors, then the explorers. Of course, big, new discoveries will attract capital quicker than simply relying on existing resources, which is why GTCH/GGLDF needs to get that warrant money so they can go after a Tier Two or, hopefully, Tier One category for Fondaway Canyon. I definitely think it is doable, but money will call the shot.

FTZ/FTZFF needs absolutely nothing other than the continuation of the three active and fully- funded drill programs in order to advance to all-time highs. Management is eager to re-commence with drilling at Caballos, and that is important because drilling will be ending around the end of June as Chilean winter will come fast. They can drill all year round at Polimet and Buen Retiro, but the excitement will be the next 3-4 holes at Caballos. This holding represents 21% of the GGMA 2025 Trading Accoun,t which is why I have such high expectations for the account.

| Want to be the first to know about interesting Gold, Uranium, Oil & Gas - Exploration & Production, Base Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc. and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.