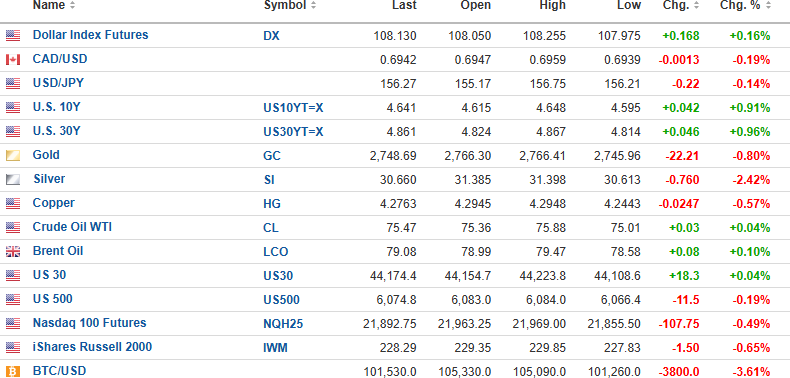

USD dollar index is up 0.16% to 108.130 this morning, with the 10-year yield up 0.91% to 4.641% and the 30-year yield up 0.96% to 4.861%.

Gold (-0.80%), silver (-2.42%), and copper (-0.57%) are down, with oil (+0.04%) up to $75.47/bbl. Stock index futures are mixed, with the DJIA (+0.04%) up 18.3, but the S&P 500 (-0.19%) is down 11.5 points, and the NASDAQ (-0.49%) is down 107.75 points.

Risk barometer Bitcoin (-3.61%) is down $3,800 to $101,530 and appears to be textbook "distribution" from where I sit.

GTCH/GGLDF PEA

I sent out the document and press release earlier, as well as a Tweet to my 3,483 followers with the superb news that Getchell Gold Corp.'s (GTCH:CSE; GGLDF:OTCQB) Fondaway Canyon has turned out to be everything and more than I expected and while it is frustrating that the world has been refusing to pay up for the shares despite concrete evidence since 2022 that Getchell owned as probable Tier One asset over time, this morning's news release has most certainly armed them with enough ammunition to attract the interest of the investment community and the corporate entities in the hunt for more growable gold ounces.

I will refrain from any gushing commentary but rather repeat an email from a friend of mine that first introduced me to the company eight years ago and a long-term shareholder since 2011.

"Gents . . . Wow wow wow! . . . this is amazing . . . check out the sensitivity analysis . . . and look at the numbers using a gold price of $2750!

Also of note the scope of these numbers only covers the potential Open Pit in the Central Area and not the potential resource under the open pit . . . this deposit is open for expansion in virtually every direction and has potential Tier One Asset written all over it!

I love it!"

A "Tier One Gold Asset" is an asset with a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold, and total cash costs per ounce over the mine life that are in the lower half of the industry cost curve.

Fondaway Canyon qualifies in LOM ("life of mine") and, with further drilling, should be able to achieve the 500,000-ounce p.a. in time.

Getchell is a huge Buy. Big "eyes" are now on the company. Now all we need is "money flow" to favor the sector. . .

Stocks

All day yesterday, the SPY:US traded sideways after gapping up on the opening from 11:30 am to just before the final bell and then faded, which reeked of distribution during most of the day.

Operation "Stargate," announced by President Trump, sent the companies involved screaming out of the gate, but understand that none of them have the cash to build a $500 billion AI facility, so it will have to come from the capital markets or the government which means it was one big "nothing-burger."

While stocks can certainly work higher, one trade not for the "weak of heart" is the SPY Feb $595 puts, which traded at $20 nine sessions ago. They closed at $3.97 last night. I will not make them a formal GGMA Buy, but they are very tempting.

Also, the VIX:US did not budge yesterday trading briefly under 15 but then quickly rebounding and then closing higher on the day. On a day with the S&P charging out of the gate, I find it noteworthy that volatility rose and view that as an omen of sorts.

| Want to be the first to know about interesting Critical Metals and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.