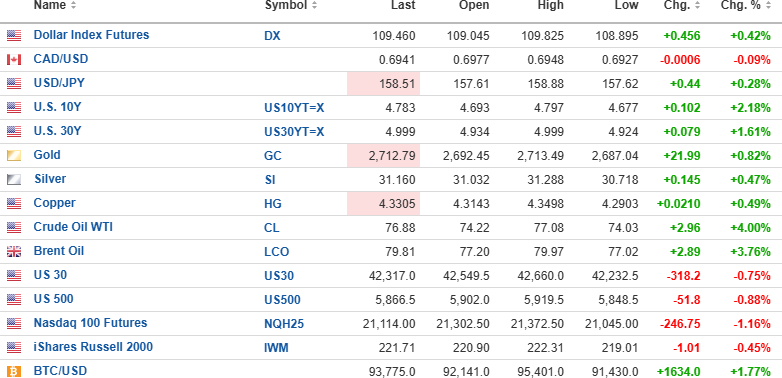

The USD index futures are ahead 0.42% to 109.460 this morning with the 10-year yield up 2.18% to 4.783 and the 30-year yield up 1.61% to 4.999%.

Gold (+0.82%), silver (+0.47%), copper (+0.49%), and oil (+4.00%) are all higher.

Stocks futures are down sharply with the DJIA down 318.2 points, the S&P 500 futures down 51.8 points, and the NASDAQ down 246.75.

Risk barometer Bitcoin (-2.21%) is up $1,634 to $93,775.

NFP "Jobs" Report, Stocks, and Gold

The BLS this morning reported at 256,000 versus the widely-expected 155,000 new jobs, sending bond yields screaming higher. The critical "red line" for the long bond is 5% so with a last print at 4.996%, the bond market could soon (if not already) be triggering a sell signal for stocks. Stocks are called sharply lower, with the VIX:US trading up 1.45 to 19.15.

Gold is up $21.99 to $2,712.79, so the markets are doing exactly what I was expecting, with commodities surging against a strong USD and interest rates spiking into a "hot" unemployment number. UVIX:US is called to open at $3.73 up from Monday's low of $3.03.

Given that this is the end of the first real trading week of 2025, I doubt that traders will want to go into the weekend with unhedged or overweighted equity positions. Therefore, any bounce in the S&P 500 should be seen as a selling opportunity for stocks and a buying opportunity for the VIX/UVIX.

| Want to be the first to know about interesting Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.