Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) announced it has exercised its overallotment option and closed on its recently announced non-brokered private placement for CA$2.12 million.

When first announced earlier this month, the offering was for a placement of up to 13,333,333 units of the company at a price of CA$0.15 per unit for intended proceeds of up to CA$2 million.

The overallotment option allowed the company to increase the offering by as much as 10% for as much has CA$2.2 million.

Michael Ballanger of GGM Advisory Inc. called the company "one of my favorite juniors."

Ballanger said this latest financing brings the company's 2024 funding levels to more than CA$5 million, "an outstanding accomplishment in what has been a difficult funding environment for the juniors."

Each unit issued pursuant to the private placement comprised one common share of the company and one-half of one common share purchase warrant of the company, Fitzroy said. Each warrant shall entitle the holder thereof to purchase one additional common share at an exercise price of 25 cents per share until Oct. 16, 2026.

The company said it intends to use the proceeds from the latest placement for exploration activities and property commitments at its current projects and general working capital.

A Potential Company-Maker?

Fitzroy Minerals said it is focused on "exploring and developing mineral assets with substantial upside potential in the Americas."

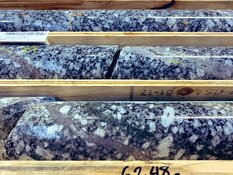

Its current property portfolio includes the Caballos Copper and Polimet Gold-Copper-Silver projects in Valparaiso, Chile; the Taquetren gold project located in Rio Negro, Argentina; and the Cariboo project in British Columbia.

It is also in the process of completing due diligence investigations into acquiring Ptolemy Mining Ltd., holder of the Buen Retiro Project in a copper-rich district of Chile. In September, Fitzroy announced it had extended its exclusivity letter to complete its investigations through December.

Ballanger wrote in an email alert to his readers on Tuesday that he expected final approval for the transaction to come soon.

Michael Ballanger of GGM Advisory Inc. called the company "one of my favorite juniors."

"Once cleared, I expect that the floodgates will open up and positions will be taken," Ballanger wrote. "The stock traded up to CA$.30 on Friday and then immediately got rejected as profit-taking took on a morbid urgency. By the time the drills start turning at Buen Retiro, I expect to see new high ground for the year, and by the time the market learns of the raw potential of this IOCG (iron oxide copper-gold) monster, (the stock will hit) new all-time high ground above CA$.76."

By all accounts, it could easily grow into a billion-dollar asset which would make current prices, to put it mildly, incredibly cheap," Ballanger said.

The "Buen Retiro Project, if consummated, offers Fitzroy Minerals shareholders significant discovery leverage into a copper bull market," company President and Chief Executive Officer Merlin Marr-Johnson said when the agreement was first announced in June.

"Based on the geophysics, if the anomaly carries grade and scale and is indeed an IOCG, it is going to draw a great deal of attention from everybody including the majors in the region," Ballanger wrote for Streetwise Reports on Oct. 21. "This project (Buen Retiro) is a potential company-maker (and life-changer)."

In the 'Right Place at the Right Time'

Technical Analyst Clive Maund wrote on October 15 that the company "is considered to be in the right place at the right time."*

"There has probably never been a better time to be a copper, gold, and silver mining company," Maund wrote.

"Silver is in high and rising demand for industrial uses with the prospect of a boom in investment demand as the demise of currencies accelerates, which of course will impact gold prices in a similar manner," wrote Maund, who rated the stock an Immediate Buy for "all time horizons."

There is "a growing probability and buildup in upside volume in recent weeks that has driven volume indicators higher makes a breakout all the more likely soon, which, … looks set to happen soon after the just announced financing has been digested by the market," Maund noted.

The Catalyst: A Triple Play

The company's combination of metals definitely has the making of a triple play. Gold, in particular, continues to hit record prices as traders flock to it "amid a tight U.S. presidential vote and persistent concern that violence in the Middle East may escalate into a wider war," Jack Wittels and Yvonne Yue Li wrote for Bloomberg on Tuesday as bullion hit a fresh all-time high of US$2,742.08 per ounce.

"Robust central-bank buying and expectations of US interest-rate cuts have also underpinned gold's stellar run this year," they wrote. "Federal Reserve officials continue to opine on the path forward, with Jeffrey Schmid favoring a slower pace of rate reductions and Mary Daly forecasting more cuts."

Silver is also in demand. "The silver market has been on fire over the last few days, as we have seen the market break hard above the crucial US$32.50 level," Christopher Lewis wrote for FX Empire on Tuesday. "This move is very strong."

Technical Analyst Clive Maund wrote on October 15 that the company "is considered to be in the right place at the right time."

"I think this is a scenario where people are waiting and desperately trying to get into this market," he noted. "So, I do think that a short-term pullback is more likely than not going to be looked at as an opportunity. It’s also worth noting that the US$32.50 level is an area that previously had been resistant."

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB)

Silver, as the most conductive element in nature, is vital to the energy transition. It coats electrical contacts in computers, phones, cars, and appliances and is also an important element in solar technology.

Mordor Intelligence noted that the white metal is expected to register a compound annual growth rate (CAGR) of more than 5% between 2024 and 2029.

Copper is also very important to the future of energy and is used in everything from batteries to solar panels. Electric vehicles contain as much as 175 pounds of copper. Power-hungry artificial intelligence (AI) is also expected to put a squeeze on electricity demand and the need for copper.

According to Credendo, demand for copper could double by 2035. New copper production — and investment in exploration — will be needed to fuel the supply of those vehicles in the long term, analysts have said.

Ownership and Share Structure

According to Reuters, 6.54% of Fitzroy Minerals is owned by management and insiders. Of those, Executive Chairman Campbell Smyth owns the most, with 5.09%.

Fitzroy Mineral's market cap is CA$24.65 million with 95.97 million free float shares. The 52-week range for is CA$0.07 and CA$0.30.

| Want to be the first to know about interesting Critical Metals, Gold, Silver and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for quotes from the Clive Maund source October 15, 2024

- For the quote (sourced on October 15, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$2,500.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed.

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.