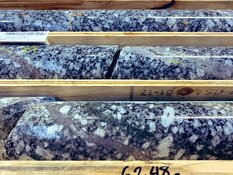

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN) announced assay results from its 2024 drilling program at its Lawyers property, part of its 100%-owned Lawyers-Ranch Project in the Toodoggone Mining District of northern British Columbia.

According to the company, the results successfully confirm "high-grade, near-surface mineralization." Deeper intercepts confirm modelled stopes, pointing to the potential for expanding the underground mining scenario in future drill campaigns.

"The recently completed, positive Preliminary Economic Assessment (PEA) outlined a 90% Measured and Indicated potentially mineable resource," Thesis said in a release. "Consequently, the 2024 drill program was strategically focused on infilling, upgrading and potentially expanding the most impactful of the 10% inferred ounces by targeting those that could significantly contribute to the upcoming Prefeasibility Study (PFS) planned for late 2025."

Analyst Phil Ker of Ventum Capital Markets, in an updated research note on Oct. 23, called the first assays from this year's 4,100 meters of drilling "positive."

"High-grade intervals near surface support potential for enhanced economics from shallower horizons expected to be captured within open-pit mining, while deeper high-grade intervals align with anticipated underground mining stopes," wrote Ker, who rated the stock a Buy with a target price of CA$1.55.

Highlights of Results

Company President and Chief Executive Officer Dr. Ewan Webster said the new results "both continue to validate the high-grade potential near surface and confirm continuity of mineralization at depth."

"The shallow, high-grade gold and silver intercepts provide an excellent opportunity to enhance the open-pit scenario, while the deeper intervals align well with the underground stopes outlined in the PEA," he continued. "With silver prices trending upwards, the substantial silver content in these intercepts provides a meaningful tailwind to the project’s economics, complementing the already projected 4 million+ ounces of average annual silver production outlined in the PEA. This progress is a key step in de-risking the project as we move toward our Pre-Feasibility Study in 2025."

Highlights of the results include the following intercepts showing shallow, high-grade gold and silver mineralization:

- Hole 24CCDD001 intersected 22.62 meters of 1.16 grams per tonne gold (g/t Au) and 47.08 g/t silver (Ag) or 1.75 g/t gold equivalent (Au Eq), including 7 meters of 3.17 g/t Au and 123.54 g/t Ag or 4.72 g/t Au Eq.

- Hole 24CCDD003 intersected 8 meters of 7.29 g/t Au and 327.75 g/t Ag or 11.39 g/t Au Eq, including 2 meters of 16.23 g/t Au and 866 g/t Ag, or 27.05 g/t Au Eq.

- Hole 24CCDD003 also showed an additional interval of 3.07 meters that intersected 6.69 g/t Au and 189.27 g/t Ag or 9.05 g/t Au Eq.

Deeper intercepts confirmed and expanded modelled underground stopes, Thesis said:

- Hole 24CCDD005 intersected 4.89 meters of 3.82 g/t Au and 119.76 g/t Ag or 5.31 g/t Au Eq, including 0.39 meters of 19.3 g/t Au and 791 g/t Ag or 29.19 g/t Au Eq.

- Hole 24CCDD006 intersected 10.16 meters of 0.9 g/t Au and 25 g/t Ag or 1.21 g/t Au Eq, including 2 meters of 4.56 g/t Au and 141 g/t Ag or 6.32 g/t Au Eq.

- Hole 24DRDD001 intersected 6 meters of 0.69 g/t Au and 224.17 g/t Ag or 3.49 g/t Au Eq, including 2 meters of 0.58 g/t Au and 448 g/t Ag, or 6.18 g/t Au Eq.

Ker said the company is expected to continue delivering more results from the exploration work.

"As the Company continues to de-risk Lawyers-Ranch through various deliverables, we see ample opportunity for a further re-rating in the stock," he wrote.

PEA Outlines Strong Economics

Earlier this month, Thesis filed an updated filed an updated National Instrument 43-101 technical report for the preliminary economic assessment (PEA) for the Lawyers-Ranch project that outlined strong economics with a pretax internal rate of return (IRR) of 46% and a pretax net present value (NPV) at a 5% discount rate of CA$1.99 billion. After-tax IRR is 35.2% with an NPV at 5% of CA$1.28 billion, using US$1,930 per ounce gold and US$24 per ounce silver.

"The 2024 PEA saw a considerable increase in production versus the previous (2022) PEA with a 32% increase in annual average production to 215,000 Au Eq ounces, including an average 273,000 Au Eq ounces annually over the first three years, and a 55% increase in life-of-mine (LOM) production to 3 million gold-equivalent ounces, extending mine life to over 14 years," the company said in a release at the time.

The PEA also offers a low all-in sustaining cost (AISC) of US$1,013 per ounce of gold equivalent and offers a quick after-tax payback of two years, the company said.

After the release of the updated PEA, which combined the Lawyers and Ranch properties in September, Analyst Jonathan Guy, director of mining research for Hannam & Partners, raised the firm's price on the stock from CA$2.04 to CA$2.48, a 230% return from the share price at the time of the report.

"In our view, this sets out a materially more attractive project than Lawyers on a standalone basis," Guy wrote of the PEA.

The Catalyst: Gold's Advance Continues

Gold continued to hit record highs this week, rallying to US$2,757.99 per ounce, "defying the dollar's rise, which kept pressure on the yen and the euro, while global stocks edged lower amid investors' reluctance to place major bets ahead of the U.S. election," Reuters reported on Wednesday.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Thesis Gold Inc. (TAU:TSXV; THSGF:OTCQX; A3EP87:WKN)

"Geopolitical tensions remain the primary driver. . . Two weeks out from the U.S. election, the race seems to still be a dead heat, and so a fair amount of political uncertainty is also driving safe haven interest in gold," Peter A. Grant, vice president, and senior metals strategist at Zaner Metals, told Reuters on Tuesday.

"Certainly, if things heat up further in the Middle East, we could see US$3,000 before the end of the year, but I'm sort of leaning more towards Q1," Grant said.

This rise has "resulted in big returns for the investors who bought in earlier this year," Angelica Leicht reported for CBS News on Monday. "For example, the investors who purchased gold in March when it hit US$2,160 per ounce have seen their gold values increase by nearly 27% in the time since. That's a huge uptick in value in a matter of months, especially on an asset that's known more for long-term growth."

Ownership and Share Structure

According to Thesis, about 66% of the company is owned by institutions, and about 4% is owned by insiders. The remaining 30% is retail.

Top shareholders include Franklin Advisers Inc. with 7.82%, Merk Investments LLC with 7.58%, Delbrook Capital Advisors Inc. with 5.5%, Sprott Asset Management LP with 4.63% and Van Eck Associates Corp. with 2.45%. Director Nicholas Stajduhar owns 1.09%.

The company said it has 196 million shares outstanding, 198.9 million fully diluted. Its market cap is CA$168.83 million, and it trades in a 52-week range of CA$1.00 and CA$0.37.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Thesis Gold Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.