This is believed to be an excellent time to buy Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) stock or to add to positions for two big reasons.

One is that it has dropped back over the past several months to a zone of strong support at a low level, as we will see when we review its charts later. The other is that important exploration work is being undertaken at the company's two main properties that could soon turn up significant results.

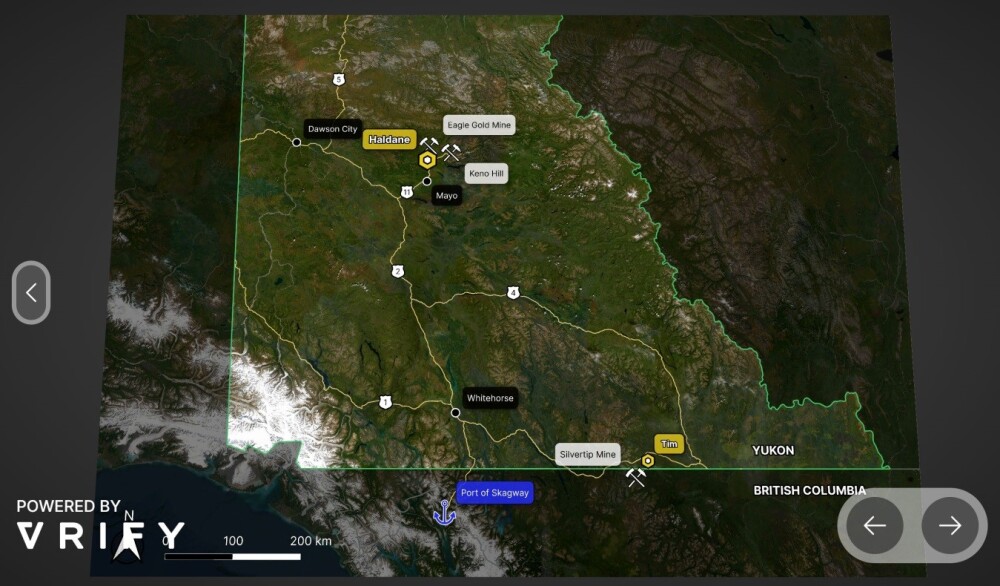

While the company does have other lesser properties and prospects, its two main properties are both located in the Yukon, at the locations shown on the following slide lifted from the latest investor deck.

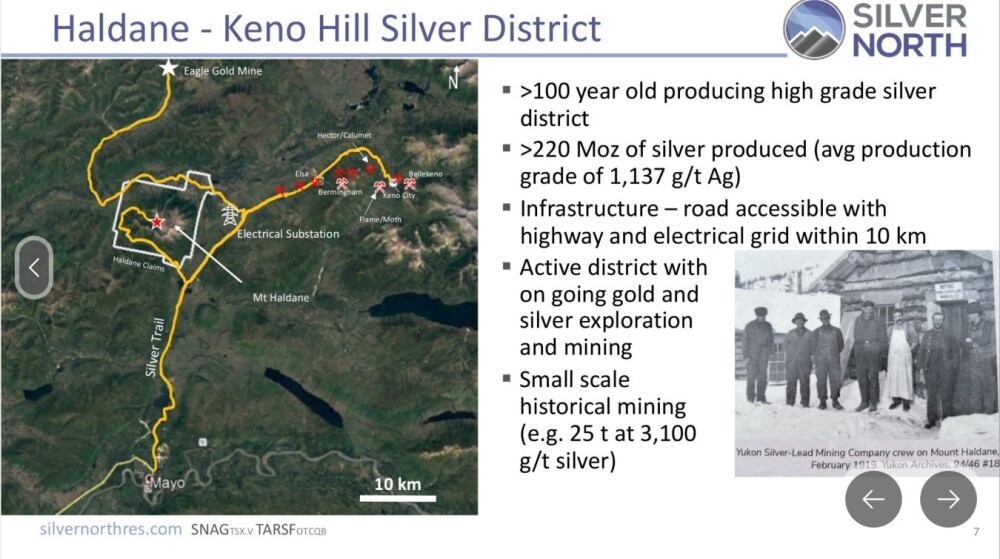

Some information about the Haldane property is shown on the following slide.

The next slide shows some interesting and relevant information about the Haldane – Keno Hill Silver District.

Just a week ago, the news was released that a new drilling campaign has commenced at the 100% owned Haldane property, with 1000 meters of drilling planned for three holes. Since it will clearly not be too long before the results from this drilling are known, positive results could obviously act as a catalyst for the stock.

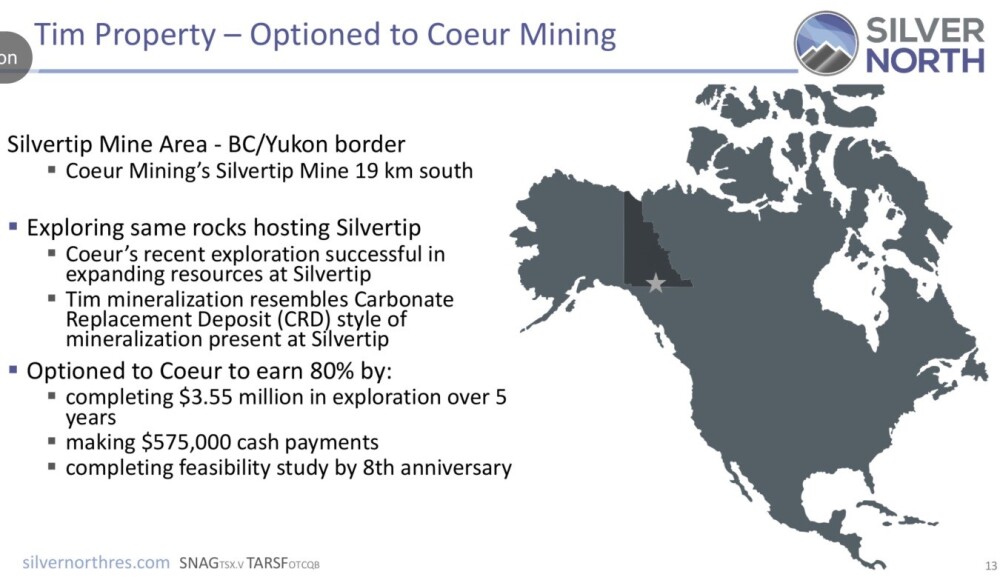

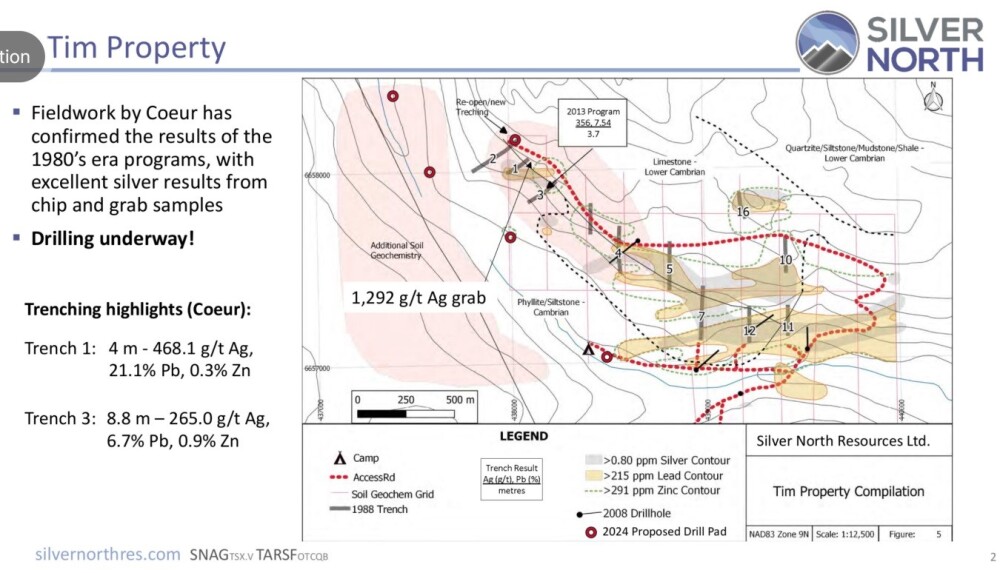

Meanwhile, the company's other main property, the Tim silver property to the south of Yukon, very near to the British Columbia border, is under option to and operated by Coeur Mining, which has the advantage that Coeur pays for the exploration, the company revealed on the August 19 that, up until that point, 1300 meters of drilling in four holes had been completed. The analytical results from this program are expected to be received in October, or, in other words, soon. Again, this has the potential to act as a catalyst for the stock.

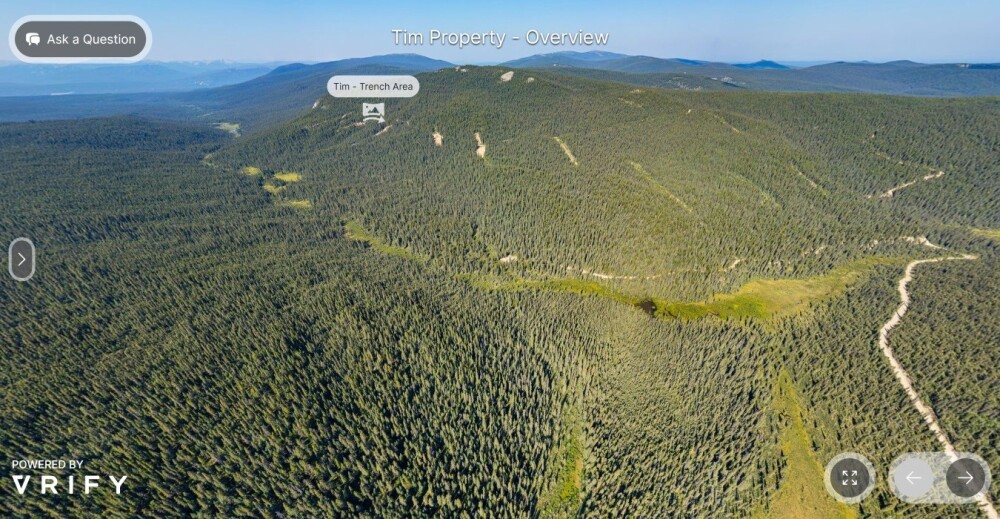

Some information about the Tim property is shown on the following slides.

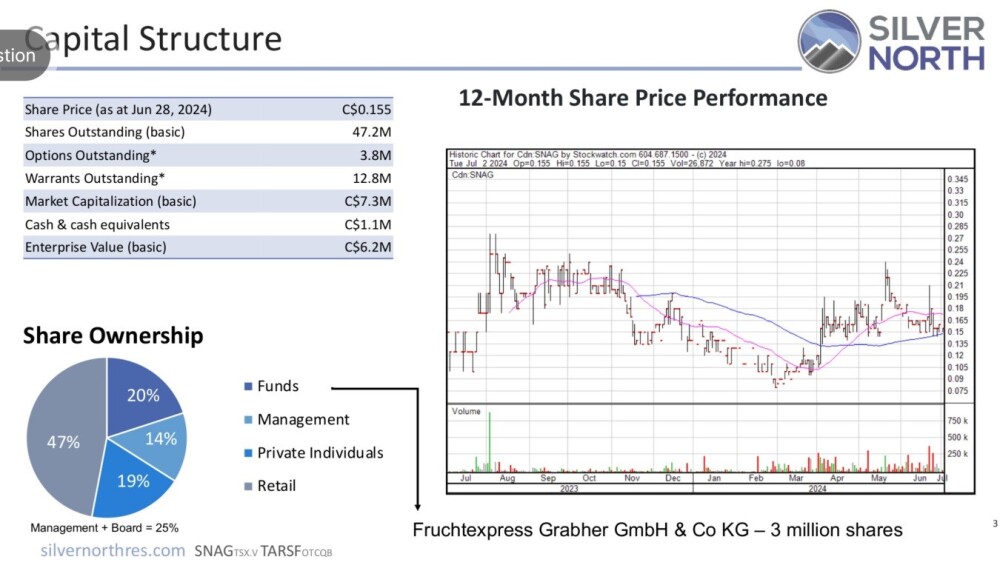

The last slide overviews the capital structure of the company and shows that funds, management and large private investors own about 53% of the stock, leaving 47% in the float.

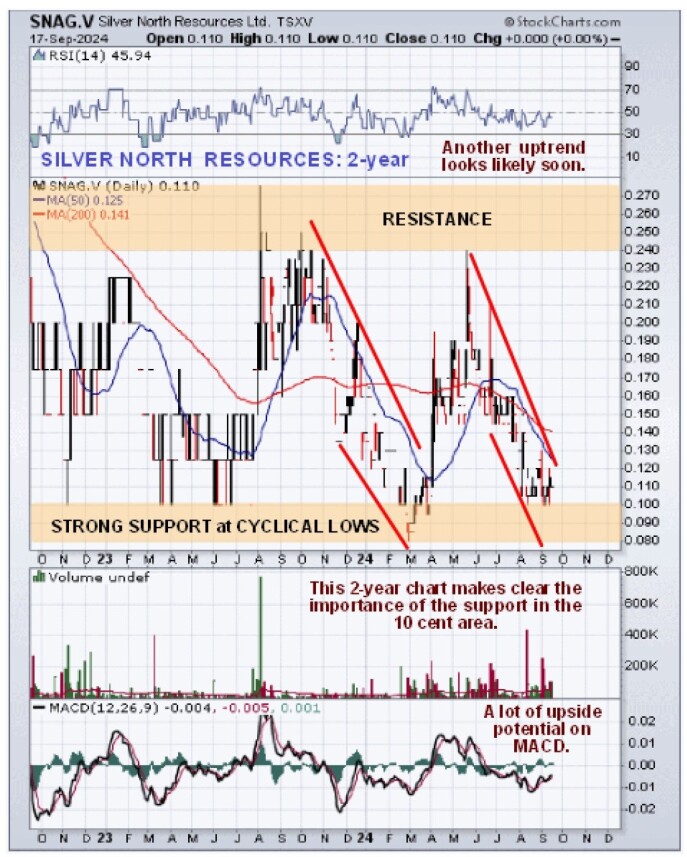

Turning now to the charts and starting with the 6-month chart, we see that Silver North has reacted back over the past four months to another "buy spot" at strong support, where it is viewed as very attractive.

A Double Bottom is believed to be completing at the support, with the price looking about ready to rise away from its second low.

The 2-year chart enables us to appreciate the significance of this support, for the price has risen off it four times already during the life of this chart, and given the positive outlook for the sector, it is considered very likely that it will rise off it again, which should result in good percentage gains quite quickly for buyers in this area.

Zooming out again, the 9-year chart "opens out" the giant base pattern that has formed from 2015, and on it, we can see that, within this base pattern, and from the start of 2021 highs, there has been a severe bear market that brought the price down to a very low level where trading has developed over the past two years that looks like a base pattern which the price is now near to the bottom of, and hence this is considered to be a very good point to buy.

(The reason for using a 9-year chart instead of a 10-year one is that going back 10 years includes much higher prices that flatten out subsequent action, making it more difficult to see what has been going on).

Finally we will look at the very long-term chart going back 20-years. This chart shows us that Silver North traded at vastly higher prices at the peak of the great 2000s PM sector bull market, which was in 2011.

The main value of this chart is that it shows us what juniors like Silver North are capable of when a major PM sector bull market grips the investing public's imagination, as happened in the late 2000's, which with gold plodding ever higher and looking set to accelerate and silver destined to follow suit looks on course to happen again.

The conclusion is that Silver North is at another favorable "buy spot," and it is rated a Strong Buy for all time horizons.

Silver North Resources' website.

Silver North Resources Ltd. (SNAG:TSX; TARSF: OTCQB) closed for trading at CA$0.105, US$0.0868 on September 17, 2024.

| Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Silver North Resources Ltd. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Silver North Resources Ltd.

- Clive Maund: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be construed as a recommendation or solicitation to buy and sell securities.