Lithium Ionic Corp. (TSX-V: LTH; OTCQX: LTHCF; FSE: H3N) has completed a significant royalty agreement with Appian Capital Advisory LLP, marking a substantial step in the company's strategic development. The agreement grants Appian a 2.25% gross revenue royalty in exchange for US$20 million.

The agreement includes an option for Lithium Ionic to buy back the royalty for US$67.5 million within five years, providing the company with potential future financial flexibility.

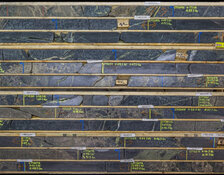

Appian Capital, known for its focus on long-term investments in mining and mining-related sectors, brings a wealth of expertise to the table. The proceeds from this agreement are earmarked for the advancement of Lithium Ionic's Bandeira lithium project, situated in the highly prospective Lithium Valley in Minas Gerais, Brazil. This region is renowned for its rich deposits of lithium-bearing pegmatites and has emerged as a pivotal center for global lithium production. In addition to project development, the funds will support general corporate purposes and working capital needs.

Looking Into Lithium

The lithium mining and production sector has experienced significant growth and development in recent years, driven by increasing demand from various industries, particularly electric vehicles (EVs) and energy storage.

According to Fortune Business Insights on July 1, "The global lithium mining market size was US$393.64 million in 2023. The market was projected to grow from US$414.75 million in 2024 to US$649.44 million by 2032 at a CAGR of 5.77% over the forecast period." This robust growth highlights the vital role lithium plays in modern technological advancements.

The rising demand for electric vehicles has been a crucial factor in the lithium market's expansion. Fortune Business Insights reported, "The increasing demand for electric vehicles to limit the emissions of carbon into the atmosphere is leading to the demand for lithium batteries across the globe."

As of July 22, Tip Ranks notes that this average price target represents a potential increase of 510.71% from the most recent price of CA$0.56.

Similarly, as the Motley Fool reported on June 18, "Soaring battery demand from EVs and energy storage (saving power for later distribution to the electric grid) had some investors anticipating a solid recovery in lithium demand in the next few years."

They also highlighted that "With such strong government support and automakers aligning their strategies, the future demand for lithium looked promising."

Government policies worldwide have also supported this sector's growth. In a May article for Business Standard, it was mentioned that "India considered offering incentives to encourage private companies to set up lithium processing facilities, as New Delhi tried to develop its nascent lithium mining and boost supplies of the EV battery metal." Furthermore, "The critical minerals policy was comprehensive and covered all aspects from exploration to mining to value addition," reflecting a global trend toward supporting the lithium mining industry.

Technological advancements in mining practices have also contributed to the sector's positive outlook. Fortune Business Insights also highlighted that "New technological studies had led to developing such mining techniques, which were more energy and resource-efficient." This innovation has made lithium mining more sustainable and cost-effective, further driving market growth.

The increasing use of lithium-ion batteries for grid storage is another vital trend. Fortune Business Insights noted, "The surging demand for storing grid-based energy was one of the key factors that was expected to further drive the demand for Lithium ion batteries and, hence, propel the metal's requirement." This trend underscores the expanding applications of lithium beyond just EVs.

Lithium Ionic's Catalysts

The recently completed royalty agreement with Appian Capital is a major catalyst for Lithium Ionic Corp. The upfront cash infusion of US$20 million will accelerate the development and construction of the Bandeira lithium project, enhancing its potential to become a leading player in the lithium industry. The project's location in the Lithium Valley, a hub of significant lithium-bearing pegmatites, provides a strategic advantage for the company.

Additionally, the agreement includes an option for Lithium Ionic to repurchase the royalty within the first five years for US$67.5 million, offering financial flexibility and potential future cost savings. The royalty obligations are secured by substantial assets related to the project, providing assurance to investors and stakeholders about the company's commitment and capability to deliver on its promises.

Blake Hylands, a representative of Lithium Ionic, emphasized the importance of this agreement, stating in the news release, "This partnership with Appian Capital underscores our commitment to advancing the Bandeira project and solidifies our position within the global lithium market."

In addition to the royalty agreement, several ongoing and upcoming milestones are poised to drive further growth for Lithium Ionic. The company is currently conducting extensive drilling with the aim of expanding existing resource estimates and identifying new ones. The company expects to obtain construction permits for the Bandeira project in Q3 2024, a major step toward initiating mine development. Furthermore, the company is advancing engineering studies on its second-largest lithium deposit, Salinas, with a Preliminary Economic Assessment (PEA) scheduled for completion in the second half of 2024, which will provide a clearer picture of the project's economic potential and pave the way for future development.

The company notes that these catalysts, combined with the company's strategic initiatives and robust project economics, position Lithium Ionic for significant advancements in the near term, enhancing its value proposition in the rapidly growing lithium market.

Experts Talking Lithium Ionic

In a research report published on May 30, 2024, Clarus Securities analyst Varun Arora provided an in-depth analysis of Lithium Ionic Corp. following the company's release of a positive feasibility study (FS) for its Bandeira lithium project in Brazil.

According to Arora, "Bandeira's FS confirmed robust economics with NPV of ~4.9x and globally top quartile margin with an operating cost of US$444/t and AISC of less than US$600/t versus developer peers at approximately US$660/t; LRS US$599/t, Sigma US$523/t, and CBL around US$550/t." He highlighted the significant near-term upside potential beyond the FS results, suggesting that the study was "only a snapshot in time, offering immediate upside from the expanded M&I resource reported in April 2024 as well as from the conversion of inferred resources into the mine plan." Arora estimated a potential for up to a 40% boost in mine life and a 30% increase in NPV to approximately US$1.7 billion.

Lithium Ionic's strategic plans included advancing the Bandeira project towards production, aiming to become Brazil's next operating lithium mine by H2 2026. Arora emphasized several key advantages for Lithium Ionic, such as the early submission of a permitting application in November 2023, secured grid power connection and water rights for Bandeira, and a well-progressing permitting process with mine construction approval expected in Q3 2024. He noted that the completion of the FS was a material de-risking milestone.

Arora also pointed out multiple catalysts for Lithium Ionic over the balance of 2024, including potential non-dilutive funding opportunities, 50,000 meters of planned drilling, construction permit approval, and the commencement of initial mine development. He concluded that "at CA$123 million market cap, LTH is the cheapest of all the players in the region," underscoring the company's valuation appeal.

As of July 22, Tip Ranks ranked Lithium Ionic as a Strong Buy. It reported that over the past three months, three Wall Street analysts have offered 12-month price targets for Lithium Ionic Corp. The average price target is CA$3.42, with the highest forecast at CA$3.50 and the lowest at CA$3.25. Tip Ranks notes that this average price target represents a potential increase of 510.71% from the most recent price of CA$0.56.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Lithium Ionic Corp. (TSX-V: LTH;OTCQX: LTHCF;FSE: H3N)

Ownership and Share Structure

According to the company, management and insiders own 20% of the Lithium Ionic.

One of the insiders, President & Director Helio Diniz, owns 5.52%, Director Michael Lawrence Guy owns 5.10%, Director David Patrick Gower owns 2.56%, and Andre Rezende Gumaraes owns 2.52%, according to Reuters.

30% is held by institutional investors. Reuters reports Waratah Captial Advisors owns 7.01%, JGP Gestao de Recursos Ltda owns 2.69%, RBC Global Asset Management Inc owns 1.94%, Sprott Asset Management LP owns 1.55%, BMO Asset Management owns 1.30%, and IXIOS Asset Management SA owns 1.20%

The rest is retail.

Lithium Ionic has 158.58 million shares outstanding and 131.15 million free-float traded shares.

The company's market cap is CA$101 million, and it trades in a 52-week range of CA$0.51–$2.70. per share.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Lithium Ionic is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- James Guttman wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.