The drone industry in the United States is experiencing a notable uptick, with two key manufacturers seeing their stock prices climb. This surge appears to be driven by a confluence of political and governmental factors, all pointing to a pressing need: The U.S. requires a vast array of autonomous drone systems, both for itself and its allies, preferably sourced domestically and as quickly as possible.

Several ongoing catalysts are fueling this trend:

- Taiwan's Precarious Situation: China's aggressive posturing towards Taiwan has intensified, with recent military drills raising concerns about a potential invasion. In response, the U.S. has agreed to supply Taiwan with US$360 million worth of drones.

- War Preparation: The U.S. is strategically preparing for a potential conflict with China, focusing on rapid weapons stockpiling. Admiral Samuel Paparo's statement about creating an "unmanned hellscape" in the Taiwan Strait underscores the emphasis on autonomous drone warfare.

- Cross-Domain Military Enhancement: The Pentagon's Replicator program, initiated in August 2023, aims to deliver thousands of all-domain autonomous systems by August 2025. This US$1 billion initiative seeks to deter Chinese aggression toward Taiwan.

- Shift Away from Chinese Drones: Despite Chinese dominance in the global small drone market, the U.S. is moving to restrict their use. Federal legislation will ban government purchases of drones from China and certain other countries starting December 2025, with several states already imposing similar restrictions.

- Network Security Concerns: Proposed legislation like the Countering CCP (Chinese Communist Party) Drones Act aims to limit the use of Chinese-manufactured drones in the U.S., citing national security risks.

- Federal Contracting Opportunities: The summer season typically sees increased government contracting activity, potentially benefiting drone manufacturers.

The DOD announces its awarded contracts, valued at US$7.5M or more, on its website each business day at 5:00 pm EST. There is a great article by Multibagger Monitor titled "Inflecting Drone Company w/ Near-Term (+300% vs. -30%) Binary Event ($RCAT)." It goes into all of these catalysts in great detail. You can read that here.

Growing Drone Market

The global drone market is projected for substantial growth across defense, commercial, and recreational sectors. Defense drones are expected to reach a US$5.6 billion market value by 2032, while the U.S. drone market could hit US$31.3 billion by 2034.

Two companies have notably benefited from these trends, with Red Cat Holdings Inc. seeing a significant stock price increase in recent weeks. This uptick may be linked to anticipation of government contracts, though nothing has been officially confirmed. You can view this in the below chart from John Newell of RSD Discovery Group.

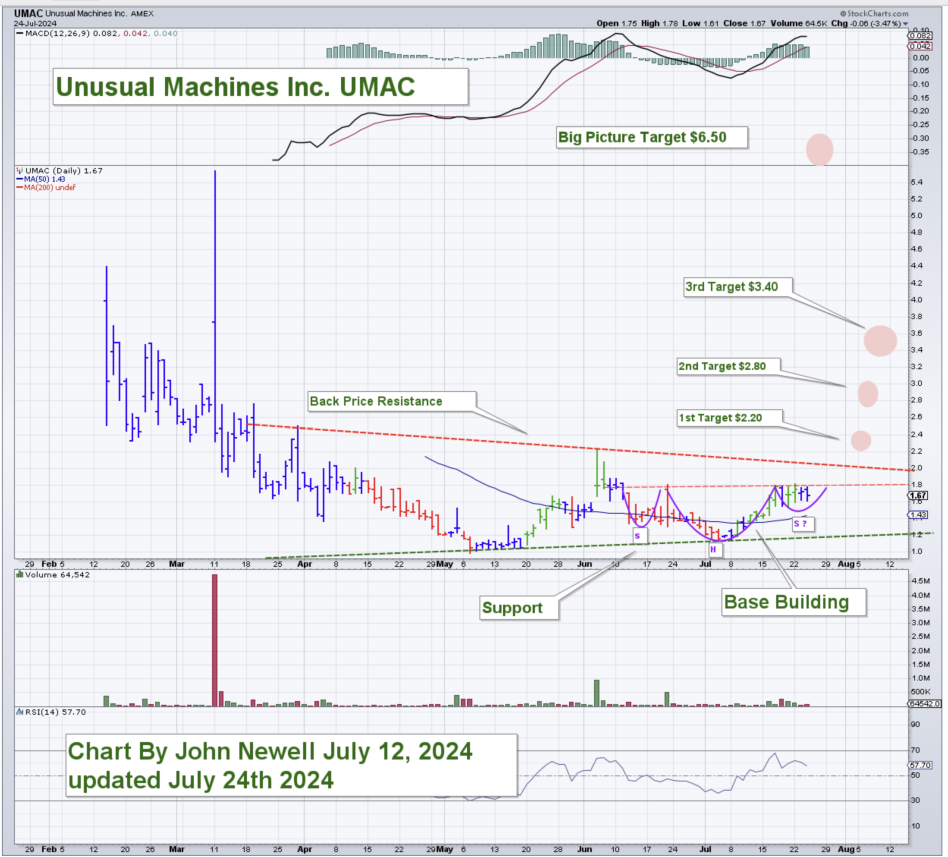

The second company, Unusual Machines, might have a base building, as the below chart shows.

Red Cat Holdings Inc.

Taking a closer look at Red Cat Holdings Inc. (RCAT:NASDAQ), we can see the company is making waves in the drone industry, with its stock price showing impressive gains recently.

Streetwise Ownership Overview*

Red Cat Holdings Inc. (RCAT:NASDAQ)

This company, which specializes in developing and manufacturing drone hardware and software for military and defense applications, has had a noteworthy stock performance, climbing 47% from US$1.15 to US$1.91 per share between July 5 and 16, 2024, reaching its year-to-date high. Over the past year, the stock has traded in a wide range from US$0.525 to US$1.65, indicating significant volatility and potential for growth, as shown by stockwatch.com.

Red Cat's stock closed for trading at US$2.12, with a trading volume of 1,012,378 shares on July 24, 2024.

As an article by Multibagger Monitor opines, "potentially transformative near-term contracts make Red Cat an appealing "GARP with catalyst" play." The article goes on to say, "If Red Cat wins T2 (or a significant Replicator contract), the stock will move several hundred percent within days to months, assuming the market parses the information and execution is solid. If Red Cat fails to win a program of record, it will nevertheless benefit from massive legislative and governmental tailwinds. Organic growth for the Teal 2 should continue apace."

Red Cat is a company with offices in Puerto Rico and a factory in Utah. They're fully certified to sell their products to the military and government agencies, and they've already won several military contracts.

Their main product is called Teal, which they recently improved. Teal is different from other spy and attack drones used by the military. The company says Teal is a better choice because it's cheaper and can be used more than once, unlike some other drones that are lost after one use.

In a June 14 research report, Ladenburg Thalmann Analyst Glenn Mattson stated, "The product is portable by rucksack and can give soldiers in the field situational awareness in the form of ISR as well as provide offensive capabilities in the form of loitering munitions delivery systems."

With this, Mattson gave the company a Buy rating and a US$4 target price, showing there is still upside for the company.

Technical Analyst Clive Maund also shared his optimism in the stock in a July 15 post, stating that holders should "stay longer for a potentially massive spike."

As for ownership of Red Cat, according to the company, 37.27% of the stock is held by management and insiders. Reuters notes that CEO Thompson owns 16.5%, and Director Nicholas Liuzza has 1.31%.

Institutional investors have 9.01%. The Vanguard Group Inc. has 1.75%, and Pelion Venture Partners has 1.21%, Reuters reported.

The rest is in retail.

The company's market cap is US$79.48M. Its 52-week trading range is US$0.525−US$1.65.

Unusual Machines Inc.

Unusual Machines Inc. (UMAC:NYSEAMERICAN) is a Florida company that makes and sells drone parts.

Streetwise Ownership Overview*

Unusual Machines Inc. (UMAC:NYSEAMERICAN)

The stock has had some ups and downs. It went public in February at US$3.03 per share, reached US$3.50, then fell to US$1.04 in May. But it's been recovering since then.

It rose 13.5%, between July 10 and July 11, to US$1.43 per share, up from US$1.26, and closed at US$1.67 on July 16, 2024, as noted by Stockwatch.com.

Unusual Machines closed for trading at US$1.67, with a trading volume of 64,643 shares on July 24, 2024.

Unusual Machines works with the previously mentioned company, Red Cat. In fact, they bought two businesses from Red Cat: Rotor Riot, which makes drones for fun, and Fat Shark, which makes special goggles for flying drones.

Now, Red Cat is using Unusual Machines to make parts for their new FANG drone systems.

*In a June 20 article, Technical Analyst Clive Maund rated Unusual Machines as an Immediate Strong Buy.

"[Unusual Machines] generates US$5M revenue a year with 20–30% year-on-year growth that is expected to continue," he wrote.

In terms of ownership, about 12.54% of UMAC is owned by management and insiders, according to the company, and about 40% is held by strategic investor Red Cat Holdings Inc.

The rest is retail.

The company's market cap is US$12.97 million, according to Market Watch, with 9.33 million shares outstanding with 2.25 million free float shares.

It trades in a 52-week range of US$1.37 and US$1.47.

| Want to be the first to know about interesting Technology and Special Situations investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Unusual Machines is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Unusual Machines and Red Cat Holdings Inc.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 20, 2024

- For the quoted article (published on June 20, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.