Two U.S. manufacturers of drones, parts and accessories have seen their stock price rise recently, and their ascent possibly is due to a handful of political and governmental catalysts playing out in the country.

The nature of these ongoing circumstances points to one conclusion: The U.S. needs a huge number of autonomous drone systems for itself and its allies; the sooner, the better, and ideally from domestic sources.

6 Ongoing Catalysts

Because these catalysts are enduring rather than one-and-done, any number of them may benefit drone stocks.

1) Intensifying Threat To Taiwan

Media reports indicate China is escalating tensions with Taiwan, most recently with its military exercises in the region, seemingly in preparation for a possible invasion of the island, Reuters reported. About 65 Chinese military aircraft were detected around Taiwan Wednesday, its defense ministry noted.

Last month, the U.S. Department of State agreed to again supply Taiwan with weapons, this time $360 million worth of drones, the U.S. Defense Security Cooperation Agency reported.

2) Preparing For Potential War

Given China's persisting threat to the democratically governed island, the possibility of a future war exists between the U.S. and its allies against China. As such, the U.S. is mentally preparing for such an event, a July 7 Bloomberg article purported. This, in part, involves massive and rapid stockpiling of weapons and ammunition.

"I want to turn the Taiwan Strait into an unmanned hellscape," Admiral Samuel Paparo, the new U.S. commander in the Indo-Pacific region, told Bloomberg. This means primarily employing autonomous drones, lots of them, in swarm-like attacks to ward off China and if need be, do the fighting instead of humans.

3) Arming Fighters Across Domains

This concept was the impetus for the Pentagon's Replicator program initiated last August. The goal is for the U.S. Department of Defense (DOD) to deliver, by August 2025, all-domain autonomous systems (ADA2) to warfighters "at a scale of multiple thousands, across multiple warfighting domains," reported the Defense Innovation Unit. The DOD needs about US$1 billion (US$1B) in funding to achieve this and to date, has secured US$500 million (US$500M). It also needs huge quantities of ADA2s.

"The ultimate purpose of Replicator, as of all U.S. efforts to gird for confrontation with China. . .is to convince [President Jinping] Xi that any attempt to take Taiwan by force is futile so that he won't even try," Bloomberg's Andreas Kluth wrote.

In other arming efforts, last July, the Pentagon announced Project LASSO, an effort to get loitering munitions, also called suicide or kamikaze drones, to U.S. Army infantry units, Defense and Security Monitor reported. Similarly, The U.S. Marine Corps launched programs to get this type of weapon to its squads.

4) No More Buying Chinese Drones

Chinese companies dominate the world's small drone market, reported Bloomberg. In the U.S. specifically, drones from the eastern country account for about 90% of the consumer market and 70% of the industrial market. However, some U.S. jurisdictions have restricted the use of Chinese drones.

At the federal level, starting in December 2025, the U.S. government no longer will be able to purchase or use drones made, or containing certain components made, in China, Russia, Iran and North Korea, according to UAV Coach. The ban is a result of the American Security Drone Act passed earlier this year.

Additionally, seven states to date prohibited the agencies under them from using Chinese-produced drones, The Hill reported in June. These states include Mississippi, Arkansas, Florida and Tennessee. And others, like California, Connecticut, Missouri, Kansas and South Dakota, are considering taking similar action.

Another piece of proposed legislation, the Drones for First Responders Act, would put pressure on the U.S. to source drones domestically. The bill calls for a greater and increasing tariff on imported drones from China, which account for 90% of the drones U.S. first responders use. Compared to the 25% today, the new tariff will start at 30% and increase by 5% each year. Also, the bill would ban the U.S. import of drones from China by 2030.

5) Securing Communications Networks

The proposed, federal Countering CCP (Chinese Communist Party) Drones Act, making its way through Congress, could limit the use of use of Chinese-manufactured drones in the U.S. reported DroneLife in June.

The bill calls for including telecommunications and video surveillance equipment and services produced or provided by China's DJI Technologies, the world's largest drone manufacturer, in the list of communications equipment that poses national security risks.

6) Federal Contracting Season Underway

Summer is prime time for U.S. agencies to solicit quotes, proposals and information, evaluate the prospects and award contracts. Contracts for a supply of drones and/or drone parts could be initiated at any time.

The DOD announces its awarded contracts, valued at US$7.5M or more, on its website each business day at 5:00 pm EST.

There is a great article by Multibagger Monitor going into all of these catalysts in great detail. You can read that here.

Drone Market Expanding Worldwide

Forecasts indicate continued growth in all segments of the drone market: defense, loitering munitions, commercial and recreational, the current data show. This bodes well for manufacturers in the industry.

The worldwide market for defense drones, excluding loitering munitions, is projected to reach US$5.6B in value by year-end 2032 from US$585.8M in 2023, according to Zion Market Research. The compound annual growth rate (CAGR) anticipated during this forecast period is 28.4%.

"The principal factors propelling the expansion of the worldwide drone defense system market are the requirements for identification systems to detect unregulated airborne commercial drones and countermeasure systems to identify counterdrones," Zion noted.

The global loitering munitions market is predicted to reach US$4.38B in value by 2032, according to Allied Market Research. This compares to the value in 2022 of US$1.55B and reflects a CAGR of 10.94%.

The U.S. markets for commercial and recreational drones are expanding rapidly, too, according to Fact.MR. U.S. Federal Aviation Administration stats show that of the total drones registered in the States as of May 31, 2024, 392,468 were recreational and 383,302, commercial. The growth in recreational drones has been "driven by advancements in technology and changing consumer preferences," according to Statista. Commercial drone growth is ascribed to their increasing use in agriculture, surveillance, and construction.

Fact.MR noted that drone sales in the U.S. are projected to grow at a 16.9% CAGR to US$31.3B by year-end 2034 from US$6.6B in 2024.

There are two stocks that have seen and increase in price over the past few weeks. The first being Red Cat Holdings Inc. You can see the an example of this from the chart by John Newell of RSD Discovery Group.

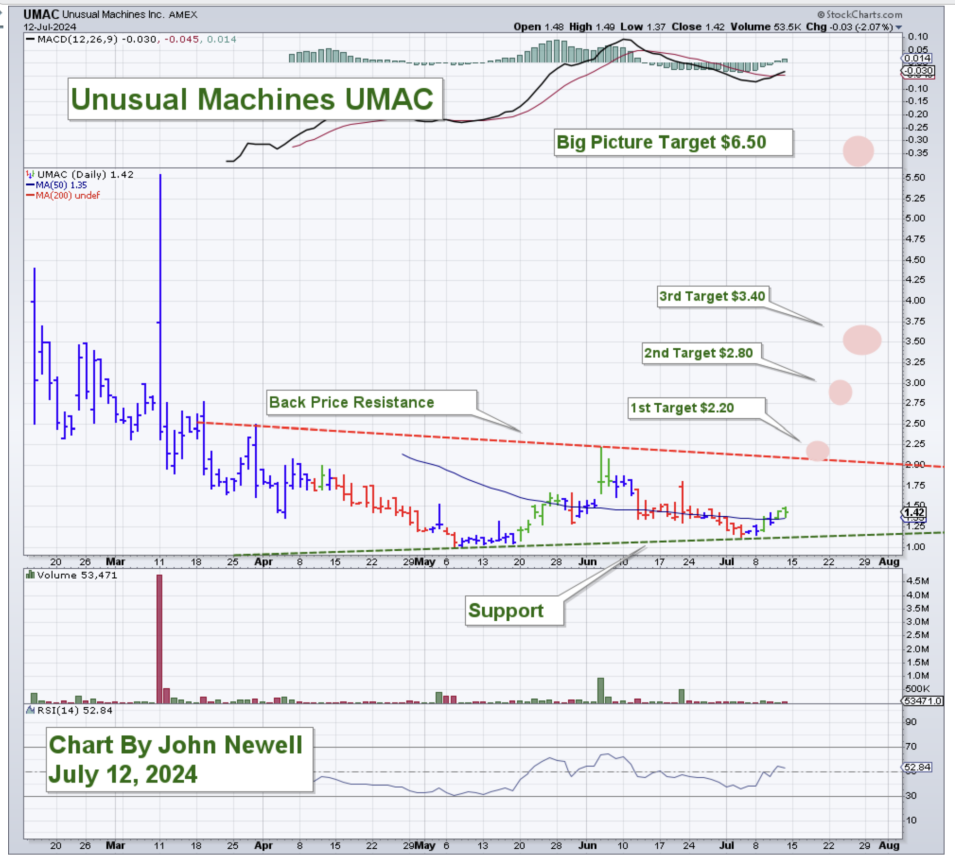

Unusual Machines Inc. has also seen growth. John Newell shared a chart on this company as well, as seen below.

Red Cat Holdings Inc.

One company with a climbing stock price is Red Cat Holdings Inc. (RCAT:NASDAQ), a developer and manufacturer of drone hardware and software for use in aerial military and other defense operations.

Streetwise Ownership Overview*

Red Cat Holdings Inc. (RCAT:NASDAQ)

Its stock rose 47% between July 5 and 16 to its year-to-date high of US$1.91 per share from US$1.15, as noted by Stockwatch.com. Over the past 52 weeks, the stock traded between US$0.525 and US$1.65 per share.

This jump may be due to anticipation surrounding government orders, though nothing has been confirmed.

In the article by Multibagger Monitor, the writer opined that "potentially transformative near-term contracts make Red Cat an appealing "GARP with catalyst" play." The article goes on to say, "If Red Cat wins T2 (or a significant Replicator contract), the stock will move several hundred percent within days to months, assuming the market parses the information and execution is solid. If Red Cat fails to win a program of record, it will nevertheless benefit from massive legislative and governmental tailwinds. Organic growth for the Teal 2 should continue apace."

Based in Puerto Rico and with a manufacturing facility in Utah, Red Cat has all the necessary certifications for supplying its products to armed forces and other governmental agencies and has been awarded multiple military contracts to date.

The company's lead product, the now enhanced Teal, is an alternative to the conventional intelligence, surveillance, and reconnaissance (ISR) and strike systems on the market, which are costly and unretrievable, the company said.

"The product is portable by rucksack and can give soldiers in the field situational awareness in the form of ISR as well as provide offensive capabilities in the form of loitering munitions delivery systems," reported Ladenburg Thalmann Analyst Glenn Mattson in a June 14 research report.

Mattson initiated coverage on Red Cat in mid-June with a Buy rating and target price that, today, still reflects upside.

On July 15, 2024, Technical Analyst Clive Maund gave Red Cat a Strong Buy rating, writing that holders should "stay longer for a potentially massive spike."

As for ownership of Red Cat, according to the company, 37.27% of the stock is held by management and insiders. Reuters notes that CEO Thompson owns 16.5%, and Director Nicholas Liuzza has 1.31%.

Institutional investors have 9.01%. The Vanguard Group Inc. has 1.75%, and Pelion Venture Partners has 1.21%, Reuters reported.

The rest is in retail.

The company's market cap is US$79.48M. Its 52-week trading range is US$0.525−US$1.65.

Unusual Machines Inc.

The stock price of Unusual Machines Inc. (UMAC:NYSE), a Florida-based drone components builder and vendor, is also increasing.

It rose 13.5% last week, between July 10 and July 11, to US$1.43 per share, up from US$1.26, and closed at US$1.67 on July 16, 2024, as noted by Stockwatch.com.

After Unusual Machines went public in February at US$3.03 per share, its stock price peaked at US$3.50 then gradually dropped to its all-time low of US$1.04 in mid-May.

Since, it has rallied to where it is now.

The company is a partner of Red Cat and owns two former Red Cat subsidiaries, Rotor Riot, a source of recreational and hobbyist drones, and Fat Shark, a brand of first person view (FPV) goggles.

Red Cat has tapped Universal to provide the first drone and components for its new FANG line of FPV systems.

"[Unusual Machines] generates US$5M revenue a year with 20–30% year-on-year growth that is expected to continue," Technical Analyst Clive Maund wrote in a June 20 report.*

He rated the Universal Machines' stock as an Immediate Strong Buy.

In terms of ownership, about 12.54% of UMAC is owned by management and insiders, according to the company, and about 40% is held by strategic investor Red Cat Holdings Inc.

The rest is retail.

The company's market cap is US$12.97 million, according to Market Watch, with 9.33 million shares outstanding with 2.25 million free float shares.

It trades in a 52-week range of US$1.37 and US$1.47.

| Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Unusual Machines is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Unusual Machines and Red Cat Holdings Inc.

- Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

* Disclosure for the quote from the Clive Maund article published on June 20, 2024

- For the quoted article (published on June 20, 2024), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500 in addition to the monthly consulting fee.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts’ Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.