Since we looked at Graphano Energy Ltd (GEL:TSXV; GELEF:OTCMKTS) toward the end of May, the company has made solid progress advancing its projects, and on the 26th of this month, the company announced that it had staked an additional 20 mining claims on the western side of its existing 100%-owned Lac-Aux-Bouleaux (LAB) project on the strength of strong exploration results.

This is important news as the new claims more than double the holdings comprising the LAB Project. As CEO Luisa Moreno states, "We are pleased to have extended our LAB claims, significantly enhancing our exploration potential in the area. The LAB region, home to an historical graphite mine and adjacent to the operating Lac-des-Iles mine, is the only graphite-producing area in North America. Our exploration results at the LAB project have been very promising, reinforcing our commitment to expanding our footprint in this region."

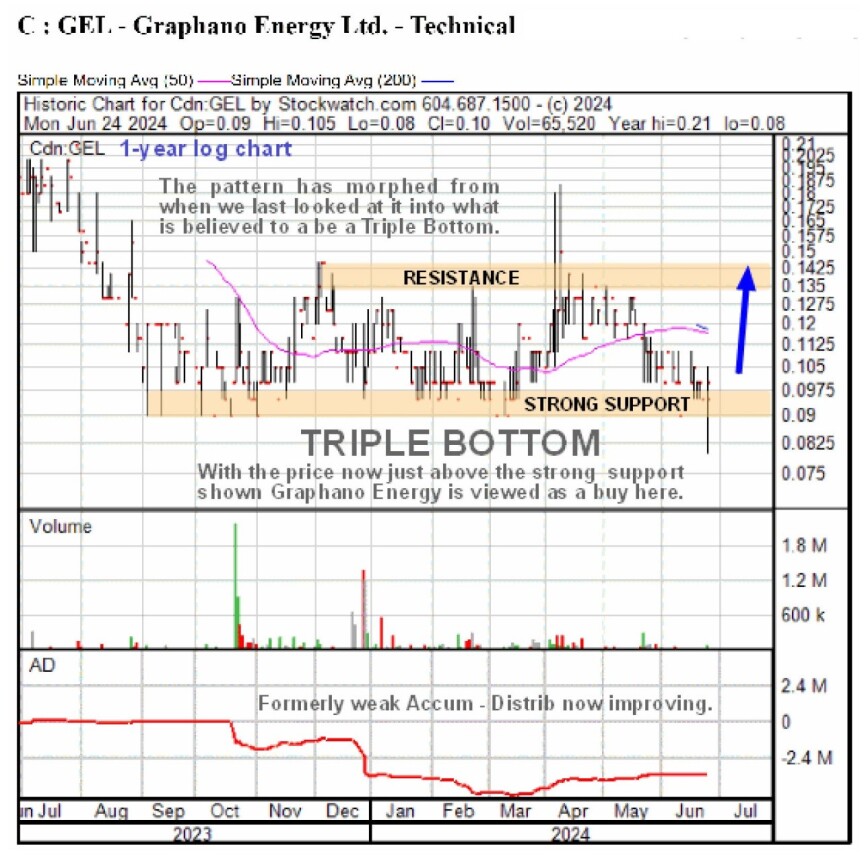

The intensifying debt crisis is expected to lead to a capital flight from all debt instruments and fiat generally into tangible assets and specifically into commodities such as graphite, all of which are expected to soar. This means we are now believed to be at a favorable point to buy Graphano Energy stock as it is at the third low of a large Triple Bottom base pattern and is thus at a very good entry point, as we will see when we review its charts towards the end of this article.

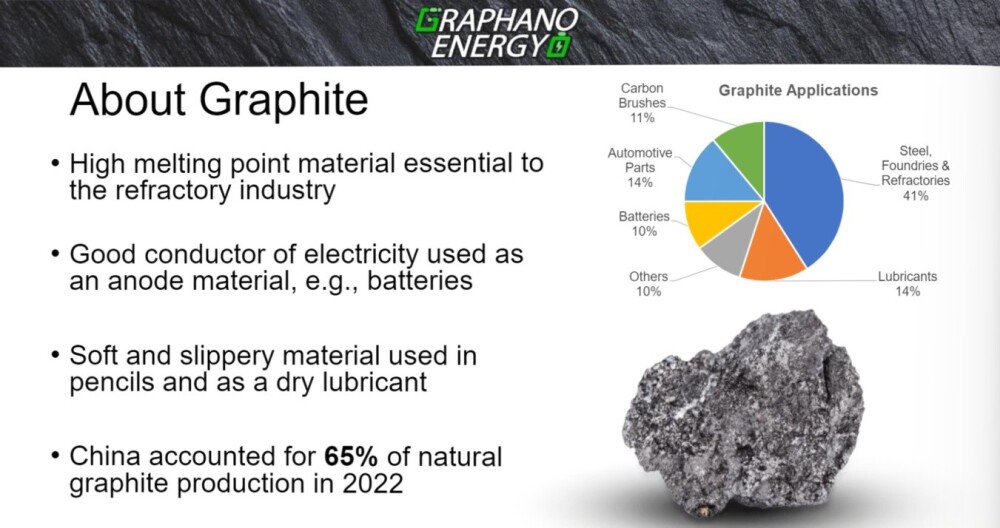

Many people, perhaps not surprisingly, do not know much about the uses to which graphite is put, and the following slide, lifted from the company's investor deck, provides some information on the characteristics of graphite and its uses and an additional reason for showing this slide is that it points out that China accounted for 65% of natural graphite production in 2022 but last Fall China announced restrictions on the export of graphite to the U.S. and other countries, and it was recently in the news that the U.S. is to slap a 25% tariff on natural graphite imports from China, starting in 2026, a development that is going to make the product of domestic producers such as Graphano Energy a lot more competitive and attractive.

Many people, perhaps not surprisingly, do not know much about the uses to which graphite is put, and the following slide, lifted from the company's investor deck, provides some information on the characteristics of graphite and its uses and an additional reason for showing this slide is that it points out that China accounted for 65% of natural graphite production in 2022 but last Fall China announced restrictions on the export of graphite to the U.S. and other countries, and it was recently in the news that the U.S. is to slap a 25% tariff on natural graphite imports from China, starting in 2026, a development that is going to make the product of domestic producers such as Graphano Energy a lot more competitive and attractive.

In related news, the CEO and President of Graphite One, Anthony Huston, was invited by President Biden to a WHITE HOUSE INVESTMENT AND JOB CREATION SESSION, which gives gives an indication of how seriously the administration are taking the domestic production of this important raw material which is also interesting also because Graphite One was recommended in an article posted about a week before it took off strongly higher.

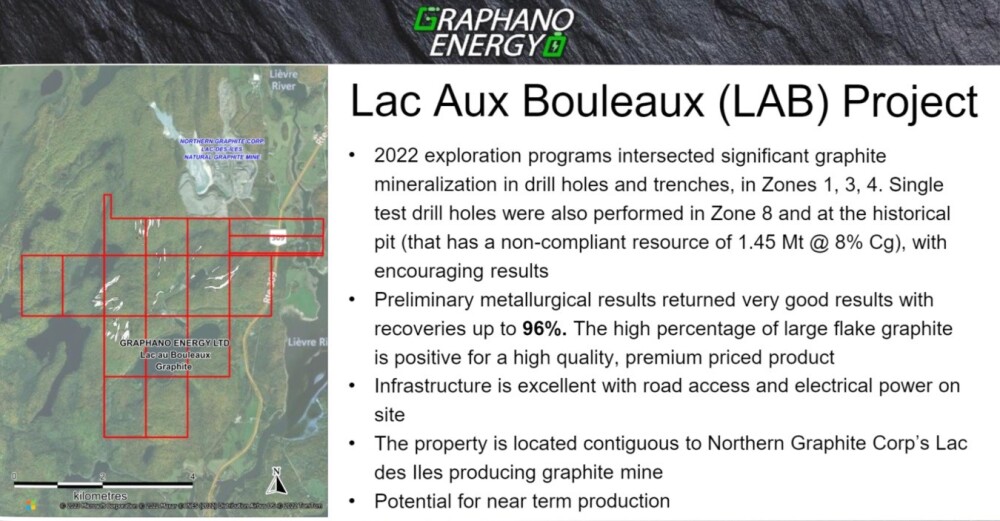

The company has three graphite-bearing properties that are quite close to each other in Quebec, with the flagship LAB (Lac Aux Bouleaux) property being adjacent to the only producing graphite mine in North America, which is the Lac de Iles mine belonging to Northern Graphite. The past two drilling seasons have produced consistently positive drill results and the company has staked additional ground.

The extent of the LAB Project is shown on the following slide and a very interesting and important point to observe is how the LAB ground is contiguous with Northern Graphite's Lac de Iles mine to the north which, as mentioned above, is the only producing graphite mine in North America, and it is understood that in the past Northern Graphite made an attempt to buy out Graphano Energy.

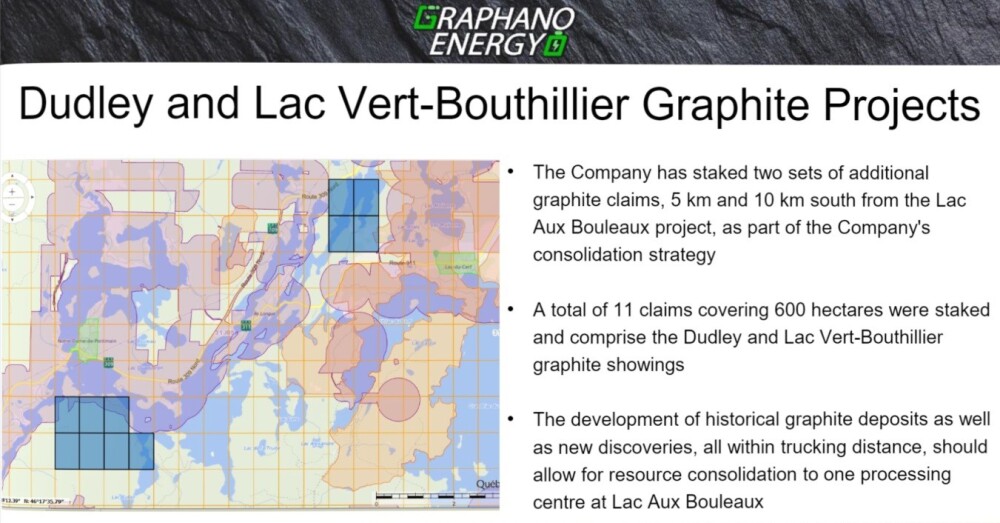

The company's other two graphite projects, which are comprised of two sets of additional claims, the Dudley and Lac Vert-Bouthillier properties, are in the same general area which means that, once developed, the company will benefit from economies of scale since the ore from all three properties can be trucked an acceptable distance to one processing center at Lac Aux Bouleaux. The following slide shows the relative positions of the Dudley and Lac Vert-Bouthillier properties and the claims that comprise them.

The company's other two graphite projects, which are comprised of two sets of additional claims, the Dudley and Lac Vert-Bouthillier properties, are in the same general area which means that, once developed, the company will benefit from economies of scale since the ore from all three properties can be trucked an acceptable distance to one processing center at Lac Aux Bouleaux. The following slide shows the relative positions of the Dudley and Lac Vert-Bouthillier properties and the claims that comprise them.

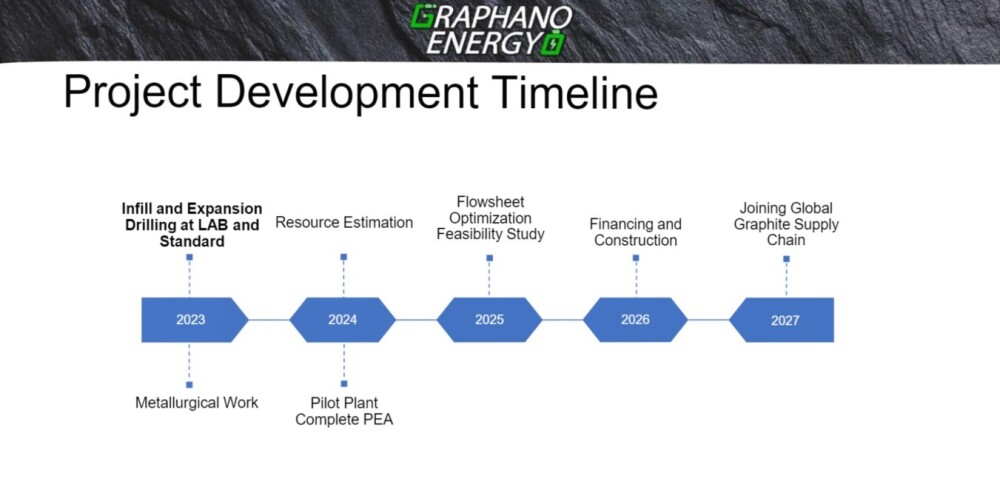

The next slide shows the timeline to production, and while it may initially seem a little offputting that production does not look set to begin until 2027, we can be sure that investors will want to position themselves ahead of this, which means that the stock can be expected to advance long before production starts, especially if the company delineates a larger resource with passing the time as looks likely, and especially given that a major commodities bullmarket is getting started and now, of course, we have the added catalyst of tariffs and trade wars that will make domestic production of important raw materials all the more important.

The number of shares in issue is about 17 million of which 11% are owned by insiders, 4% are owned by management, 3.5% by institutions with the largest (non-insider) shareholder having a 9.8% stake.

Catalysts that are likely to help get the stock moving as the year wears on, in addition to the powerful macro factors mentioned above, are the ongoing prospecting work during the Summer season, the reporting of metallurgical results, announcements concerning the new properties that have been staked, and the prospect of a new drilling campaign towards the end of the year.

Now we turn to the stock charts for Graphano Energy where we quickly see that they provide clear and strong evidence that it is in the late stages of basing following a long and severe bear market.

Starting with the 3-year log chart, which shows all of the action in the stock since it started trading, we see that after it began trading in the latter part of 2021, it ran up in a brief but strong uptrend, after which it sloped off into a severe bear market that by the time it had run its course in September of last year had dragged the price down as low as 9 cents so the stock had lost well over 90% of its value at its late 2021 peak at about CA$1.28.

The reason for using a log chart in this case is that it "opens out" the base pattern, making it easier to see what is going on, and we also get a fit for the long-term downtrend channel using log. Since hitting bottom last September, the price has clearly been marking out a base pattern, which we will now proceed to look at in more detail on a 1-year log chart.

On the 1-year chart, we see that a fine, large Triple Bottom base pattern has formed since last September, with its first low(s) having occurred last September and October, and it dipped back to form the second low of the pattern in March. In the last article, it was thought that it had completed a Double Bottom and was ready to break out and advance, but instead, it has dropped back to make a third bottom, so the pattern has changed into a Triple Bottom.

It, therefore, makes sense to double down and buy it again here or for the first time. A bullish reversal candle formed a couple of days ago when it breached the support intraday but then rallied back to close above it. This was a sign that the third low is in and the stock is now ready to advance.

With a rally off the third low of the Triple Bottom expected soon, Graphano Energy is rated an Immediate Strong Buy and the first target for an advance is the resistance shown at the top of the base area at about CA$0.14.

Graphano Energy's website.

Graphano Energy Ltd (GEL:TSXV; GELEF:OTCMKTS) closed for trading at CA$0.10, US$0.068 on June 24, 2024

Want to be the first to know about interesting Alternative - Cleantech, Battery Metals and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Important Disclosures:

-

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.