In October 1973, Arab oil producers cut supplies to countries supporting Israel in the Yom Kippur War. Gas prices quadrupled, and fuel shortages plagued America.

The embargo ended in March 1974 after the ceasefire accords. But it transformed global energy politics. Now, with the current conflict in the Middle East, there are talks of another potential oil embargo.

Oil Embargo on the Horizon?

On November 2, Bob Moriarty of 321gold.com sat down with Liberty and Finance to talk about the markets, including what would happen if an embargo of this caliber were to occur. Elijah Johnson of Liberty and Finance asked Moriarty if he believed this embargo would happen soon and, if so, how it would impact the financial system and energy market.

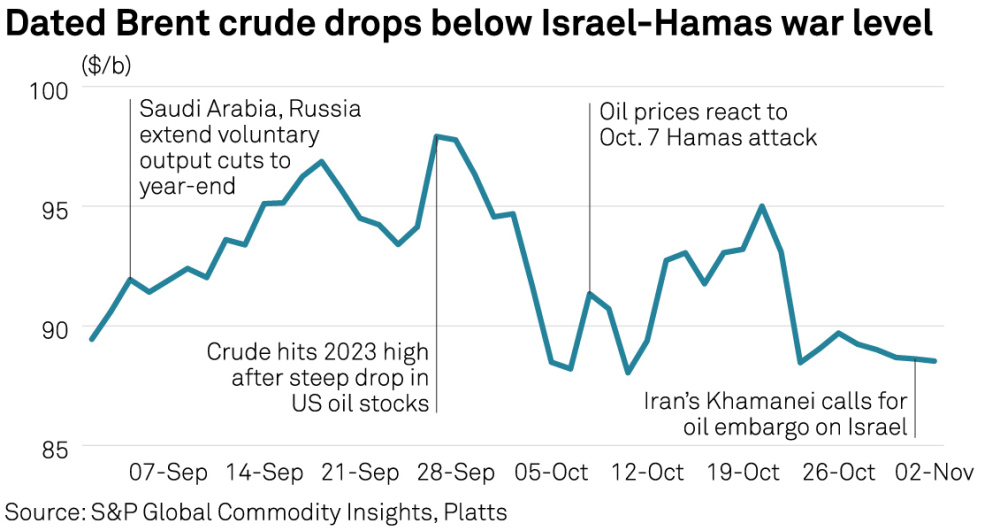

Moriarty noted that it would "yank the rug out from the Western debt-based system." He stated that he sees an oil embargo in our future, and while it may be "catastrophic" for the financial system, he does not foresee an alternative. This, in turn, would lead to rising energy prices.

In 1973, oil prices soared to US$11 a barrel. As S&P Global Reported, "By 1974, global oil prices had increased by 300% after OPEC imposed targeted embargos on exports to the U.S., UK, the Netherlands, Japan, and Canada, in response to their support for Israel in the war against Egypt and Syria."

With this in mind, Moriarty opined that we could "go from US$90 a barrel today to US$360 a barrel."

VOA News also agrees, stating, "Any damage to Iranian oil infrastructure from a military strike by Israel could send prices jumping globally." In its report. VOA shared comments from Mike Sommers, president and CEO of the American Petroleum Institute.

Sommers stated, "American oil and gas are needed now more than ever."

With this, investors may want to turn their attention to Western oil and gas companies as rising prices would benefit that industry.

For example, Bill Newman of Research Capital Corp. has put out a few research notes and recommended Western oil and gas companies over the past few months. Valeura Energy Inc. (VLE:TSX; PNWRF:OTCMKTS)

Valeura Energy Inc.

November 11, >Newman reported on Valeura Energy Inc. (VLE:TSX; PNWRF:OTCMKTS).

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Valeura Energy Inc. (VLE:TSX; PNWRF:OTCMKTS)

Valeura Energy Inc. is a Calgary, Alberta-based upstream oil and gas company pursuing a strategy of adding shareholder value through international mergers and acquisitions, with a focus on Southeast Asia. The company targets assets that can generate substantial near-term cash flow and opportunities for mid-term reinvestment. It also holds a longer-term position in a deep, tight gas play in Turkey.

However, while in Southeast Asia, Valeura Energy is growing through acquisitions in regions outside of North America. In his report, Newman gave Valeura a Buy rating and a CA$8.25 target price, which at the time had a significant return of 164%.

This may be due to the fact that Valeura's "cash is building," and Research Capital expects this to continue."

A more detailed report can be read here.

Reuters reports that 5.98% of Valeura is held by management and insiders. CFO Yacine Ben-Meriem has the most out of management at 3.97%, with 4.04 million.

13.65% is with institutions. Out of this group, Baillie Gifford & Co. has the largest holding at 12.32%, with 12.53 million shares.

The rest is with retail investors.

According to Market Watch, Valeura has a market cap of CA$381.38 million and 101.7 million shares outstanding. It trades in the 52-week range between CA$0.60 and CA$4.23. Gran Tierra Energy Inc.

On November 1, Newman gave Gran Tierra Energy Inc. (GTE:TSX; GTE:NYSE.MKT)a Buy rating, with a target price of CA$29.44 per share.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Gran Tierra Energy Inc. (GTE:TSX; GTE:NYSE.MKT)

Gran Tierra Energy is an oil and gas exploration and production company headquartered in Calgary, Alberta, Canada. Gran Tierra Energy focuses its operations on oil and gas assets primarily located in South America. Since its establishment, the company has pursued exploration, development, and production of petroleum resources across several countries in the region. Gran Tierra Energy's founders brought together expertise in geology, geophysics, petroleum engineering, and finance to build the business in the Western hemisphere energy sector.

In his report, Newman commented, "We believe Gran Tierra represents good value, trading at a large discount to our estimated proven reserve after-tax net asset value of CA$29.44 per share and at a 2.7x multiple of our 2024 enterprise value:debt-adjusted cash flow."

You can read our full research report here.

According to Reuters, 2.77% of the company is held by management and insiders. President and CEO Gary Guidry has the most out of management at 1.24%, with 0.41 million shares.

31.08% is with institutions, with 1.60% with brokerage firms, and 29.48% with investment managers. As for top investors, GMT Capital Corp. owns 7.48%, with 2.49 million shares, and RBC Wealth Management, International has 3.01%, with 1 million.

The rest is held by retail investors.

Market Watch notes that Gran Tierra has a market cap of CA$310.95 million and 33.29 million shares outstanding. It trades in the 52-week range between CA$6.13 and CA$17.90.

Rok Resources Inc.

Rok Resources Inc. (ROK:TSX.V) was reviewed by Newman in a September analysis. Rok Resources is an oil and gas exploration and development company headquartered in both Saskatchewan and Alberta, Canada. The company aims for sustainable exploration and keeps its projects close to home in the Western Canadian Sedimentary Basin.

In his research note, Newman wrote, "With the recent surge in oil prices, a highly successful drilling program, and increasing production, ROK is gaining significant momentum as it approaches 2024."

He gave Rok a Buy rating and a CA$0.75 target price, which is a 92% increase from the price at the time of CA$0.39.

Further details can be found here.

Reuters reports that 16.63% of the company is with management and insiders. CEO and Chairman Cam Taylor has the most in this category at 4.90%, with 10.56 million shares.

Institutions hold 5.08% of the company. Mackenzie Financial Corporation has the most of all institutions, at 4.52%, with 9.73 million shares.

The rest is with retail investors.

According to Market Watch, Rok Resources has a market cap of CA$80.77 million and 215.39 million shares outstanding. It trades in the 52-week range between CA$0.28 and CA$0.53.

Looking Ahead

The 1970s embargo revolutionized geopolitics and energy markets. While history never repeats itself exactly, the lessons remain relevant. True energy security requires a thriving domestic oil and gas industry.

The West has made strides toward that goal, unlike decades ago. Now, booming domestic output helps inoculate the economy against overseas turmoil. While conflict in the Middle East may yet impact oil flows and prices, traditional oil and gas firms still warrant portfolio allocations as well.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production and Oil & Gas - Services investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Katherine DeGilio wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

For additional disclosures, please click here.