After having received the Aquifer Protection Permit (APP) draft by the Arizona Department of Environmental Quality (ADEQ) for the Gunnison Copper project on June 14, which had to undergo a public comment period of a month and final decision making after this, Excelsior Mining Corp. (MIN:TSX; EXMGF:OTCQB) finally received the APP on September 5, which is one of the two biggest possible catalysts for this copper developer, and very good news. The other catalyst in this regard will be the granting of the Underground Injection Control (UIC) permit, which is issued by the Environmental Protection Agency (EPA). There has always been a significant amount of doubt if Gunnison could be permitted, as it would be the first greenfield copper ISR project in the USA to do so, and Arizona doesn't have a reputation of going easy on permitting anyway.

In comparison, the nearby Florence project of Taseko (former Curis) received just temporary operating permits in December 2016 for its test facility, whereas Gunnison is in the process of receiving operating permits for the entire project, of which the granted APP is the first of the two major permits needed. Notwithstanding this, Excelsior management always has been very confident on the entire permitting process, probably strengthened in their belief by the impressive skills and experience of VP Sustainability Rebecca Sawyer, who has been leading the process from the beginning, and apparently rightly so.

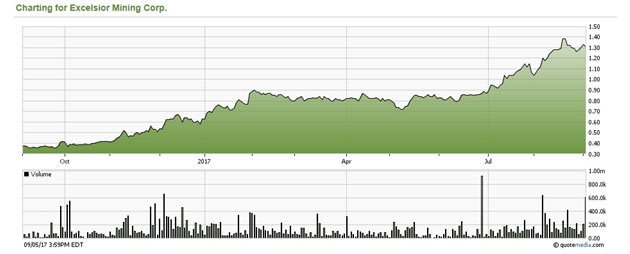

Although the share price has been going up steadily the last year, building one of the best charts in the industry, it is not really clear to me what part of this has been caused by investors anticipating the grant of permits:

Share price Excelsior Mining (MIN.TO); 1 year period

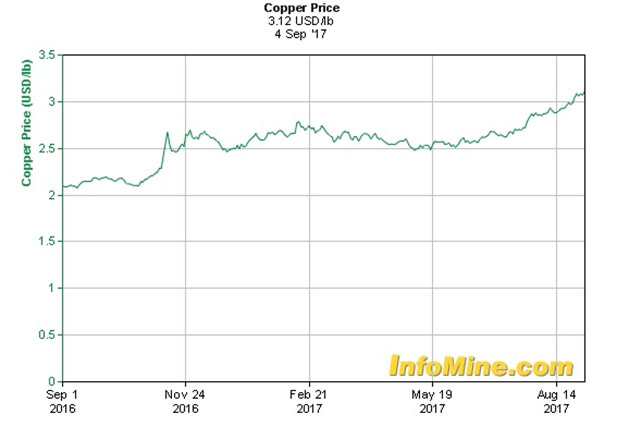

As you probably know, copper prices have been going up in that period as well, based on growing demand, a lower dollar, strikes, power outages and lower grade, and roughly seem to follow the same pattern as the Excelsior chart:

This could indicate a lot more re-rating potential, as it looks to me if the entire chance on permitting success hasn't been priced in yet. As I will show in a bit, the NPV value of Gunnison at current copper prices is still much higher than the current market cap, which will no longer make much sense as soon as the project would be fully permitted.

Let's discuss the APP permit first here, to get things clear. The news release shows that it isn't the definitive permit yet:

"The ADEQ has issued Excelsior a Grant Letter, which remains appealable under specific circumstances for 30 days. After the close of the appeal period, the APP will be fully executed and the permit will then be active."

My first question to management was what they were anticipating with this appeal period for potential risks. Their answer was pretty straightforward, there could be appeals although they don't expect any, but in any case they expect a 100% chance on receiving the APP before the end of this year. Such an appeal would most likely take a month. On my follow up question why they are so convinced again, the answer was equally straightforward: they firmly believe there is nothing substantive contained within the five comments that were received. To me this looks if the APP is already very close to the finish line, and for about 95% a done deal, which is very important for the company.

The federal UIC permit is expected by management to follow the same trajectory, and Excelsior anticipates the draft permit to be received in September, with the permit to be issued two months later in November. I am convinced that negotiations on any financing package will significantly pick up speed when both APP and UIC permits are arranged. Initial capex is very low at $47 million as ramping up is staged, so I don't expect any problem with arranging packages here, and any equity part, if necessary at all, will hardly cause any dilution at current or higher share prices. And even if financiers decide to start out at a much larger capacity to profit from high copper prices, and would need a much bigger equity component, adding let's say 30-40 million shares to the current 183 million F/D figure is still very modest anyway.

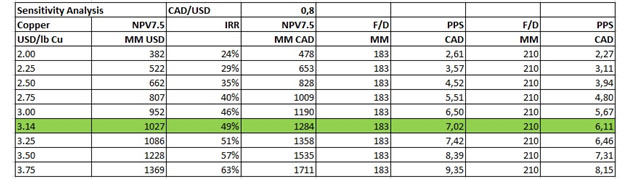

Let's see what happens in a quick sensitivity analysis on Gunnison, when using the current 183 million F/D shares without any dilution, and for example a 210 million F/D share count, assuming in both cases a fully financed and constructed project, ready for commencing commercial production. In that case I estimate the market cap to be equal to full post-tax NPV7.5 (although I have to add that I don't consider Arizona a risky jurisdiction when operating, and a 5 or 6% discount could be warranted as well although opinions differ on this subject). In the following table MM means million, F/D fully diluted shares and PPS price per share:

At a current share price of C$1.32 and a current copper price of $3.14/lb Cu, it will be clear why there is still so much upside for Excelsior, and why it most likely will be significantly re-rated between receiving permits and production. Just a fully permitted project at FS-stage, which is also very profitable and has a low capex, could rate anywhere between 30-50% of NPV, so I expect Excelsior to trade at least around C$2.00 when both permits are granted. I don't expect any issues with arranging financing or with construction, as the company has powerful backing by Greenstone who is a controlling shareholder at 50.4%, and wants to see this going into production as soon as possible. The future is looking bright for this developer, which has probably the most profitable copper project on the planet.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Excelsior Mining is a sponsoring company. All facts are to be checked by the reader. For more information go to http://www.excelsiormining.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by The Critical Investor