History makes it clear that secular bull and bear cycles in gold are mostly correlated to one indicator: negative and declining real rates and real yields. That's the key driving force.

Supply and demand for gold are unlike other commodities. The overwhelming majority of gold produced isn't consumed; therefore, its supply keeps on growing.

That's why investment demand is the determining factor that drives the price higher or lower.

In times of positive real interest rates, there is little incentive to hold gold, which is why it has underperformed under those circumstances.

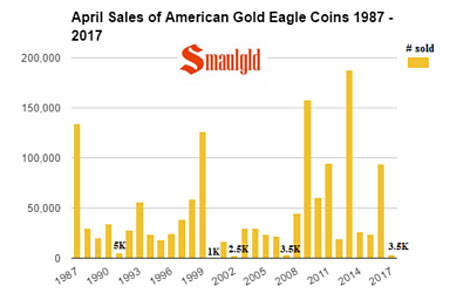

Courtesy of Smaulgld.com

Right now, investment demand is at a 10-year low, and though we all know that central banks do not report their leasing, buying, or selling of gold—especially in China, where gold holdings are kept confidential—and although we are all aware of the London and New York paper manipulation and smashing of gold contracts, this chart at least partially shows that many gold buyers have turned into S&P 500 buyers. They couldn't resist any more.

Inflation has cooled its progress and yields are kept low, so we are mostly in ideal conditions for a renewed bull market in gold after six brutal years. But there isn't a green light yet.

The fact is that the 2011 bear market, which hasn't officially finished selling out yet, is normal!

Yes, it is long, and yes, it has wiped out a ridiculous number of stocks from the exchanges, but that is the nature of gold bear markets. Rick Rule and Doug Casey, who actually experienced 40 years of these cycles themselves, state that this is the worst one yet.

So, what is missing now is the S&P 500's well overdue correction, and even a bear market. This is the final hurdle before gold stocks make parabolic moves higher, which I believe will even shock the few investors that are actually positioned now and are suffering from temporary pains.

My Most Advanced Strategy:

More advanced traders do not only purchase shares of the highest-quality juniors on the long side anytime there's sustained weakness. That's an important part of the overall strategy, and it's called Dollar-Cost Averaging.

But what truly seasoned investors do, which is my partners' and my own strategy as well, is short the basket of juniors (GDXJ and others) on the flip side.

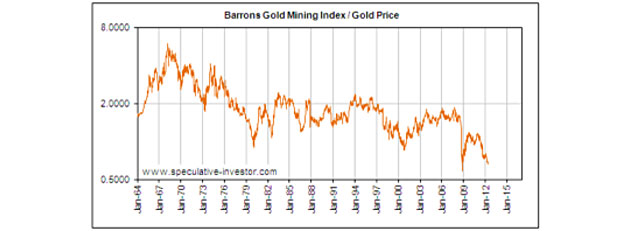

Gold mining stocks are trading at valuations not seen in decades. Valuations may be at levels not seen since before 1980.

In addition, the gold miners, relative to gold, have never been cheaper since at least the 1940s. Furthermore, the value of gold in the ground ticked below its 25-year low.

Gold and gold stocks are struggling now and it could continue, but they are perfectly set up for a

The massive move in precious metals during the first half of 2016 is only the warm-up of what lies ahead. We have to take advantage of the coming weakness or we risk missing the big move when it starts. Companies like this, chaired by the ultimate mining company builder, could end up cashing investors in at 1,000% gains and more.

Tom Beck is senior editor of Portfolio Wealth Global. Known as one of the first millennial millionaires in the United States, Beck is a relentless idea machine. After retiring two years ago at age 33, he's officially come out of retirement to head up Portfolio Wealth Global. He brings a vision of setting a new record for millionaires with his seven-year plan to accelerate any subscribers' net worth who will commit to the income lifestyle. Beck delivers new ideas on the marketplace that were once only available to the rich. Traveling the world, he's invested in over a dozen countries, including real estate.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Tom Beck: I, or members of my immediate household or family, own shares of the following companies referred to in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies referred to in this article: None. My company has a financial relationship with the following companies referred to in this article: First Mining Finance Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor's fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by Tom Beck