No one I know, including myself, can predict with great accuracy the day-to-day direction of any investment. However you can go to the chat board of any investment and most of the people there feel they and they alone know what gold or silver or the Dow is going to do tomorrow. When on occasion they manage to get it right they sprain their arms patting themselves on the back. But if two people are tossing a quarter and one chooses heads and the other tails, one of them will get it right. Markets pretty much can only go up or down, they rarely stay the same.

Due to the friction caused by commissions and the spread between bid and ask, you not only have to be right to make money, you have to be pretty right. A 5% move in the right direction may be necessary to break even.

There are alternative investments where you don't have to bet on direction to profit. I cover two of them in my best selling book on Amazon, Nobody Knows Anything.

One is a platinum/gold spread and the other is a silver/gold spread. You don't have to guess and after all, that is all we are ever doing when investing, we guess what direction an investment will go in next. You can use historical data to determine the range of an investment in the past and presume the future will be similar.

There are relationships behind all sorts of commodities. For some reason sugar and silver tend to make tops and bottoms together. I won't ever wonder why, they just do. Others are more logical. If you read that Cheerios have doubled in price, you can safely suggest that Wheaties probably will also move up. Whatever affects Cheerios will usually affect Wheaties.

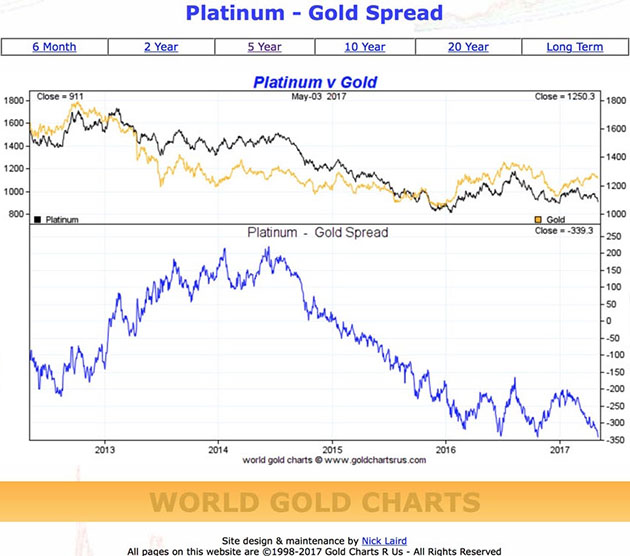

Gold is a precious metal, as is platinum. Over the past several hundred years, for a variety of reason platinum has almost always carried a premium to gold. It's scarcer and costs more to produce than gold. But since 2015 the spread between platinum and gold has gone negative three times with platinum going higher than a $340 discount to gold three times.

In all of history platinum has never gone to a greater discount to gold than about $350 for a few minutes. It is now possible to do a platinum/gold spread on the CME. Maintenance margin is $3060. The contract is for 100 ounces of gold vs. 100 ounces of platinum. A $10 move is worth $1000. Since platinum has never gone to a greater discount to gold than it is right now, it's a pretty conservative bet. In the two previous cases since 2015 where the spread touched $340, in the first case, the spread decreased to minus $160 and the second time it decreased to minus $200. You can be invested in precious metals without having to guess direction. You want to be long platinum and short gold. Who cares what the price should either be? You only care that the high price for gold relative to platinum will decrease.

The other interesting spread is the ratio between silver and gold. How many ounces of silver does it take to buy one ounce of gold? Over the past 100 years or so, the ratio has varied between 17-1 and 100-1 while averaging 53-1. When I wrote Nobody Knows Anything, the ratio was 84-1, which was a really safe spot to invest. In the past ten years the ratio has varied between about 85-1 and 32-1. During the last two years the ratio has been as high as 84-1 and as low as 65-1.

Again the CME has futures contracts where you can trade the ratio. Maintenance margin is a tiny $1450.

According to Tom McClellan, the silver/gold ratio going over 72 is an indication of stress in the financial system. So while the platinum/gold spread makes platinum look cheap, the silver/gold ratio has gone from 68-1 to 75-1 in the last month. There is nothing saying the silver/gold ratio might not go to 85-1 or even 100-1 in the financial crisis we all know is coming one day soon.

Nobody knows what the "right" price is for gold or silver or platinum regardless of all the pundits who claim they and they alone are correct. But you can use history as a guide to determine a safe point at which to invest. Right now gold is more expensive than it has ever been relative to platinum and pretty damned expensive relative to silver. Who knows if the metals will go up or down? But you can make money understanding and betting on past history and still be pretty conservative.

Investing is not rocket science if you understand the basics and use some common sense. There are no gurus.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author