The ideal gold deposit today for a junior mining lottery ticket would be over 2 million ounces of medium- to high-grade gold located in a safe jurisdiction, preferably in a developed mining camp. The junior spends money exploring and developing the resource and sells it to a major or mid-tier for big bucks. It's the pot of gold that all the juniors claim to be aiming for but few actually hit.

With the rise in gold shares since early this year, the slam-dunk stories are getting fewer and fewer as the rising tide lifts all boats. But there are still a few good stories around if you are willing to search. I've found one, BonTerra Resources Inc. (BTR:TSX.V, BONXF: US, 9BR:FSE), that appears to have two home-run potential projects.

Timing is everything when buying the penny dreadfuls. From late 2011 until late 2015 the value of junior gold shares plummeted as some stocks dropped as much as 99%. A very few stocks advanced and great drill results presented little more than a liquidity event to long suffering investors so they could dump shares. But from January of this year, you could have poured funds into some of the biggest crap stocks in Vancouver and seen hundreds of percent gains.

Likewise with the mining companies' management, there is a time to buy when you can do no wrong. BonTerra Resources got as high as $7.70/share in a post-rollback price in 2011 before blowing sky high, dropping to a low of $0.09 in late 2013. The share price went sideways for two years as new management was brought in to clean up the mess left behind. The new management restructured the company, fired those needing firing and paid the bills left over. But they knew that opportunity was just around the bend because giant bear markets breed giant bull markets.

In 2012 Gold Fields Ltd. (GFI:NYSE) entered into an agreement with Kerr Mines Inc. (KER:TSX) on the Larder Lake project owned by Bear Lake Gold, a subsidiary of Kerr Mines. Gold Fields agreed to spend $40 million in exploration to earn 60% of the property. Beaten up by the decline in gold prices, Gold Fields gave up all worldwide exploration in 2015 and handed the project back to Kerr. Good timing on their part, they managed to nail the bottom of the market.

Let's do the math. According to both Kerr and Gold Fields in 2012, 60% of the Larder Lake project was worth $40 million in spending. That makes 100% of the project worth $66.66 million according to my Bomar Brain. But Gold Fields didn't want to spend any more money on exploration and Kerr still wanted to do a deal on the property.

Enter BonTerra at the very bottom of the market. In March they announced a deal with Kerr where they would purchase 100% of the Larder Lake property for a little over $4 million in cash and shares. The last time anyone did a deal this good was when the Dutch bought Manhattan for $24 in beads. Given that at today's price, BonTerra has a total market cap of about $33 million; according to both Kerr and Gold Fields Larder Lake alone was worth twice the company's market cap in 2012.

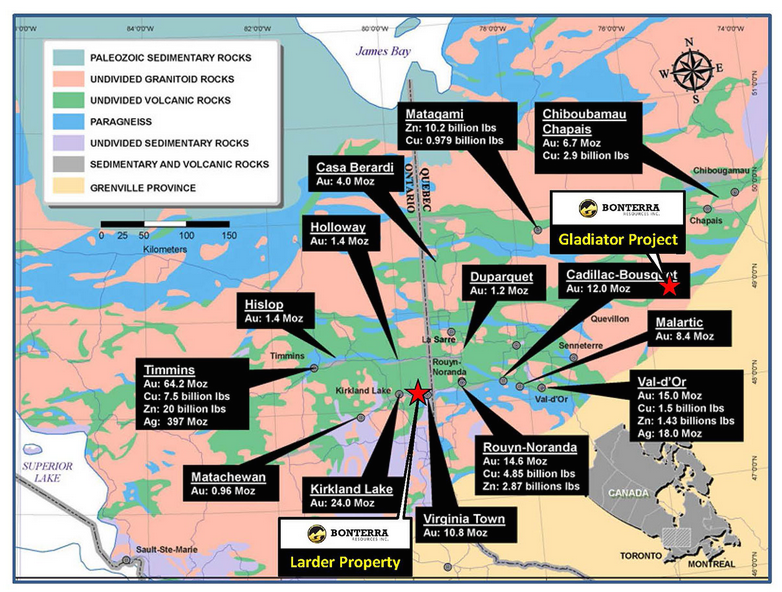

Larder Lake is a 2,165-hectare land position right on the Cadillac Larder Fault Break where records show 13 million ounces of past production. The Larder Break Fault runs from Kirkland Lake to Val d'Or. The property is a mere 7 km west of the Kerr Addison Mine with production of 11 million ounces of gold.

The project has multiple historic mines with two different shafts already sunk on the property. There has been over 100,000 meters of drilling to outline a historic 43-101 resource done in 2011 of 917,000 ounces of gold in the inferred category at 5.55 g/t and an additional 43,800 ounces of gold at 4.07 g/t in the indicated category.

While Gold Fields had an option on Larder Lake, they completed over 25,000 meters of drilling in 59 holes and spent $6 million. Those holes are not represented in the existing 43-101. I expect BonTerra to soon announce a massive drill program with a plan to issue a new updated 43-101 by Q1 of 2017.

But Larder Lake isn't BonTerra's only 2 million ounce potential gold mine in Canada. Their mother ship project is actually the Gladiator Project located in the Abitibi mining district in mining-friendly Quebec adjoining the Oban Windfall property. Gladiator has a 7,563 ha land position in the Abitibi greenstone belt. Gladiator is being drilled as you read with a 25,000-meter drill program that began in February of 2016. The project has an existing 43-101 resource of 492,000 ounces inferred at 3.53 g/t Au.

BonTerra Resources is a great example of a company that was handed lemons and made lemonade. They got hammered from 2011 until 2015 by almost 99%. They rolled back, restructured, and made plans to capitalize on the mistakes of others. At the very bottom of the market they were snapping up ounces of gold at $6 an ounce. When the market turned, they did private placements, got cashed up and went back to work.

The retail market has yet to glom on to their real value. They went up 200% between the low in January and a high in March but have been in a long correction since then even after picking up nearly a million ounces of gold at $6. The funds and strong hands on the other hand get it. Oban Mining Corp. (OBNNF) is a big shareholder as is Kerr Mines as a result of the deal they did in March on the Larder Lake property. U. S. Global has a piece of them along with Sprott. In July Oskisko announced they now owned 9.5% of BTR on an undiluted basis.

I'm on record as believing we are still correcting the incredible advance in gold shares since the first of the year and I believe that correction will possibly continue into October. But many shares have already corrected and are now positioned for another big advance. When this correction ends, I see a lot of fireworks.

BonTerra is well cashed up with over $5 million in cash waiting to be spent on an aggressive drill program and resource update on both major assets. In addition, at the end of the February quarter there were over 12 million warrants outstanding at an average price of $0.26 that are all solidly in the money. I would expect them to be exercised over time providing an additional $4 million in cash.

If you subtract the $5 million in cash from the $33 million market cap, investors are getting gold in the ground for under $20 an ounce and that isn't going to last for long. They are going to increase their resource ounces and I expect as this bull matures, mining companies will begin to value those ounces a lot higher.

BonTerra is a sleeper that has not made it onto the radarscopes of retail investors but I expect them to shift gears soon and be providing a lot of solid information about drill results and plans. I liked the story enough to go out in the open market and buy shares. BonTerra is an advertiser and naturally I am biased. Do your own due diligence.

BonTerra Resources

BTR-V $.405 (Sep 12, 2016)

BONXF OTCBB 84.1 million shares

BonTerra Resources website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: BonTerra Resources Inc. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. BonTerra Resources Inc. is an advertiser of 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.