One look at the recent chart of U.S. home prices city-by-city and I had to sit down armed with an Extra-Strength Tylenol and a quarter flagon of Glenfiddich. Zerohedge has been all over this entire commodities rebound since they (amazingly) sourced out the reason.

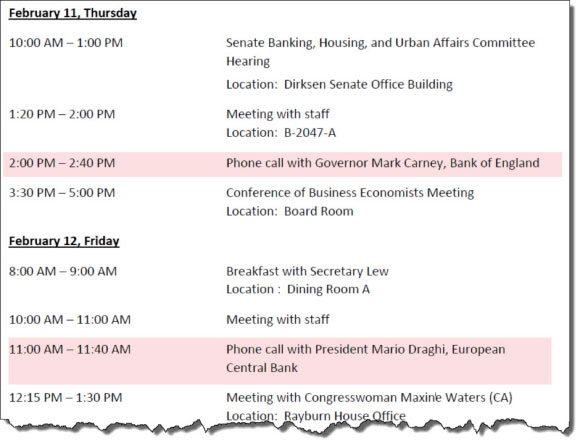

From the minute the phone call went out on Feb. 11 from Fed Chairman Yellen to BOE Chairman Mark Carney followed the next day to ECB head Mario Draghi, the four most important markets on the planet changed direction dramatically, with all of the markets representing the greatest risks to the banking business turning on a literal dime and continuing on a tear ever since. Firstly, before I down my second belt of single-malt, here is the itinerary of the call made by Janet Yellen to Carney and Draghi. . .

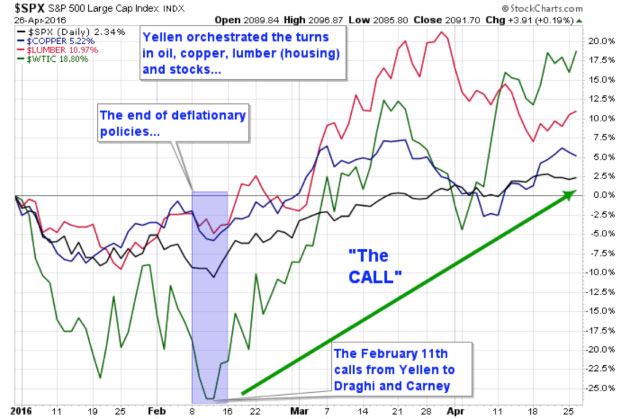

Now look carefully at the charts of the S&P500, copper, West Texas Intermediate crude oil and lumber. Stocks have historically been the advanced barometer for economic growth; copper (or "Dr. Copper") is widely seen as a barometer for economic demand; WTIC ("oil") around February was creating huge dislocations in the credit markets (HYG); and lumber is the surrogate for "mortgages" found in housing. What do all of these markets have in common? They are all markets to which the global banking cartel were dramatically overexposed and overleveraged. If these markets stayed in the tank for another quarter, the default "covenants" would have been triggered, the immediate result of which would have been very "bank-unfriendly." Observe the dramatic changes that occurred after Feb. 11 and 12 (see charge above). All forms of bank collateral were immediately lifted to debt covenant safety as the invisible hands of the Fed, the BOE and the ECB went to work. . .

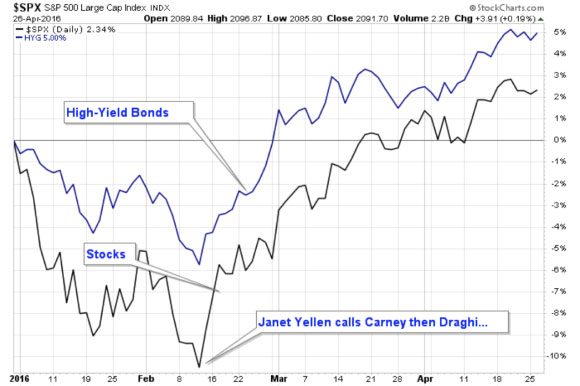

Now let's look at the relationship of the High-Yield Bond Market ("HYG") to stocks and to the now-legendary "Yellen phone call" from Feb. 11. . .

So all of this talk regarding "economic growth" and "Fed Policy" and "portfolio management" has NOTHING to do with securities analysis; it has EVERYTHING to do with PROTECTING the BANKS. There are zero provisions in place to protect the AVERAGE INVESTOR; there are countless provisions in place to protect the BANKS. By ensuring that the collateral represented by assets underwritten by the global banking cartel continue to rise, the bankers continue to PROTECT their ability to finance political campaigns and political agendas.

In other words, on Feb. 11, these central bankers ORDERED the escalation in asset prices, deemed all-too-necessary and highly germane to the interests of the global banking cartel.

Have you ever noticed that everything we get "fed" (large swig of Scotch interruption) by the "FED" is essentially designed to placate the major shareholders of that non-governmental institution called "The Federal Reserve Board?" Do a Google search on "The Creature from Jekyll Island;" you will get the following review of G. Edward Griffin's superb book. . .

"The Creature from Jekyll Island—one of the classic exposes of the treachery and thievery we call 'The Federal Reserve'—which is curiously neither federal, nor is it a reserve. No one cuts to the center of the issue quite like Griffin. This is an issue that impacts nearly every aspect of your material life, since you probably earn and buy almost everything you have with 'Federal Reserve Notes. ' The IRS, too, is little more than a collection agency for the 'Federal Reserve.' Find out the truth and the history of this evil which strangles our society."

Does it get any better (or worse) than that?

So today is the revelation of the past two days of discussions by the members of the Federal Reserve as to the course of monetary policy. More to the point, it will be sanitized to appear to have the interests of the American people at heart, but as I opined a couple of days ago, substitute the word "banks" every time you read a statement from a government agency or a mainstream financial news channel that mentions "the American people" or "the country." What relevance does this have to the future outlook for gold and silver prices? Just as the "Big Three" central bankers (Yellen, Carney and Draghi) ordered the ramping of bank collateral shown in the charts above, they must, by default, allow those two bellwethers of impending inflation, gold and silver, to rise in a manner that breaks the back of rising deflationary expectations. The significance of rising collateral prices is that it has signalled that the moneychangers—the bullion bank behemoths—cannot execute their plan to artificially rescue the shale oil "miracle" that has created "American Energy Self-Sufficiency" without allowing similar rises in natural gas and wheat and pork and, of course, gold and silver.

The script played out beautifully today with it being a basic "nothing" day for the metals and the miners. With the HUI up 1%, it is still running into resistance in the 210 area and the longer it trades between 195 and 210, the greater the likelihood of a pullback/correction. However, thus far gold and silver have refused to buckle despite elevated RSI and ugly MACD convergence, while bullish sentiment is as robust as I have seen since 2009. I am proceeding in a manner that assumes that a correction is coming, owning a few put options on the miners but sufficiently long enough to keep me in the game if I'm wrong. The next few days will reveal just how much power is behind this breathtaking up move in the metals and whether it has the staying power into the seasonally weak months of May to July.

The gold brokers are back to lighting $50 Cohibas with $100 bills again and the newsletters are in full "pump" mode, so while happy days appear to be here again, complacency in my trading habits will have me eating out of a dog food can again if I am careless, overconfident or both. "Fettucine Alpo" is not my preferred repast these days, so diligence remains crucial. . .

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger