Of the Energy Metals that I am actively following, lithium stands apart from almost all others as one that I view most positively. The last lithium "boom" from an investor perspective was in 2007 when lithium exploration and development plays rocketed upwards, bolstered by the thinking that an electric vehicle "revolution" was imminent. Obviously, that was premature. EVs of all types (hybrids, plug-ins, etc.) are finally starting to gain traction, but any sort of environment where vehicle electrification becomes more than a small percentage of the overall global vehicle fleet is still a ways off.

Paradoxically, I think this is a good thing if you're an investor in lithium.

My investment case for lithium should be familiar to anyone who has read these notes in recent months, but as a brief refresher, here it is:

Lithium production is an oligopoly. Despite the strong growth rates in lithium demand (estimated at 8% per year), oligopolies do not welcome competition and therefore if you're a company aspiring to join the ranks of producers, you need some sort of a competitive advantage or strategic relationship which allows you the possibility of achieving the lowest cost of production.

The growth rate in demand is key. I can't think of another metal I am following with such a strong forward looking growth rate—a real rarity when most commodity demand forecasts barely match global GDP forecasts.

Lithium also has what I call multiple "avenues of demand" which are all growing at different rates. Current day avenues include ceramics and pharmaceuticals while "tomorrow's" avenues are primarily focused on the lithium-ion battery industry. With an overall growth rate of demand of 8%, even if demand falters somewhat and averages 6%, this is still double global GDP growth rate estimates, offering a buffer against economic headwinds.

Global lithium production is estimated at 160,000 tonnes per year. The small relative size of this industry (nickel, graphite, copper are all many times larger) is actually a positive as lithium remains a niche metal, not well understood or misunderstood by investors of all types. This is asymmetry personified.

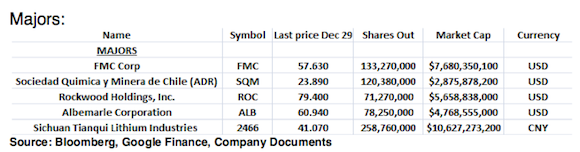

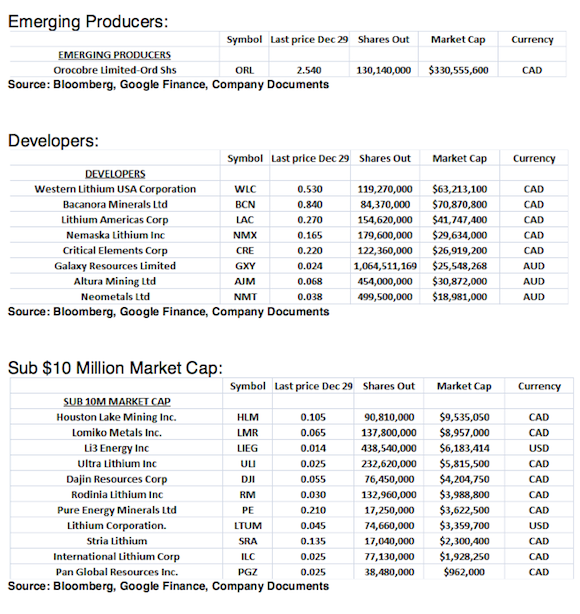

Based on my research, the collective market capitalization of the lithium production and exploration/development industry is over USD $26 billion heavily slanted towards the producer segment. I'm currently monitoring 25 publicly traded companies broken down amongst the following categories:

As an aside, it is important to note that FMC and SQM generate an incredibly small percentage of their revenues (sub 10%) from lithium, but are still counted as major producers. This is not the case for ROC, which generates a substantially higher percentage (34%) of revenue from lithium.

This list obviously excludes private companies and I also included Albemarle (ALB:NYSE) and Rockwood (ROC:NYSE) as separate entities, though the merger is set to close in the Q1 2015.I plan to conduct a more comprehensive analysis of these companies (size of resource, potential economics, etc.) in a future note. As an aside, I own no shares in any company mentioned above and have no financial relationship with any of the above companies.

I also offer this list to demonstrate another reason why I'm optimistic about lithium investment going forward: the small number of companies in the sector. With five major producers (soon to be four), one emerging producer, eight developers, and eleven companies with market caps below $10 million, and one ETF, the sheer number of companies competing for investor attention pales in comparison to those in other niche metal industries such as rare earths or graphite. This industry concentration makes it easier to separate the "wheat from the chaff". In addition to this, failure to meet supply projections due to any number of factors such as financing challenges implies that pricing will remain healthy, and hopefully won't show a repeat of the parabolic share performance in 2007 that ended in tears.

I also find this sector unique in that its small size is all the more remarkable when you consider the relative size of companies which depend on lithium in their respective value chains. Examples include Apple (AAPL:NASDAQ) with a market cap of USD $662 billion, Tesla Motors (TSLA:NASDAQ) with a market cap of USD $28 billion, LG Chem (051910:KRX) with a market cap of USD $11 billion, or Panasonic (PCRFY:OTCMKTS) with a market cap of over USD $28 billion. Each of these companies, to varying degrees, depends on a reliable supply of lithium.

That so many major technology and manufacturing companies are dependent on lithium chemicals to drive their businesses is proof that lithium is a metal that punches well above its weight class. While lithium is by no means the most expensive raw material used in batteries, the cost isn't the major issue, but access to a secure supply is.

Oversupply, But For How Long?

In an effort to present both sides of the argument, the lithium industry is dealing with slight overcapacity (approximately 180,000 tonnes of capacity versus 160,000 tonnes of production in 2013), so while this excess capacity gets "mopped up" it offers investors valuable time to understand the potential lithium holds. At current consumption rates and if planned production remains on schedule, the lithium industry may find supply/demand equilibrium in 2017. Pricing has remained remarkably firm in 2014 relative to other commodities that have fallen on tough times such as iron ore. Again, lithium's small size and growth potential appear to be the reasons behind this resilience in price.

Renewables As A Demand Driver

One key area to watch regarding lithium demand is growth in wind and solar power. The price of solar power, in particular, has fallen precipitously in recent years and many believe this trend will continue. The main issue here is the intermittency of the sun and wind and energy storage has frequently been hailed as the solution. In addition to that, energy storage is still a relatively expensive proposition. That said, as renewable sources of energy approach grid parity (possibly by 2020, though some believe it could be sooner), R&D into battery technology continues apace, and citizens from around the world continue the inexorable quest to live a higher (Western) quality of life, it is clear that the need for a more sustainable form of growth is imperative. This growth must be fed by commodities amongst which lithium will be at the forefront.

2015 may be what I think will be the first of several crucial years for the industry. The potential demand from TSLA's Gigafactory has been talked to death and I won't revisit it here. However, when you couple that with plans of other battery manufacturers looking to increase capacity along with demand from traditional end uses, it is clear that more lithium will need to be made available –and relatively soon. I mentioned earlier that while there is no hurry to invest in the lithium space, the inflection point looms. Lithium is a dynamic market and an understanding of the various technologies that require lithium is at least as important as an understanding of traditional mining metrics such as grade or tonnage. When these dynamics converge, lithium has real potential to break out of its "niche" status for good.

Chris Berry

Disruptive Discoveries Journal