The Russia/Ukraine situation is about to give U.S. refiners another big payday.

Unless you were backpacking off the grid for the past month (a real possibility for some of you, I know), you probably know that Russia just annexed Crimea. Suddenly, a major world crisis has broken out somewhere other than the Middle East. . .and it has big implications for oil markets.

Outside of the U.S., oil is expensive. The benchmark crude oil for Europe is called Brent, which is produced in the North Sea above England. Since the 1970s, the U.S. crude oil benchmark price, called West Texas Intermediate (WTI), has been more expensive than Brent.

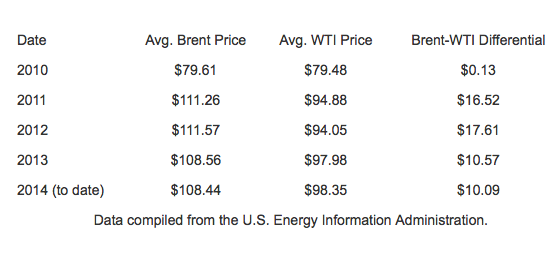

However, starting in 2011, WTI has traded at a discount to Brent. It hit an all-time high near $30 per barrel in September 2011. The table below shows the average price difference per barrel between Brent and WTI. As you can see, they were nearly equal in 2010, but gapped apart in 2011 and 2012.

As you can imagine, companies that can buy oil for $16 or $17 per barrel cheaper can make a much larger profit margin than competitors that must pay more. That's the advantage U.S. refiners enjoyed in 2011 and 2012. It showed up dramatically in their profit margins.

Take ExxonMobil, the largest energy producer in the U.S. In 2012, its refining arm propelled the company to a five-year high. ExxonMobil raked in $9.95 billion in the fourth quarter of 2012 alone. Another giant refiner, Chevron, also hit a five-year high that quarter... thanks to cheap U.S. crude.

U.S. refining companies, like those two majors, spent the last eight years pulling an end run around the law against exporting crude oil. They bought cheap oil here in the U.S., ran it through their refineries, then shipped it to... well, just about anywhere else.

You can see that refiners benefit from cheap U.S. crude and expensive Brent crude. In the past year or so, the price difference narrowed. But right now, the Brent-WTI differential is about to widen again...

Demand for both oil and gasoline is down in the United States. Domestic production continues to rise as well. That means falling WTI prices. Add to that political pressure to push oil prices lower too, and we could see WTI fall far below Brent again.

How is Russia involved? As the world's second largest producer of oil, Russia has a lot at stake in its oil prices. It produces roughly 10.4 million barrels per day (mmbd) of crude oil, and exports about 7.2 mmbd.

If we use fourth quarter 2013 prices for oil, Russia's annual oil and gas exports total $362.2 billion, or about 14.5% of the nation's gross domestic product. Even more important, Russian oil prices and Brent pricing influence each other... So if Brent prices are pushed up due to this conflict, and the U.S. continues to push WTI prices down, the Russian economy will feel the pinch.

Cue March 12, 2014, when the U.S. actually sold crude oil from the strategic reserve for the first time since 1990. It was just 5 million barrels, a drop in the global bucket.

But WTI prices fell from more than $104 per barrel in late February to less than $100 today. That's not a huge fall, about 4% in three weeks. However, it could be a sign of things to come. . .and a clear indication that oil prices will be a target if Russia continues its aggression in Ukraine.

Matt Badiali

The Crux