The Gold Report: Eric, you published an Open Letter to the World Gold Council saying that the massive imbalance between supply and demand is not reflected in prices because available statistics are misleading, and that is the most important obstacle to a healthy gold mining industry. Why has it been so difficult to get accurate statistics and what should be measured to get a better picture of demand, particularly in emerging markets?

Eric Sprott: I have always had a dispute with the data that Thomson Reuters GFMS Gold Survey puts out, which the World Gold Council uses as the basis for its analysis of gold. Since I've been involved in the gold market, the supply always magically equals the demand. Of course, we know that's almost impossible.

The report has two what I call fudge numbers. One is recycling, which is a very big item. The report suggests it could be upward of something like 1,600 tons some years. I don't know how it would possibly come up with that number. I find it very difficult to get numbers on recycling in any country, let alone all countries.

Two, the report always uses what it calls a net investment demand or supply. It's the plug number to make supply equal demand. Many times I think that the investment number is understated.

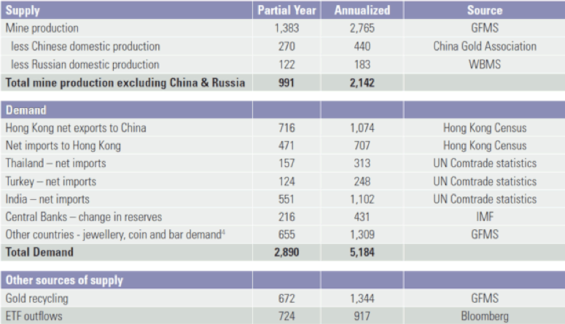

Furthermore, as I wrote in "Do the Central Banks Have Any Gold Left?," we have seen a net increase in gold demand over the decade of at least 2,000 tons per year (2,000 tpa). China's demand alone is going up 100%; jewelry demand is up 50%. Mine supply has essentially been flat at 2,700 tpa, or 2,100 tpa for Western consumption because China and Russia don't export the gold they produce. As we move into 2013, we start to see significantly higher imports of gold into the Asian countries. That makes the shortages even more extreme. We could see demand of 5,100 tpa. That would result in a 3,000 tpa shortfall, not a balance. How can all these people be buying all this gold per year when the supply hasn't gone up? That is why I question the GFMS data. I think it is flawed.

TGR: You published a chart with your calculations of actual supply and demand (below). What statistics should investors use to understand what is being imported versus what is being mined in China and Russia?

ES: The Chinese announce their monthly gold production, so we know how much gold is produced; we just don't get export and import data. The only data we get is that Hong Kong exports well over 1,000 tons into China. That makes it highly unlikely that China would be exporting at the same time it is importing. It's hard to imagine that somebody isn't supplying that market. In my mind, that someone is central banks.

I think Western central banks lease gold into the market to keep the price down. We can't tell what they lease, because on their own balance sheets they have one line called gold and gold receivables. Of course, gold receivables is the least they put out, so they can pretend they own it. But, in fact, the gold is gone. We get no transparency whatsoever as to what part of that line is real metal and what part of it is leased gold.

Central banks think they should be totally nontransparent. As you may be aware, there has been no audit of the gold held by the U.S. Department of the Treasury since 1954. There are no physical data supplied by any central banks as to what their current positions are.

Earlier this year, Germany requested the 330 tons that it had leased to the U.S. Department of the Treasury be redelivered to Germany. At first the U.S. declined to deliver, and then it agreed to deliver the gold over seven years. There is no logistical problem with delivering gold. So why is it that when a country says it wants its gold back, which would represent approximately 4% of all the gold theoretically the U.S. has, that it takes seven years to deliver it? It begs the question.

TGR: Could the selloff of the EFTs noted in the report make up some of the supply shortfall?

ES: The ETF was raided in H1/13, and I think the World Gold Council should wonder why. I believe it is because there was no gold. The plan was to slam the gold price down, get everyone to liquidate their SPDR Gold Shares ETF (GLD:NYSE) shares, then buy the shares, redeem them for gold and deliver the gold out to the counterparties that are demanding it. The whole thing was a setup because of the shortage of gold.

TGR: Have the statistics this year been more off, according to your calculations, than in previous years? Or is this a continuation of a trend?

ES: No. They've been radically different this year in the sense that we now see this huge increase in imports, 471 tons into Hong Kong. This is a 4,000-ton market, so 471 tons is 12% of the market. Hong Kong in total has exported about 900 tons into China in the first eight months of the year. These are gargantuan shifts. Let's just take the month of August, when Hong Kong imported 299 tons. The free world mines 175 tons per month. That means it bought not quite twice the value of all the gold mined in the month. Where did it come from? Who supplied the gold? That is what I want to know.

TGR: How is what is happening today different than the controversy Frank Veneroso outlined in "The 1998 Gold Book Annual" in 1998?

ES: It's the same thing. Frank Veneroso wrote a tremendous book in 1998 suggesting that, instead of having 36,000 tons of gold, the central banks really only owned about 18,000 tons, and that they had been supplying gold to the market. What I've done in the meantime is identify that it looks as if there's another 2,000 tpa that have come out of the central banks somehow. Therefore, I throw out this question: Is there any gold left?

I suspect that the raid on gold that happened in H1/13 was created by central banks because there probably was no gold left, and they thought by bashing the price of gold down that everyone would sell it. In one respect, it worked. Many who owned the SPDR Gold Trust, the paper gold, sold it. But it started huge buying in the East, in India and China in particular. There were months when India and China were probably consuming 300 tons/month, and we only mine 175 tons/month. So the central banks won one battle to get the gold out of the ETF, but they lost the other battle by igniting this buying interest with low gold prices. At $1,200/ounce ($1,200/oz) gold, you can buy 50% more gold than when it's $1,800/oz for the same amount of dollars. There could be a lot of appetite here.

TGR: If there really is 3,000 tons core annualized demand above supply, what does that mean for what the price of gold will be going forward?

ES: Well, it will be astronomic, because things get out of control. When people finally realize that there's a shortage of gold, the price starts to go up. The most incredible thing to me is that because of all the misinformation out there, China can buy an extra 25% of the gold market over the last two years, and the price goes down. Do you think that could happen in any market like oil, corn, wool or anything? It goes against the rules of supply and demand.

TGR: What should the price of gold be?

ES: It should be substantially higher.

TGR: We've been talking about gold. Is there a similar situation going on in silver? Is silver a more transparent market?

ES: No, it's not. In fact, it's probably less transparent because it's even harder to get data on silver. Who knows how much is used in industry? I have no idea. But in the current year, India looks as if it will go from buying 2,000 tons silver to 6,000 tons silver. Silver is about a 25,000-ton market. So we have a situation where India has stepped into the market and bought 16% of the market out of nowhere, and the price has gone down. Again, that doesn't seem logical to me.

One of the reasons Indians are buying more silver is because they've been restricted from buying gold. If the Indians had to buy as much silver as they normally buy of gold, in the last six months of this year, they'd have to buy two years of silver supply to equate to the gold they normally would buy in the last six months.

TGR: For our investor readers, this can all be very confusing. What should they take away from the debate about the actual supply and demand for gold and silver?

ES: Most markets are manipulated. I think we know that. The bond market is manipulated by the Federal Reserve. We're finding out that the forex market is being manipulated, as is the swaps market. Certainly, the energy markets have proven to be manipulated. Platinum, palladium. The high-grade bond market was manipulated. There are a lot of things that get manipulated.

Therefore, it is important to understand who is trying to set the price. The cash markets trade about 80% of annual production every day. There is no physical metal behind those trades; it would be impossible to constantly move that amount of metal. It is all paper. But the paper market determines the price of physical gold, not the other way around. And I would argue that the physical market says the price should be up, while the paper market knocks it down.

TGR: Can this continue indefinitely? Eventually, won't it become apparent and people will trade based on the actual price based on supply and demand?

ES: No, it can't go on forever because some people do demand delivery of gold. That's why I look at the delivery side. COMEX inventories have fallen from 11 million ounces (11 Moz) to 7 Moz. Most of the dealer gold that's owned on the COMEX has already been nominated for. So there's really no gold held by the dealers anymore. I think the physical market will win out.

We have also seen what's called the gold forward offered (GOFO) rate. It is negative today, which means there is a tightness in the gold market. That's only happened five times. It happened in June of this year. It happened in October 2008 after gold had a big decline. It happened in 2001 at the bottom of gold, and it happened in 1998, when we had the World Gold Agreement, and all of a sudden the price of gold shot up. Every time it has happened, gold has been followed by a very large rally.

TGR: Thank you for your time.

At this point The Gold Report called John Gravelle, global mining leader for PwC, to ask where the numbers in the WGC report came from and what the supply-demand picture really says about what the price of gold should be. He wasn't able to clarify the source of the recycling numbers or the numbers used in the Thompson Reuters GFMS statistics by press time, but he did break down the sources of the supply.

TGR: The World Gold Council report outlining the supply and demand picture for gold was published last month. What were the major trends?

John Gravelle: It was a snapshot of the situation in 2012. As we continue doing this, we will be able to see more trends develop.

TGR: The report showed that gold production increased by 50% from 2007 to 2012, spurred by a doubling in the gold price, and that China is the largest producer, with 14.4% of gold production, followed by Australia, the U.S. and Russia. In fact, Mexico's production grew by 118%. What are the factors behind those changes? Can that continue?

JG: Mexico certainly had a good run. The government has introduced a number of business reforms that are seen, with one exception, as being positive. The one exception is the mining reform, which includes a 7½% royalty that has been proposed. That will cause people to take a second look at their investments in Mexico. It could have a dramatic impact on the rate of return compared to other gold-producing countries. Mexico has a lot of positives, and gold production has gone up as a result. But the industry is in a tough spot. Costs are going up; shareholders are reluctant to provide financing for significant new capital projects. It will be interesting to see what happens to Mexico over the next three years as a result of some of these changes.

TGR: What about China? According to the report, it mined 413 tons in 2012, or 14.5% of world production.

JG: China has become the biggest gold producer. It's also the biggest gold-consuming nation. China has continued to mine gold. We've seen some countries fall off, such as South Africa, which historically has been one of the main players. South Africa certainly has its challenges. A lot of investors have been scared away from there. China continues to produce because it has the demand. Even with the record production, the country is still a significant net importer of gold. It will continue to be a big producer and consumer of gold.

TGR: And Australia? It has also had some controversy around natural resource taxation.

JG: I always thought of Australia as being an iron and coal country and never focused on it as a major gold-producing country, but in fact it produced 250 tons in 2012. It has a new government now and the mining tax proposed three years ago was eventually scaled back, so it doesn't apply to the gold industry, only coal and the iron ore. Also, Australia's new government looks like it wants to create a more favorable environment for investment. However, Australia is still a high-cost place for gold miners. Gold miners must compete for scarce skilled labor against all the much bigger iron ore and coal miners. Water is also an issue. Australia is a historic mining jurisdiction, but it has its challenges.

TGR: When I talk to people about mining in the United States, it's not all one thing. Depending on the state, the country risk can be very different.

JG: It does vary by state. Nevada is a key one for the gold miners. But together, the United States delivered 231 tons in 2012.

TGR: Russia, at 230 tons, is also a net consumer of gold.

JG: Some Canadian companies have done an excellent job of navigating the environment there and being successful investing there, but the government has been inconsistent toward mining and most foreign investors are a little worried about what the government may do, for example, with their licenses. It's always been a higher-risk jurisdiction.

TGR: Overall, do you see that the price of gold fluctuates based on actual supply and demand factors or just macroeconomic headlines that might indicate a change in demand factors in the future, for instance if people lost confidence in the dollar and bought gold as a store of value?

JG: Speculation as to whether the U.S. Fed will continue to taper can have an impact. because if the money supply increases that's positive for gold. We do see people buying based on what governments are doing.

The other factor that is interesting about gold is current-year demand is simply current-year demand. Full stop. Current-year supply, however, is not simply just the gold that was produced in that year, because unlike other commodities, gold isn't consumed; sometimes gold produced in prior years comes on to the market. For example, if sentiment toward holding gold decreases, ETFs that hold physical gold can get flooded with redemption requests, so they need to sell their physical gold, thereby decreasing the price of gold. Demand can go up and down a bit based on the price of gold, but often the factors are external. I think going forward we are looking at a favorable market for gold.

Current-year demand is very high compared to current-year supply coming from current-year production. China will continue to be a net importer. Those economies are getting richer and they're growing a lot faster than the rest of the world. As those countries grow there's going to be more demand for gold. The gold producers have had a very difficult time getting more production operational in this funding climate. If we don't have prior year supply coming on to the market, I think it's a positive supply/demand story for gold.

TGR: Thank you for your time.

Eric Sprott has more than 40 years of experience in the investment industry. In 1981, he founded Sprott Securities (now called Cormark Securities Inc.), which today is one of Canada's largest independently owned securities firms. After establishing Sprott Asset Management Inc. in December 2001 as a separate entity, Sprott divested his entire ownership of Sprott Securities to its employees. Sprott's predictions on the state of the North American financial markets have been captured throughout the last several years in an investment strategy article that he authors titled "Markets At A Glance." Sprott has been widely recognized for his strategic insights and his accurate market predictions over the years. His newest ventures are Sprott Money Ltd., one of Canada's largest owners of gold and silver bullion, and the recently launched Sprott Physical Platinum and Palladium Trust.

John Gravelle is the global and Canadian mining leader for PwC, based in Toronto. Gravelle assists several large mining companies with operations in the Americas address their business issues. He is also a tax services partner and provides tax advice to numerous large- and medium-size producers as well as junior exploration companies.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

1) JT Long conducted this interview for The Gold Report and provides services to The Gold Report as an employee.

2) Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Eric Sprott: I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.