Last month saw the publication of a new report by Adamas Intelligence, in which the company predicts a massive reduction in active rare-earth-element (REE) projects due to diminished investor interest, and a stark inability for most projects to be economic because of their inherent elemental make up, poor cost and pricing assumptions, and a lack of processing capacity outside of China. Adamas kindly provided TMR with a copy of the report for review.

Titled "Sifting The Winners from Losers Amidst the Impending Rare Earth Industry Shakeout," the 121-page report connects these negative factors to the lingering effects of the 2008-2009 global financial crisis, and the recent spikes in REE prices.

With a dramatic reduction in the number of 'live' projects in the near future as its initial premise, the Adamas report attempts to determine just who the 'winners' and 'losers' in the REE sector will be, by using a set of comparative parameters that normalizes each of the existing advanced projects via a single price deck, and applying discounts to basket prices using a consistent methodology and cost factors for each project, as appropriate.

The result is a list of just 10 projects that Adamas believes are going to make it.

The report kicks things off with a Landscape section, providing a history of the REE sector from the 18th century to the present day, including industry development and the growth of REE demand. This section also includes some good background materials on the how and why of REE-bearing mineral formation, as well as a brief review of the 800 or so occurrences of REEs around the world, drawing mainly on US Geological Survey data. Particularly useful in this section is a description of over dozen different types of REE deposits.

Using 46 of the advanced REE projects present on the TMR Advanced Rare-Earth Projects Index on June 1, 2013 as its basis, the report then turns its attention to specific projects for subsequent analysis. Created in 2009 to help compare 'apples to apples' in the REE sector, the TMR Index was first published on our Web site in 2010 and has subsequently become the de facto industry standard for tracking such projects. To be included on the Index, a REE project needs to have a mineral-resource estimate that is compliant to internationally recognized guidelines such as Canada's NI 43-101 (which uses the CIM framework), Australia's JORC Code and South Africa's SAMREC code.

The Adamas report divides the 46 projects into two groups. The first includes those at the so-called resource-exploration stage, where a resource has been defined but no further work has been completed. The second includes projects at the so-called project-development stage, ranging from those currently undergoing a preliminary economic assessment (PEA) / scoping study, to those at the pre-feasibility (PFS) and feasibility study (FS) stages. As it happens, there are 23 projects in each of the two groups.

The report then looks at the different forms of REE products that each of these projects is slated to produce, and how the project owners plan to derive revenues from them. Toll separation is the route that makes the most sense to me, given my involvement in the Innovation Metals initiative to develop an independent REE toll separation capability in North America.

It is quite remarkable, however, how many companies have given little to no thought beyond the production of an intermediate mixed REE concentrate. A good number have completely unrealistic expectations of the revenues that they think that they will be able to generate from selling such concentrates. The Adamas report does a particularly nice job in breaking down the 'sentiment' of the various project owners on this topic, evaluating in detail the implications of the lack of processing capacity and demand for intermediate products outside of China (hint: it's not good for the sector…).

Adamas subsequently builds here on its earlier premise that an industry shakeout is inevitable, given the sheer number of projects in the pipeline - a premise that Jack Lifton and I share. As I frequently mention to our clients, TMR has always looked at this sector from the perspective of the technology supply chain, which is not necessarily aligned with that of the investment community. The supply chain is looking for raw materials with which to manufacture products, not a three-bagger in the next 12 months…

Though there are exceptions, in general the supply chain doesn't care which REE projects will successfully come to fruition, only that enough come to fruition such that their ability to secure REE metals, oxides and other compounds from sources outside of China, at a reasonable price, is realized. Individual players in the supply chain will, however, want to have a good idea of which projects stand a chance of success, for the purposes of securing supply contracts and other arrangements.

From the investor perspective, however, there are simply too many projects chasing a finite amount of capital. As an accredited investor remarked to me only last week, there is a large volume of opportunities chasing capital right now, in a very tight money market. Valuations for individual companies continue to decline "which makes money very patient."

Adamas rounds out the Landscape section with some interesting commentary on the "[m]isleading metrics and ambiguous reporting practices" that we see in the sector. The wide variations in the way that data is reported by junior mining companies is by no means unique to the rare-earth sector - it is however more egregious than pretty much any other sector out there.

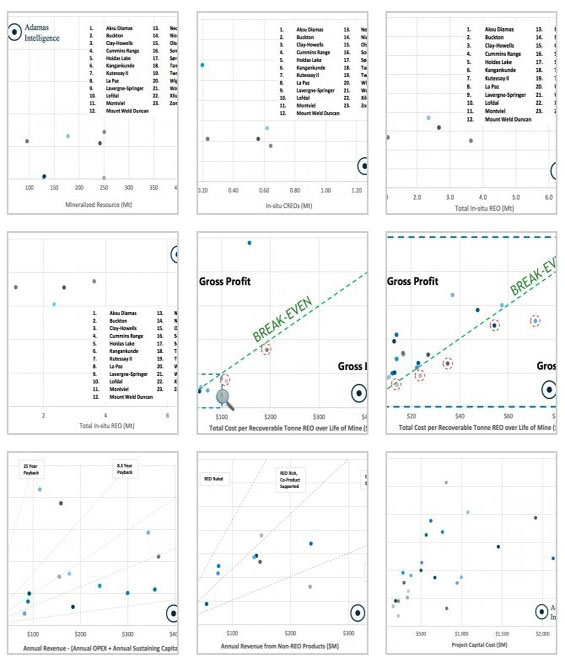

To combat the various reporting discrepancies, in the Analysis section Adamas begins to lay out an approach for normalized metrics that allow for the appropriate comparison of one project to another. In general I like the approach that is used here. The free TMR Index keeps things pretty simple for REE projects, focusing on the most basic project information such as resource size, grade and distribution of individual rare-earth oxides and the like. TMR's paying clients and subscribers get access to the dozens of additional parameters that we track, and about which any serious student of the sector needs to be aware (what TMR refers to as 'probability of success' metrics). Adamas does a good job of its own in collating these types of metrics, and in using them to help the reader make the 'apples to apples' comparisons that are absolutely required when evaluating the sector.

The report collates specific parameters such as project size, grade, relatively distribution and potential co-products. It also includes projected operating costs, capital costs, sustaining capital costs and contingencies, as well as projected head grade, production capacities and recovery rates. All of these parameters are used to paint the appropriate picture.

Analysis begins with the 23 exploration-stage projects, with Adamas comparing and ranking projects on the basis of four parameters that have a specific weighting:

- Total quantity of in-situ REOs in the mineral resource (40%);

- Quantity of in-situ critical REOs (CREOS) and their relative abundance in the resource (30%);

- Hypothetical value of the in-situ REOs (20%); and

- The relative abundance of total REOs (TREOs) minus the relative abundance of oxides of lanthanum and cerium (10%).

The 23 development-stage projects are evaluated with a different set of parameters, weighted as follows:

- Gross profit from REOs and REO equivalent over the life of the mine (40%);

- Total quantity of CREOs recovered over the life of the mine (20%);

- Capital expense payback period (15%);

- [Revenues from non-REOs / total cost] + [75% x [revenues from REOs / total cost]] (10%);

- Annual production of less-desirable REOs (7.5%); and

- Project capital cost per unit mass of REO and REO equivalent produced annually (7.5%).

This differentiation between the two types of projects is pretty useful and logical. However, the Adamas ranking approach does not allow for direct comparisons between projects in the exploration-stage group, and those in the development-stage group, since the latter relies on information that can only come from a completed PEA, PFS or FS report.

It should be further noted that Adamas does not include Molycorp's Mountain Pass or Lynas Corp's Mount Weld CLD projects in this report. At first glance this is probably because both of these projects are now in operation (though their run rates do not yet match their operational capacity), and in a sense have ostensibly 'made it'. It should be noted, however, that anyone looking for data on these two projects of a similar type to that currently available for development-stage projects will have a surprisingly hard job doing so – especially for the Mount Weld CLD project. Because these two projects 'came of age' a number of years ago in terms of resource and reserve development, much of the information is simply not in the public domain.

Actually reaching the production stage is no guarantee of either profitability or strict adherence to either a previously assumed operational or business model. As the 19th century Prussian military strategist Helmuth von Moltke remarked, "No battle plan survives contact with the enemy."

Adamas uses a proprietary projected 2015-2020 price deck for separated REOs, in order to put dollar values on product sales. It is similar to the one that I use in my own work, which I based on historical (pre-2010) prices, modified by a few relevant external factors. The Adamas numbers are refreshingly conservative, which means of course that a number of the junior mining companies are not going to like them. Swap these prices in for those in many of the PEA reports out there (and even in one or two PFS reports) and you'll quickly find that such projects are not going to be economic—a finding that becomes readily apparent in the Adamas report.

In addition to REOs, Adamas has also developed a price deck for co-products of REE projects, such as zirconia, and oxides of niobium and tantalum. The report further normalizes project basket prices to account for the different types of mixed REE concentrates that each project will yield (e.g. carbonates, hydroxides, chlorides, oxides etc.).

The report includes some interesting charts that plot various parameters against each other. A selection of these charts is shown in the gallery below (they are fully labeled in the report itself; access some charts here ).

So, after assigning rankings to each project based on the metrics above, within each group Adamas gives each project a final ranking, based on a final score using the weightings described above. I have to say that the final rankings for the exploration-stage projects contained a few surprises. There were fewer surprises in the development-stage project rankings; I am not at liberty to share specific details here out of respect for the proprietary nature of the Adamas report—get a copy of the report for yourself to see where the various projects stand.

It should be clearly noted that the final rankings obtained via the Adamas methodology depend entirely on the parameters chosen, and the weightings that were applied. Such an approach is necessarily arbitrary, and changing the parameters used, or the weightings assigned, will doubtless result in different outcomes. It goes without saying that the dollar-value assumptions made, are based on the data provided by project owners and their engineering consultants in the technical reports that they put out. Nevertheless, it is certainly an interesting and useful approach. If you'd like to look at alternative methodologies, Adamas provides all of the underlying data used to create the rankings, so that you can 'roll your own' if you so desire.

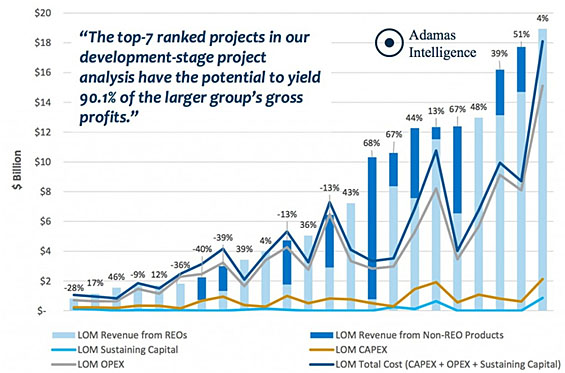

The Analysis section concludes with an acknowledgement that the ranking approach used may not suit the requirements of every investor or other users of the data. The report notes, however, that the top seven-ranked projects in the development-stage group account for over 90% of the total group's gross profits, as represented in the chart below.

The report then turns to the fundamental question posed in the title of this review article—who will survive the impending shakeout? In the Outlook section, Adamas predicts that only 10 out of the 46 projects will make it. Of these 10, eight are in the development stage, with only two projects currently at the exploration stage making it through to the other side.

Adamas summarizes its findings as follows:

- The top-five ranked projects in the development-stage group "offer robust profit margins, timely payback on pre-production capital, and the prospect of solid revenues from REOs and non-REO products alike. As proposed, these projects can endure REO price swings and will remain lucrative amidst a future marked by low REO prices".

- The sixth, seventh, and eighth ranked development-stage projects, "have what it takes to endure the impending bloodbath. Robust profit margins, timely payback on pre-production capital, strategic integration, REO separation plans, and/or promise of polymetallic revenue streams are just some of the pros that will keep these players alive".

- Adamas notes that five of the top-eight ranked development-stage projects are looking to produce separated REOs, whereas the other three plan to produce only mixed REE concentrates.

- Adamas believes that its third- and sixth-ranked exploration-stage projects will survive. "High relative distribution of CREOs and potential speed-to-production will keep the third-ranked project interesting, while polymetallic revenue potential, an expansive resource, and toll-separation arrangements will keep wind in the sails of the sixth-ranked project".

The report goes on to warn of hurdles that will remain even after the herd has been culled.

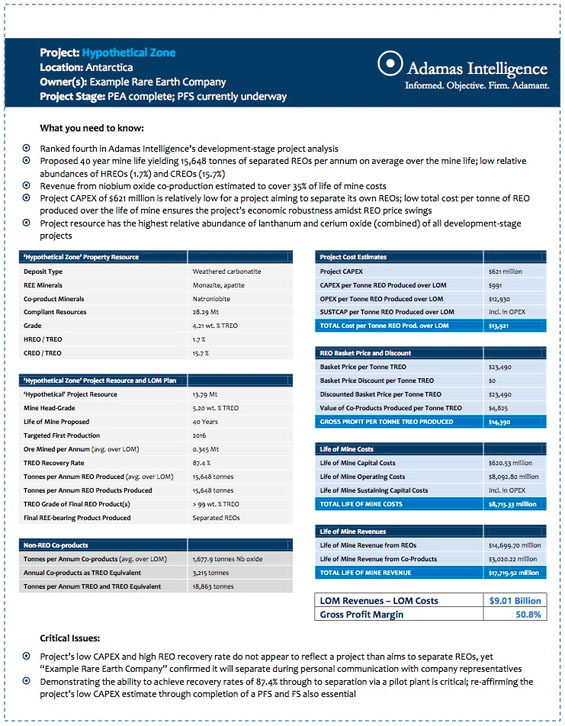

For the remainder of the report, Adamas has produced one-page Profiles for each of the 46 individual projects that it reviewed, containing a multitude of data points and parameters that will be of interest. An example of the format that they've used is shown here.

So now to getting access to the report; Adamas is offering two versions of the new publication:

1) The complete 121-page report, including the Landscape, Analysis and Outlook sections plus the individual project Profiles, is normally available for $2,997. I managed to persuade Adamas, however, to give TMR readers a 10% discount on that price for a limited time, which will drop it to around $2,697. To order the full report, click HERE and use the coupon code 'TMR-REE' to get your discount:

2) Adamas is also offering the set of Project Profiles as a standalone product. The 58 pages in this offering include the set of 46 one-page profiles for each project, as well as the Adamas price decks for REO and non-REO products, and details of their basket-price discounting methodology and separation costs. Your investment for this offering is $997, and it can be ordered by clicking HERE.

Both offerings come with four quarterly updates, and will include any new projects that are added to the TMR Advanced Rare-earth Projects Index since the last update. The first update is scheduled to be published on November 1, 2013.

Gareth Hatch

Technology Metals Research