The Energy Report: Since the election, many reports on the possibility of U.S. energy independence have come out. Many argue that new technology and expanded production will result in a paradigm shift for the U.S. energy market and economy. What's your take?

Josh Young: There's been tremendous production growth from unconventional oil reservoirs and the U.S. is producing more energy than it has produced in a long time. Onshore production growth has been particularly impressive. I don't know if we'll ever become fully energy independent, or at least oil independent, but certainly domestic production is growing. This is a topic of broad investor interest. Coincidently, I'm speaking about this topic at the Platts conference in February to help identify sources of production growth for pipeline investment.

My approach to profiting from the trend in U.S. production is to focus on specific companies and fields. The key is finding fields that could produce a lot of oil and don't cost a lot of money to develop. I take into consideration the takeaway capacity from a field—it is important that the oil can be sold into a strong market at a reasonable price. The alternative is selling production at a big discount to the posted market oil price, and that is a more common situation than most investors realize.

TER: What geographies have the most powerful pricing at this time?

JY: Gulf Coast production near the refineries commands a far higher price than production in the Rockies. Areas like the Eagle Ford shale and East Texas have also been getting good pricing recently. Geography will matter for at least the next year or two, although I'm not sure that premium will persist in the long term.

TER: Besides geography, what other factors are important in your selection criteria?

JY: Short capital payback time is critical to my company selection. Companies I buy are typically rapidly growing—they need to earn their capital back as soon as possible to be able to fund additional development.

TER: What are some companies that meet those criteria?

JY: With a partner, I recently bought 20% of Lucas Energy Inc. (LEI:NYSE.MKT) and got on the board. Lucas is in the Eagle Ford shale and good pricing in that geography makes project economics attractive. Because I am on the board, I can't talk about any of the specifics, but certainly good pricing for oil from the Eagle Ford shale is one factor that attracted my attention.

TER: What other factors do you weigh heavily? Do you favor a particular subsector of energy right now?

JY: My goal is to find the most undervalued companies—companies with a high probability of increasing in valuation and with good margins of safety. In other words, I'm a value investor. I've invested across the space from downstream through midstream and upstream, as well as exploration companies. The composition of my portfolio depends on where the most compelling opportunities are. Some of the companies we're talking about now are very early stage—Lucas is one example. It doesn't have much production, but its acreage is in the middle of a rapidly maturing unconventional oil field.

One of my investments is in a natural gas producer that does not have a lot of development work to do, while others are in unconventional oil companies that do have a lot of work to do. For the moment, I'm staying out of services because there's been a general oversupply of oil services in North America. Revenue for services companies is not growing as fast as it could and margins are deteriorating, so I'm going to wait to see before investing.

TER: Last time we talked, you discussed AusTex Oil Ltd. (AOK:ASX). What is new there?

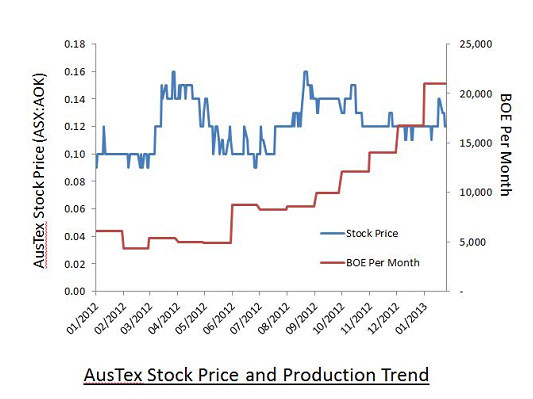

JY: AusTex is one of my largest positions and probably one of the most exciting and rapidly growing oil companies in the sector. In the last year, the stock hasn't moved much. That is remarkable because over the last year, the company went from around 200 barrels of oil per day (bbl/d) to recent peak production of 700 bbl/d. That is a production increase of over 300% in one year. AusTex has drilled and completed 16 vertical production wells in the Mississippi Lime formation. AusTex has successfully tested down to 20-acre spacing. It has about 6,000 net acres. On average, the wells are paying out in nine months. Every million dollars spent returns approximately $3.5 million ($3.5M) of net present value. By any measure, that is an attractive return.

Operators in the Mississippi Lime have been focusing on acreage rather than payback. That is the old valuation paradigm. Companies like Red Fork Energy Ltd. (RFE:ASX) and SandRidge Energy Inc. (SD:NYSE) have been valued on a per-acre basis. However, AusTex is valued on production. It's a smaller acreage position, but it's in the core of the play and keeps putting out incredibly good wells. Just one or two successful wells could be chance, but with 16 successful wells in a row, you can draw your own conclusion.

TER: Since you mentioned AusTex last year, a lot of positive things have happened for the company, yet the stock has traded sideways for a year. Is that a reflection of the broader market, the company or something else?

JY: People have focused on acreage and that's starting to change. Other companies, like Red Fork, have big acreage positions, yet the well results have been lackluster. Red Fork trades at a high valuation relative to AusTex, but there may be a rotation out of the big acreage plays. I sense a rotation into companies where well results matter more.

This is a change in the investing paradigm in the small-cap energy sector. Since late 2006, it seems like there's a different paradigm for investing in oil and gas companies every 18 months. In 2007 and early 2008, larger players were favored by investors. Then there was a shift out of the market by everyone in the 2008–2009 crash. In 2009–2010, valuations were driven by acreage. Recently, the trend has been toward valuation by production. That could help the share price of AusTex. There is a "magic number" of 1,000 bbl/d. In order for companies to be considered serious investments, they have to meet that mark. Right or wrong, many investors don't view production of less than 1,000 bbl/d as material. AusTex is well on its way to crossing that barrier—probably in H1/13. That could trigger a stock revaluation.

TER: Is Range Resources Corp. (RRC:NYSE) involved in that area as well?

JY: Range Resources actually overlaps some of AusTex's property. Range is a much larger company and has drilled a couple of horizontal wells together with AusTex. Range has drilled ~300 vertical wells in that area, but has switched to horizontal drilling. It's unclear that the horizontals are better economically, but they certainly move the production needle up. Range is focused on maximizing production per well in addition to getting good economics per well. That is a little different from AusTex, which is focused on the highest absolute economic returns per well.

TER: Another producer you mentioned last year was Sonde Resources Corp. (SOQ:NYSE). Its stock price seems to be trending upward—what's driving that?

JY: There are a couple of factors that have changed Sonde's story. The stock was down because Sonde has an obligation to drill three exploration wells offshore in North Africa in an area that's on the border of Tunisia and Libya. Sonde could have funded it itself, but it put an "ongoing concern" clause in its financial statement just in case it wasn't able to fund the exploration. As it turns out, Sonde found a joint venture partner to drill those wells. It's an attractive deal for Sonde. It's going to get a carry for its cost recovery. Then it's going to get the three wells drilled, including part ownership. It also retains upside exploration potential. Prior to the deal, the market valued the offshore project as a $45M cash sink. Now a conservative valuation might be $70M for the cost recovery, plus $15M of drilling carry, plus the exploration upside, which I value at around $15M—though it could be much higher. The change in market value of the North Africa assets went from negative $45M to positive $100M and the whole market cap of the company is only around $100M. That's huge value creation.

TER: Are there any other companies that have hidden value that you think would be interesting to readers?

JY: Last year on The Energy Report, I mentioned a company called GeoMet Inc. (GMET:NASDAQ). GeoMet's main asset is 200 billion cubic feet of proved, developed, producing natural gas in a coalbed methane field. Coalbed methane is very interesting because it's not very economic at low natural gas prices. However, even at these prices, GeoMet is able to produce natural gas and earn positive cash flow. This is a developed field—there isn't any drilling activity going on. Because of low gas prices, it doesn't make sense to do additional drilling and increase capital investment. Despite that, GeoMet is profitably producing approximately 37 million cubic feet a day of natural gas. The stock is trading for less than a dollar per thousand cubic foot that's proved, developed and producing. That is one of the cheapest natural gas assets in North America. I own a bunch of the preferred stock, which pays a 16.5% dividend yield. It's unusual to find preferred equities with high yield, a secure financial position and optionality to gas price increases.

TER: Are there any new continental U.S. areas that have hidden value that investors might not yet have considered? In California, there has been a lot of news about shale oil plays, with the Monterey shale potentially the largest oil field in the U.S. How should investors be looking at a potential play like the Monterey shale?

JY: I did some merger arbitrage trading on a company called Venoco Inc., which was trying to drill the Monterey shale and was taken private last year. Venoco's Monterey program resulted in some extremely expensive water wells. There are other juniors active in the region. I can't see the future for the Monterey at this point, and it is hard to tell if the play will eventually work, but I can find other places where I can see solid investments.

I prefer investing in equities like AusTex, where I am betting on the 17th and 18th wells in a clearly defined field. GeoMet has a 10-year production history and the reserve engineers expect that the wells will produce for another 15 years. And Sonde has a production contract based on a high-quality reserve. These three companies have a risk/reward profile that meets my value investing criteria. The risk for a Monterey shale project is far higher at this point. I will certainly follow it in the future, but for now I think there are better options.

TER: Any parting thoughts on the broader market and what small-cap energy investors should be watching for?

JY: Oil prices are getting to an interesting level again. Historically, as West Texas Intermediate oil gets to $100/bbl and higher, small-cap oil companies have done very well. It's hard to predict which equities will benefit most. In a rising oil price market, rapidly growing oil companies could achieve market valuations at a premium to their net asset value (NAV). There will be interesting times ahead.

TER: It has been great to catch up with you.

JY: My pleasure.

Josh Young is the founder and portfolio manager of Young Capital Management, LLC. He is also a board member of Lucas Energy Inc. He previously served as an analyst at a multibillion-dollar single-family office in Los Angeles. Prior to that, he was an investment analyst at Triton Pacific Capital Partners. He was also a corporate strategy consultant at Mercer Management Consulting and DiamondCluster. He holds a Bachelor of Arts in economics from the University of Chicago.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Alec Gimurtu of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: None. Interviews are edited for clarity.

3) Josh Young: I personally and/or my family own shares of the following companies mentioned in this interview: Lucas Energy Inc., AusTex Oil Ltd., Sonde Resources Corp. and GeoMet Inc. I personally and/or my family am paid by the following companies mentioned in this interview: I am paid by Lucas to sit on their board of directors, but am not compensated for investor relations or any other operating role. I was not paid by Streetwise Reports for participating in this interview.