There's a lot of news set to hit the wires this week – but none may hold a candle to what the price of oil has to say.

Since the market recovery of 2009 the price of crude has been a great benchmark for what the economy is doing. Higher crude means a rosy outlook, while lower crude stirs up "double dip" recession worries.

"It's the oil, stupid!" would be the party platform I'd adhere to these days. With that said, let's take a look at our crude barometer and see what the market is really saying…

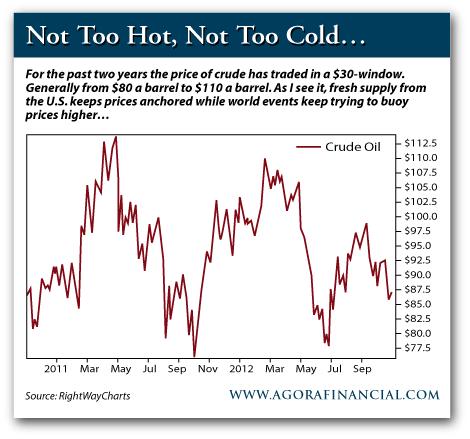

For the past 24 months oil has locked into a $30 trading range from $80-110. Both above-$100 spikes occurred around increasing Middle East turbulence – where fears of a supply disruption were highest. And each low below $80 was caused by economic malaise and recession fears – bad jobs reports, manufacturing data, you name it.

Here's a look at the chart that every oil trader needs to know…

So where can we expect to head from here? Let's take a look at the most pressing details…

First things first, remember, oil is a physical commodity. To put the oil market in perspective today – what with Hurricane Sandy brining a physical shortage of power and commodities to the New Jersey area – it's important to note that at any point in time the U.S. has right around 25 day's worth of crude oil in stock.

So if there was ever a catastrophic global event, barring any release of strategic reserves, we'd have approximately 25 days of "energy-as-usual." But after that point we'd be back to the Stone Age. Yikes! That's the kind of danger we're talking about when it comes to physical commodities!

Luckily over the past three decades (since the gas lines seen in 1973 and 1979) oil has been readily available. But that doesn't have to be the case. Looking at the spikes in the chart above, it's clear that oil traders don't always think the outlook for global oil is all that rosy.

Looking at the big picture, here in the U.S. we're getting an extra boost of luck (or is it skill?) from the shale oil boom. The next decade could hold turbulent times for global oil users – with a boiling Middle East and a rising China. But in a positive twist of fate, the oil pumps in America's shale patch are bobbing up and down at a faster clip than just a few years ago.

And from what I've heard out in the field the breakevens for the most efficient producers are quite impressive.

- The North Dakota's Bakken formation, according to the folks at Statoil, can produce oil at $50-60 a barrel. And we could soon see over 1 million barrels of oil a day (bpd) coming from the Roughrider State.

- Down in the Eagle Ford formation in South Texas, according to the folks at ConocoPhillips, oil can be produced at $37 a barrel! The Eagle Ford is the big boy on the block when it comes to new oil production for the U.S., and could produce nearly 1.8 million bpd in just a few years.

Although these breakevens may not be the norm, they do shed light on the fact that efficient producers can still make a lot of money with oil prices north of $80.

But that may not be the same sentiment coming from our neighbors to the north, in Alberta, Canada's oil sand region.

"Amid rising costs, gyrating prices and a burst of supply competition down south" the Wall Street Journal reports, "Canadian oil companies are rethinking investment in one of North America's earliest and fastest-growing "unconventional" oil frontiers—Alberta's oil sands."

"The new caution concerning oil sands in Canada" the article continues, "comes amid sharply rising costs for everything from labor to construction material and contracting. These days, even the most cost-efficient oil sands producers need U.S. benchmark prices of at least $50 a barrel to justify investment in new projects, executives and analysts figure."

So you see, $50 is about as low as oil sand operations can go. But many of the operations, including any synthetic crude production have a breakeven closer to, or north of, $100. According to a report released this summer from Bank of America Merrill Lynch, one of Canada's big oil sand producers may need oil over $113/barrel to bank a profit.

Add it all up, and the U.S. could find itself in a very enviable position in the North American oil game. Producing oil cheaper and more efficient could lend itself to increased production in the states and a cool down of oil-sand crude from Canada.

Profiting from this situation comes down to breakeven. And between you and me, I believe the U.S. is set to win this game – at least in the next 3-5 years with shale oil producers optimizing current production techniques.

So that's where our oil logic stands today. Looking at the big picture if the rest of the world stays turbulent and less oil-filled than North America, and if oil sand operations don't pose an over-supply threat, I look for prices to remain strong. You can count on spikes to the top area of that chart above.

Remember, the two million bpd upswing (coming from increased production in the Bakken and Eagle Ford) isn't happening anywhere else in the world. And although an extra two million barrels flowing through our domestic pipelines can create a solid boom for North America, it represents only 2-3% of world oil production. That means world oil dynamics can still impact the price of oil, to the upside.

Of course a recession-based market correction could send the price of oil below the $80 mark on the chart above. But so far the price of oil has remained resilient, signaling a recession-free future.

If that remains the case, this U.S. energy trend bodes best for domestic producers. And, of course, their dividend payouts.

Keep your boots muddy,

Matt Insley

The Daily Reckoning