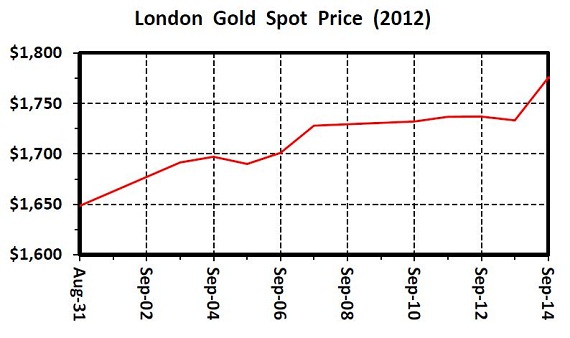

When money supplies are inflated, fiat currencies are devalued and the price of gold goes up. For example, monopoly money manipulators Bernanke and Draghi announced the purchase of more tranches of American and European debt in late August and early September and gold rose $127 an ounce in a two-week period:

During the previous six months, it had been widely anticipated that Professor Bernanke planned to engage in this third round of quantitative easing. In the various instances when he did not, gold precipitously dropped $50 or more immediately after his speech.

Despite mainstream media's promulgation of the idea, gold's inexorable increase in price does not represent a bubble. The gold price has steadily increased in every major currency over the last 11 years, and it is now all but certain the metal will end 2012 higher than it was at year's end 2011. Precious metals pundits have predicted this performance for several years now; it seems a veritable no-brainer.

By comparison, examine what happened with the price of silver in the late winter to mid-spring of 2011; it rose from less than $27 to nearly $50 an ounce and then immediately collapsed in a parabolic fall to $32 and change. This is precisely how speculative market bubbles work:

Although silver has traded below $30 most of 2012, it is now at $32 in the aftermath of QE3. Silver is not money; it is more industrial than precious metal.

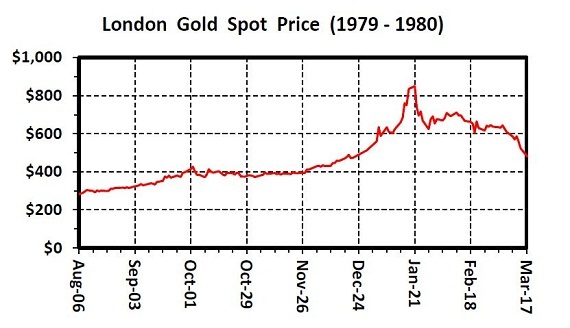

We have not seen this sort of volatility in the gold market since late 1979 to early 1980. In the course of five and a half months it went from $282 to $850 an ounce and in a classic parabolic fall, was at $482 two months later. It took nearly 28 years to reach that lofty level again.

As for the bevy of gold bug speculators currently predicting that gold will reach $2,500 an ounce by the end of the year, I can foresee no catalyst to stimulate such an exponential rise.

Regarding their mid-term ideas of gold breaching $5,000, $10,000 or even $15,000 an ounce, I would opine that if it were to reach those levels within the next few years, you should own not only gold but a gaggle of guns and an arsenal of ammo because the world would be in total economic and social collapse.

No matter what price of gold bullion retailers, newsletter writers, radio pundits, and TV talking heads with vested interests may promote, please note that financial success with their respective buyers, subscribers, listeners, and viewers depends on sustaining an emotional environment of greed, fear, and panic. Some of the older perma-bulls in this crowd have been predicting an imminent collapse of the world's financial system since the late 1970s and early 1980s. This Chicken Little notion reminds me of the multitude of born-again doomsday prophets predicting the end of the world, a la Monty Python's "Life of Brian".

Personally, I prefer the Boy Scout way and am hopefully prepared for whatever may come; i.e., I hold a minimum of 10 per cent of my net assets in physical gold in my physical possession at any given time.

For me, gold is neither an investment nor a speculation. I do not trade gold; I hoard gold. Gold is my insurance policy against financial calamity and my hedge against economic collapse.

I think that every smart investor should have a portion of his net assets in physical gold. Gold is money. Everything else is just a constantly devaluing piece of fiat paper or a keyboard stroke that is deemed by one insolvent government or another to be money.

May you own gold, live long, and prosper.

Ciao for now,

Mickey Fulp

Mercenary Geologist