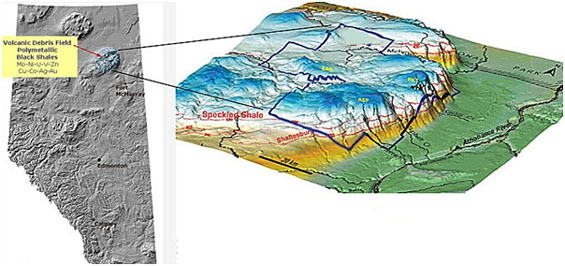

As excited as I still am about the newly-unleashed oil from tar sands, there's something else up in Alberta that has the potential to be even more lucrative. What I'm talking about is $5.3 billion (or more) worth of the hottest rare earths and precious metals—much of it lying right on the earth's surface. You can even hold them in your hand. I did.

All told, it's more than 612 million pounds of metal wealth spread over 700,000 acres—enough to supply the entire world for the next 100 years. And the thing is. . .these numbers come from just one of sixdifferent mining parcels up here, all owned by one small company. The truth is, nobody yet knows exactly how many metals are really here. . .how much they're all worth. . .or for how many centuries they can supply the world.

But one thing is certain: The tiny explorer that holds all of these metals under its thumb—and has the breakthrough technology to extract them—stands to make a fortune so massive, it would make any king envious. Heck, the value of the lithium alone is enough to send this stock 31x higher. Then there's the vanadium, exceeding its market cap by 291xs—enough to turn every $1,000 into $291,000. And those are just two of the eight metals it now controls. There are also millions of tons of rare earths, uranium, moly and more. If even one of them is partially recovered. . .or even if the stock jumps 1,000%. . .this explorer would still be massively undervalued by huge multiples.

So exactly how much wealth are we really talking about here? Let me put it this way: Right now, the total value of all of this explorer's metals exceeds its market cap by over 74,379%. And that's from just one of six mining parcels! Let me tell you the amazing story behind this explorer's game-changing technology—and the metals it's set to reap right from the surface of this massive property.

Why Mining Will Never, Ever Be the Same

You see, it wasn't so long ago that nobody thought the metal wealth spread across this vast terrain would ever be recoverable. . .even though much of sits right on the ground. In fact, just a few years ago, you wouldn't have been able to recover any of these metals if your life depended on it. Sounds strange—until you understand why: All of this metal is locked in black shale deposits, raw organic material fused from pressure at the ocean's floor millions of years ago.

And because all these metals are of such a low grade—dispersed so finely throughout so much shale—it was considered too difficult and costly to extract them when they were first found here in 1995.

But all of this is about to change. Because just as new technology enabled explorers to finally liberate petroleum locked within the oil sands, so too will it unlock a metal mother lode ready to feed the entire world for centuries to come—and make early investors richer than Midas. And it's not just that this new technology will finally set free so much wealth. It also stands to turn the entire mining industry upside down, making it much cheaper, cleaner, and safer for everybody—even eliminating CO2 emissions.

And most incredibly of all: It promises to do this using only air, water and microbes! This might sound crazy, like something out of science fiction, but the truth is that this revolutionary process for extracting the most difficult-to-reach metals works. This process is being used right now—and has already made many investors a tidy fortune.

The Mine that Almost Never Was

To understand how, all you have to do is go back to October 1, 2004, when the European Commission's 6th Framework Program launched its own metals recovery project.You see, Europe is the largest importer of ore in the world, needing 150 million metric tons of it each year. And located deep within the frozen wilderness of Finland laid 340 million metric tons of nickel, zinc, copper and cobalt—all locked within the world's largest black shale deposit.Since 1980, different companies had tried grinding, crushing, and treating the ore surrounding these metals. . .but to no avail.

It was maddening.

Of course, the Europeans could have extracted the metals if they really wanted to—but that would've required using large amounts of arsenic and cyanide to liquefy them, thus risking the poisoning of vast swaths of soil, rivers, lakes, and streams. In fact, extracting metals this way is so deadly and dangerous that it's already banned in several American states and many countries around the world. Then there's the traditional method of metal extraction used for hundreds of years: smelting.

Again, the problem with this is that the metals were so low-grade that it would have been nearly impossible to build a smelting plant big enough to extract them. And even if they did have the money and technology to build one, they'd be faced with another problem: massive, ungodly amounts of poisonous sulfur dioxide fumes spewing into the air. What Europe desperately needed was a way to get to these metals that was clean, safe, and cheap. A tall order—and a seemingly impossible one...But one company had the answer.

Free Labor from Mother Nature

In fact, it had been working on one since 1987. And the solution they came up with is breathtaking in its elegant simplicity. Instead of using heavy and expensive machinery or dangerous chemicals to release the metals, they found a source of free labor provided by Mother Nature herself:local bacteria from the ground that can eat right through the ore!

Now, truth be told, this novel method of extracting metal had been used here and there since the 1970s. . .but never on such a massive, industry-wide scale. And that was the challenge: finding the right species of bacteria from the soil with the ability to liberate 340 million metric tons of precious metals. It took years of studying and experimenting with different strains of bacteria. But after the turn of the 21st century, Talvivaara Mining had finally done it—and caught the attention of the European Commission.

So in October 2004, they joined forces with eight countries, seven universities, and the Geological Survey of Finland to begin work on what would be the world's cleanest, most energy-efficient mining project ever. In July 2005, the first ore samples were mined, crushed, and mixed with the bacteria at a demonstration plant. The result: Just 27 months later, 78% of the metals were recovered!

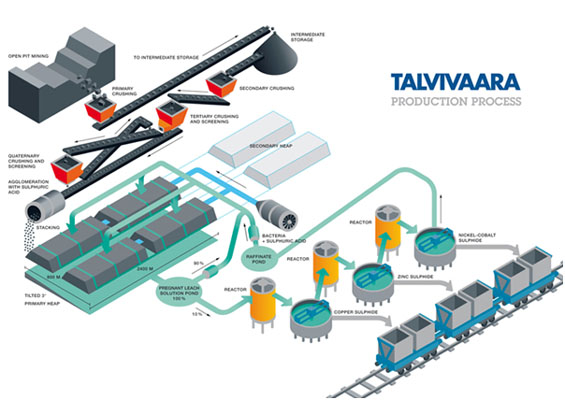

It was an astonishing success that convinced everybody the construction of the mine must move full speed ahead. Now, before I reveal the ultimate outcome of this massive, unprecedented undertaking, let me show you exactly how this "natural extraction" process works:

First, the ore is extracted, crushed and stacked inside of a heap pad. Then bacteria are sprinkled onto the ore.

Low-pressure fans supply the bacteria with air from outside. Up above, water sprays down, washing it into the ore.

Once inside the ore, the bacteria begin eating away at it, bit by bit.

After the ore is eaten away, chemical wastes released by the bacteria liquefy the remaining metal...

The resulting solution is then collected in a pond outside the heap and sent to a plant where the metals are recovered.

Afterward, the solution is recycled and sent back to the heap, where the process can begin all over again.

(And remember, as the bacteria consume the ore, they also consume the carbon within it—meaning no CO2 emissions!)

It's a natural process that takes natural decomposition and accelerates it. That's all. Clean, simple, cheap, and efficient—the mine of the future. So how did it work out for Talvivaara?

500% Gains in Two Years

Well, once the mine was set up, production began in October 2008—and it hasn't stopped expanding since. In fact, the entire operation is such a success that Talvivaara is right on schedule to reach its annual nickel production of 50,000 tons by next year. It also expects to produce 90,000 tons of zinc, 15,000 tons of copper, and 1,800 tons of cobalt each year. And in 2010, it announced production of 350 annual tons of uranium as a byproduct from its other metals—enough for all of Finland's nuclear energy needs. Not only that, it also just signed a 10-year contract with Norilsk Nickel, the largest producer in the world, to sell its entire production.

Talvivaara went from producing nothing to producing 5% of the world's nickel in just a few years. Of course, the real proof in the pudding is how ordinary investors ended up faring. And that's the best part—because just two years after this revolutionary mine kicked into gear, they walked away 500% richer.

But keep in mind that Talvivaara is a mining giant with a market cap close to $500 million. By contrast, the tiny explorer I want to show you has a market cap of just $7 million, which means the gains will much more pronounced. If this company goes up 500% like Talvivaara. . .it would still be undervalued. The metals it owns are worth several thousand times its current share price.

Meet the Precious Metal and Rare Earth All-Stars

And that's why I believe 500% gains could soon look like chicken feed once the rest of the world discovers the all-star lineup of rare earths and precious metals it holds:

Molybdenum: Corrosion-resistant and able to withstand extreme temperatures, this super-strong metal is used in everything from aircraft parts, railways, nuclear power plants, skyscrapers, and automobiles to stainless steel products in homes all over the world. Its growing popularity led the London Metal Exchange to add it their list of traded commodities in 2008. And it's such a crucial ingredient of India and China's rapid urbanization that consumption is expected to double by 2020.

Lithium: One of the most crucial metals in the world, lithium is used in medicines, ceramics and glass, and now powers laptops, iPhones, and electric cars. Prices have already tripled over just the last decade. The Techno-economic Research Unit Group sees demand more than doubling by 2020, while the U.S. Department of Energy estimates demand for large lithium batteries soaring from 10,000 metric tonnes per year. . .to over 500,000 by 2050.

Uranium: Reliable, low-cost, and emission-free, not even the tragic meltdown in Japan can stop uranium's rise as one of the world's most popular energy sources. In Russia alone, ten reactors are under construction and 14 more are being planned right now. Meanwhile, China promises to boost atomic capacity as much as eight times by 2020, while India says it will increase production 13 times by 2030, and South Korea aims to get 60% of its energy from nuclear power by then. All told, these last three countries are on track to use more uranium over the next twenty years than the United States, Japan, France, and Germany combined.

Zinc: It's the fourth most widely-used metal today—and for many good reasons. One reason is its role in strengthening steels for the construction of buildings, homes ,and businesses. And although China already consumes 59% more zinc than Europe, Japan, and the U.S. combined, it still can't get enough as its demand continues outpacing production. Consulting firm Beijing Antaike even projects a shortage of 100,000 tons by 2013 and 150,000 tons by 2014.

Cobalt: Surging demand for smartphones, netbooks, superalloys and high-speed steel around the world has shot this metal up 600% since 2002, with supply still trailing demand by 47%. And it's only getting started, as cobalt is also an essential ingredient in many lithium-ion batteries set to power the electric car revolution, with Credit Suisse estimating hybrid electric vehicle sales surging 1,525% by 2020. No wonder this metal is considered so strategic that the U.S., EU, Japan, and the Netherlands now require it for stockpile.

Copper: It's sleeping right now. . .but make no mistake, the red metal is destined for a massive rebound as huge swaths of China's rural population continues flooding to the cities, creating a huge demand for any and everything powered by electricity. Heck, China alone is expected to triple its copper consumption by 2020, according to London's CRU Group. Then there's India, set to leapfrog over the U.S., Korea, Japan, and Germany to become the world's second-largest copper consumer. In fact, Chile's own copper commission, COCHILCO, estimates that in the next ten years, Indian demand for copper will grow from 600,000 tons to 3.4 million tons annually.

Nickel: One of the most sought-after metals in the world, it has literally thousands of uses in everything from stainless steel to rechargeable batteries, special alloys, gas turbines, electric guitar strings, and so much more. Not only that, the U.S. government considers nickel to be so crucial that the Treasury can recall 5-cent coins at any time for military purposes. . .Demand just keeps growing and growing. Right now, China is quietly buying stakes in junior miners to lock in supplies—and is expected to account for 40% of global nickel consumption by 2015, up from just 12% in 2004.

Vanadium: It's the "plastic" of the 21st century: a super-light, super-strong metal that's about to take center stage in the renewable energy and electric car era. Adding just 0.09% of vanadium to steel increases its strength by 100%—while decreasing weight and energy consumption by 30%—making it ideal for use in buildings, bridges, cars, cranes, pipelines, ships, and engines. In fact, when Subaru added it to the lithium batteries in its G4e Concept cars, total travel distance from a single charge soared from 40km to 200 km. No wonder China plans to double vanadium output in three to five years, just to meet surging domestic demand.

As you can see, there's a lot of wealth sitting up here. And the great thing is if just one of these metals is extracted. . .if only a little bit of it is recovered. . .this would still be more than enough to launch this explorer into orbit. And because so much of it is already sitting on the ground, it's only a matter of scooping it up—no drilling or blasting required.

Nick Hodge

Energy & Capital