Commodities are the necessary building blocks of the world. Glance around you—commodities are what the world needs to live and prosper and are everywhere you look. The world’s seven billion people need resources, and that’s why we recommend investors consistently allocate a portion of their portfolio to a natural resources investment.

Not every investment is the same, though. Even within the commodities space, when looking at measures such as correlation, performance and risk, two indexes can have very different effects on a portfolio’s results.

Take two popular commodity-related indices for example, the Dow Jones-UBS Commodity Index (DJUBS) and the Morgan Stanley Commodity Related Index (CRX).

The DJUBS is made of futures contracts on various physical commodities that represent major commodity sectors such as agriculture, energy, grains, metals, livestock and precious metals. Basically, futures are contracts between a buyer and seller, where the buyer agrees to purchase a specific commodity for a specific price and specific time in the future.

The CRX is comprised of stocks involved in commodity related industries, such as energy, non-ferrous metals, agriculture and forest products.

Yet, while both indices are diversified across various commodities, their correlations to the overall market differ.

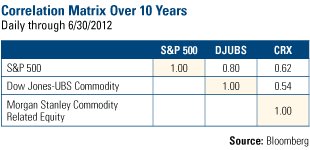

Take a look at the matrix looking at 10 years of data. The table lists the S&P 500 Index, which represents the overall U.S. stock market, and the two commodity indices. When two asset classes or investments are perfectly correlated to each other, their performance moves are in sync and they have a correlation of 1; 0 means that the two investments have no correlation to each other.

Over the past decade through June 30, 2012, you can see the DJUBS and the S&P 500 have had a correlation of 0.80. The CRX and the S&P 500 had a correlation of 0.62. This means the CRX is less correlated to the overall market than the DJUBS.

And why is a low correlation beneficial? In a diversified portfolio, it can reduce an investor’s volatility. In the article “Material World,” Financial Planning found that a low correlation is a “valuable feature” for natural resources mutual funds. When author Craig Israelsen compared the correlation to the overall market to the 10-year annualized returns of 18 natural resources funds with 10 years of performance records, “a clear pattern” emerged. “Natural resources funds with lower correlations (that is, closer to zero) had better performances during this span,” he says.

Over the past 10 years, this pattern was prevalent in the CRX, as commodity producers far outperformed the index of commodity futures.

How to Optimize Your Portfolio with Commodities

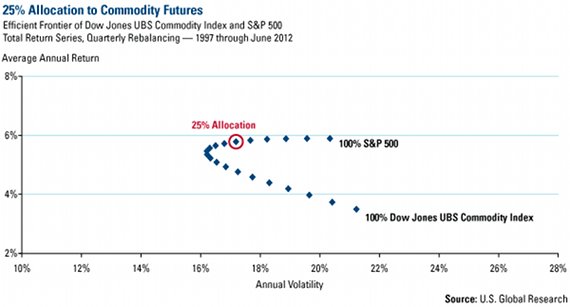

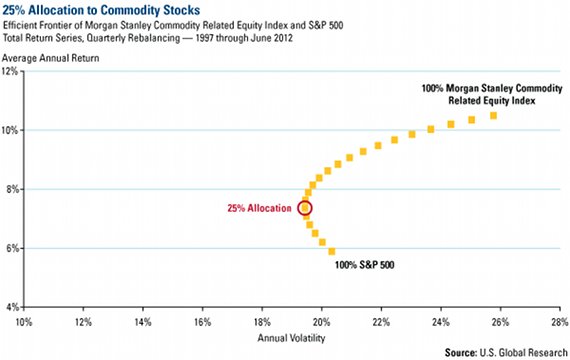

So how do correlations and long-term performance translate to your portfolio? One way to look at this would be to create an efficient frontier, which charts a range of allocations to commodities and the overall market to see which portfolio would be most efficient, i.e., which portfolio enhances returns without adding risk.

To find the optimal portfolio between commodities and the overall market, the efficient frontier plots different portfolios, ranging from a 100 percent allocation to an investment in the S&P 500 and gradually increasing the percentage of commodities. Each dot along the path of the efficient frontier represents an incremental increase toward a 100 percent allocation to commodities investment.

First, we chart the efficient frontier of the DJUBS and the S&P 500. A 100% allocation to the S&P 500 would result in a portfolio achieving a 5.9 percent return and 20.3 percent annualized volatility. Assuming the portfolio was rebalanced each quarter, our research found that a portfolio holding 25 percent allocation to the commodities futures and 75 percent allocation to an investment in U.S. equities would decrease an investor’s return by about 0.17 percent while decreasing volatility by a little more than 3 percent. Simply, the addition of commodity futures yields less volatility for about the same return.

A different picture emerges when you chart an efficient frontier for a portfolio invested in commodity equities and the overall market. In a portfolio of 25 percent commodity equities and 75 percent U.S. stocks, an investor reduces their risk by almost 1 percent while increasing their return by nearly 1.5 percent.

How Resourceful Is Your Portfolio?

The charts above illustrate how the power of commodities enhances a portfolio, although a 25 percent allocation may be a little too aggressive. For reference, about 15 percent of the S&P 500 Index is made up of energy and materials companies.

The Global Resources Fund (PSPFX) uses the CRX as its benchmark, and we're pleased to say that over the past 10 years, the four-star fund* has outperformed its benchmark, resulting in even greater returns for shareholders.

Put commodities to work in your portfolio today.

Frank Holmes

U.S. Global Investors

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

* The Global Resources Fund earned a 4-star Morningstar Overall Rating™ among 121 natural resources funds as of 8/31/2012. The Global Resources Fund earned a 3-star Morningstar Overall Rating™ among 124 natural resources funds as of 6/30/2012.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Morningstar Ratings are based on risk-adjusted return. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

The Morgan Stanley Commodity Related Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity related industries such as energy, non-ferrous metals, agriculture, and forest products. The index was developed with a base value of 200 as of March 15, 1996. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Dow Jones UBS Commodity Index is composed of futures contracts on physical commodities, and includes commodities traded on U.S. exchanges, with the exception of aluminum, nickel and zinc, which trade on the London Metal Exchange (LME). Diversification does not protect an investor from market risks and does not assure a profit.