Stock and commodity prices across the board soared on the latest announcement from the Fed, which was viewed as wildly bullish by Wall Street. The Federal Reserve launched another aggressive stimulus program on Thursday, promising it would buy $40 billion (B) worth of mortgage debt per month and continue to purchase assets "until the outlook for jobs improves substantially."

Gold was up 2% on Thursday’s announcement of the third quantitative easing initiative (QE3). Silver was up over 4%, while gold stocks advanced an average of 5% based on the XAU index. As was the case with the previous two quantitative easing programs, gold and the gold stocks love the idea of loose money.

"If the outlook for the labor market does not improve substantially, the committee will continue its purchase of agency mortgage-backed securities, undertake additional asset purchases and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability," the Fed said in a statement.

According to the Wall Street Journal, taken together, the Fed will be purchasing $85 billion worth of longer-term securities a month through the end of the year, an increase from the $45B of long-term bonds it is currently buying each month under "Operation Twist." It will also be printing more money to fund its mortgage-bond purchases, expanding the size of its $2.8 trillion balance sheet, WSJ said.

The purchases are aimed at pushing down long-term interest rates—especially mortgage rates—and increasing stock prices and real estate. The Fed's goal in launching its latest round of financial stimulus will boost the beleaguered housing market and spur broader spending and investment. The Fed stated, "The committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions."

In addition to trying to influence long-term interest rates with bond buying, officials on the Federal Open Market Committee said they expected to keep short-term interest rates near zero until at least mid-2015, beyond their previous estimate of late 2014. The Fed also added that a "highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens." In other words, loose money will be the Fed's dominant policy for the foreseeable future.

I have to confess that I did not expect the Fed to initiate QE3. Not that we weren't prepared for it; the 10-month price oscillator for gold told us to expect a break out for gold earlier this summer, while the internal momentum indicators have kept us exposed to this bull market for some time. In retrospect I suppose the price of gold was correctly anticipating the latest round of Fed stimulus, though my interpretation of gold's bull run was that gold was merely anticipating more trouble ahead in 2013 once the momentum from the four-year cycle peak diminishes.

One reason why I didn't think QE3 was needed was the strength reflected in the U.S. consumer retail economy. As we've talked about several times in recent weeks, the New Economy Index (NEI) is currently sitting at a multi-year high. NEI is in fact at its highest level since 2007, before the credit crisis even began. What this shows is that the U.S. consumer retail economy is doing much better than the pundits are giving it credit for.

Last month, for instance, sales of automobiles rose to their highest level in five years. Consumers purchased more fuel-efficient cars in response to higher gas prices, but there was also a 16% annualized increase in heavy truck sales. This reflects a willingness to spend more money on big ticket items—the first such sign of consumer bullishness since 2008. After Thursday's announcement for QE3, retail sales and business spending as reflected by the New Economy Index is probably going to go through the roof.

There is a debate among economists as to whether the latest attempt at quantitative easing will lead to economic troubles down the road, especially in the way of rising oil and food prices. There are also those (notably of the Austrian economic school) who contend that the Fed's monetary stimulus programs are producing diminishing returns and that the latest round of QE will end in failure. I view this as strictly an academic debate, and I seriously doubt anyone has the answer since we’re basically in unknown territory. From recent history, however, there is every reason to believe the Fed's latest stimulus will succeed in propping up asset prices even further and probably at least keep the economy treading water, even if job growth doesn't improve.

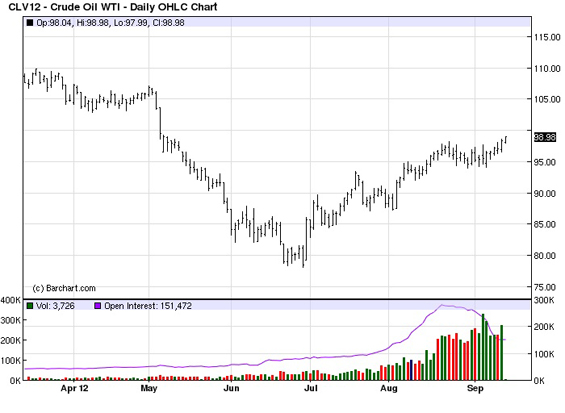

I am not one who believes QE3 will be a complete failure, though I do have a concern that it will boost oil prices to the point where the middle class becomes even more economically strained than it is now. Below is the daily chart of the crude oil futures price. The chart suggests additional upside potential for oil in the coming weeks with the $105–110 area an inviting target for speculators.

At the end of the day both stocks and hard assets alike crave liquidity above anything else, and the Fed's latest action virtually guarantees a continued bull market for the precious metals and other asset groups. The coordinated stimulus program by both the Fed and the ECB will also likely keep any nasty financial market shocks at bay, at least for the next few months.

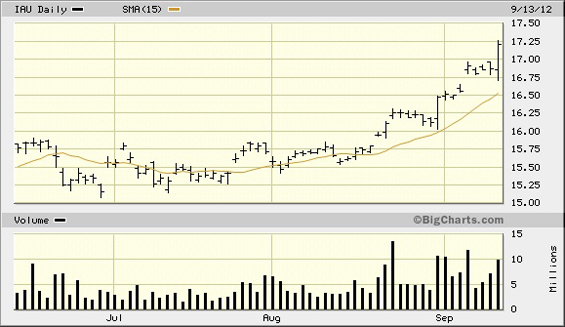

The iShares Gold Trust ETF (IAU), my favorite gold proxy, remains in a confirmed immediate-term buy signal above its rising 15-day moving average. Since confirming the buy signal in late July per the rules of our trading discipline, IAU hasn’t given a sell signal in the past six weeks and has advanced by a remarkable 10%. You can see IAU is in the process of tracing out a parabolic bowl pattern, which typically happens in a strong intermediate-term bull market advance. IAU is on its way to test the chart resistance at the 17.50 area from November 2011 and February 2012 double-top highs. If recent history is any guide, gold should be able to easily overcome this resistance and challenge the September 2011 all-time high.

Clif Droke is the editor of the three times weekly Momentum Strategies Report newsletter, published since 1997, which covers U.S. equity markets and various stock sectors, natural resources, money supply and bank credit trends, the dollar and the U.S. economy. The forecasts are made using a unique proprietary blend of analytical methods involving cycles, internal momentum and moving average systems, as well as investor sentiment. He is also the author of numerous books, including most recently 2014: America's Date With Destiny. For more information visit www.clifdroke.com. For book sales visit http://www.clifdroke.com/books/destiny.html.