There was a time in the 1980s when robotics was really cool, well except for auto workers and Detroit, but they were all over popular culture. In 1985, for example, when Nintendo's first console system launched (the NES), one of the primary marketing strategies was to sell the R.O.B. (Robotic Operating Buddy) and companion game as the reason to buy the NES, see picture below. The more successful accessory marketing strategy was the zapper gun (for Duck Hunt). But a few of my friends had the R.O.B.

Cyborgs were big in the 80s too (like Terminator) and Robocop that were more serious, but the pure Robots were featured in movies and on TV mostly for comic relief, such as in Rocky IV, Paulie has a robot butler.

But the boldest step came in 1986, when the movie Short Circuit came out, which featured a Robot, Johnny Five, with feelings (and like most other 80s movies, it also featured Steve Guttenburg). Short Circuit was followed by the sequel in 1988, Short Circuit 2, which I ended up watching many more times than the original (because back in the early 1990s, there were ONLY like 4 movie channels as opposed to like 100 these days). One of the skills Johnny 5 had was to read books really fast. Because he's a robot, reading a book only increases his desire to read more books, running around saying "Input, need more Input!."

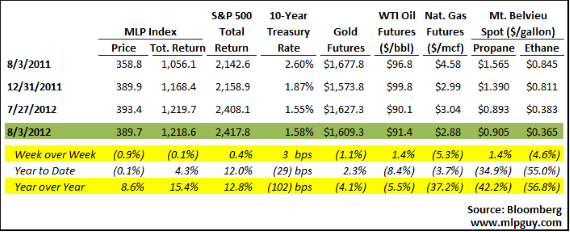

Well this week in the MLP space, we had too much input. A constant stream of earnings releases and conference calls, schizophrenic commodity prices, and a volatile overall stock market. The huge July payroll report of 163k jobs vs 100k estimates sent stocks and oil price up big Friday. MLPs held up well despite some troubling (but expected) earnings releases and distribution coverage numbers. MLPs were down in price almost 1% this week, but passed through many an ex-date, which allowed for the total return of the MLP Index to be roughly flat.

NGL prices have negatively impacted earnings of gathering & processing and E&P MLPs the most. On nearly all of the earnings calls I've listened to, management teams are saying this is a temporary blip, and have raised distributions and lowered coverage anticipating a recovery in earnings next quarter, and distribution coverage for the full year should be solid. Many reiterated guidance, but some of that guidance had already been lowered, some lowered guidance. A good example is WPZ, which announced 0.79x coverage this quarter, the first time it has dipped below 1.2x much less 1.0x since the third quarter of 2010. Distribution coverage for the year remains above 1.0x, and is expected to finish the year well above 1.0x.

There was a drop down acquisition from WES this week, at under 8.0x EBITDA, as the drop down execution continues. BWP did an equity deal, successfully getting out in front of the mountain of equity that will be issued between now and the end of the year. That equity will be absorbed with little incident if the economic data continues to surprise to the upside. If not, then expect a rocky road from here on out.

Distribution Wrap Up

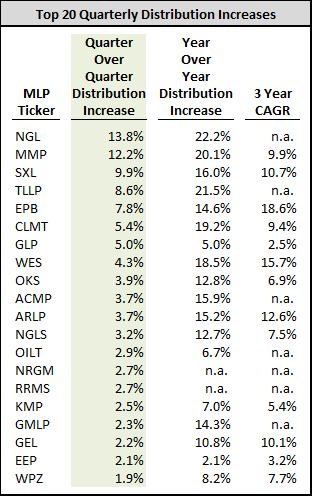

Almost all of the MLPs have announced their distributions for the quarter, so in review, below is a chart of the top 20 quarterly distribution increases in the sector, not counting the GP holding companies. NGL Energy (NGL) led all MLPs with a 13.8% quarter over quarter increase. Liquids-focused pipeline MLPs MMP, SXL and TLLP were the next 3. MMP and SXL in particular surprised to the upside with their distribution announcements. MMP's year over year distribution increase more than doubled its 3-year CAGR. CLMT and GLP also announced distributions that made their year over year increase rates more than double their 3-year CAGRs. Obviously, you can't extrapolate that to continue, but all else being equal, you'd rather have an MLP that is accelerating its annual growth rate than the other way around (EPB and EEP below fall in this other way around category).

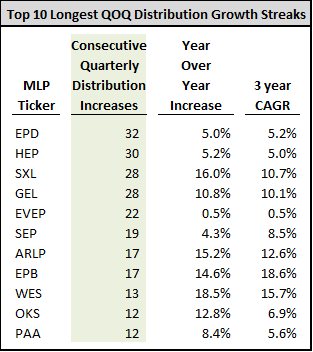

Also, generally speaking, consistent distribution increases are preferred to lumpy ones (unless you buy into an MLP that immediately announces a big lumpy distribution increase). The list below highlights the longest current streaks of quarterly distribution increases. There are some MLPs that have a practice of increasing distributions once a year or some other interval that leaves distributions flat for a few quarters in between (APU is a good example, increasing basically once a year). Those would also be consistent distribution growers even though they don't make this list.

The longest streak belongs to EPD and dates back to the middle of 2004, 32 straight quarters. HEP is sort of under the radar given its size and limited trading volume, but it sitting near its all time high a solid quarter and its 30th straight distribution increase. SXL and GEL are tied in 3rd with 28 straight quarters of distribution growth and a CAGR over the last 3 years of more than 10% each. EVEP has made nominal distribution increases since the middle of 2008, I guess just to be able to say they have grown distributions each quarter, but its kind of cop out. Past performance is not indicative of future results, but there are some pretty good MLPs on the list below, and a good place to start in terms of building an MLP portfolio.

Also, there are some pretty long streaks of NOT increasing distributions. That top ten list of consecutive quarters of flat distributions since 1996 is:

- FGP: 66 quarters

- CQP: 22

- ETP: 16

- CPNO: 14

- NKA: 9

- OXF: 8

- CPLP: 7

- SPH: 6

- MMLP: 5

- STON: 5

There are some good values in the list above, and some potential for restarting distribution growth again, which if you can time that right, can be very lucrative. But it's much more of a mixed bag than the distribution increase list above. However, the distribution growers are usually priced for that historical growth extrapolating into the future, and as you know the price you pay determines investment returns…

After this return to dropping references to 1980s movies, get ready for a Rodney Dangerfield Back to School themed post in a few weeks…

Hinds Howard

MLP HINDSight