Small precious metal producers are not well known for gifting dividends. Indeed, developing and operating a mine is capital intensive and profits—if any—are often slim for modest sized miners. Mine owners might commiserate with yacht owners who say boat stands for Break Out Another Thousand. By the same token investors in mines might say, Millions Invested, Nothing Extracted. And what's more, when it comes to dividends the argument goes that small companies should hold onto their profits to grow organically rather than lining the pockets of shareholders. This has been especially important to consider in an industry where gold and silver mineral deposits have expiration dates, replacing them isn't cheap and metal prices were long in the dumps.

Yet lately dividends have gained importance across the precious metal sector, with majors and intermediates taking the lead on boosting profit sharing. If gold and silver miners are to lose an innate premium on their shareprice, and if investors are to ditch producing companies in favour of physical gold and silver in ETFs or vaults, then dividends become all the more important as a means to attract those that want ongoing returns, not just the promise of growth. This is all the more true with gold and silver prices flying high.

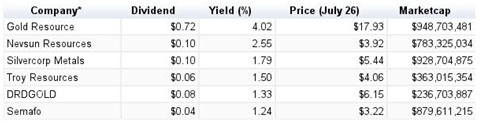

But what about small precious metal producers? It turns out they are no exception to the growing role of dividend policies. No, there aren't many precious metal producers issuing dividends, but then there are still a good handful, and they are serious about sharing profits. A search of small (under $1 billion marketcap) North American listed gold and silver producers bears this out. In order of yield (based on the last dividend, annualized) there were six small gold and silver producers that, at the very least, had distributed more than one dividend in the past year: Gold Resource, Nevsun Resources, Silvercorp Metals, Troy Resources, DRDgold and Semafo (see table below).

What stands out more than anything in looking at their dividends is not so much the yields, which aren't that bad, really, but the consistency with which the bulk of these precious metal producers have distributed cash to shareholders. Gold Resource has paid monthly dividends over the past two years since starting gold-silver production in Mexico at its El Aguila mine. Silvercorp, with silver mines in China, has consistently issued quarterly dividends since 2009. Troy Resources, a Brazil focused company, has paid 12 dividends in 12 years. DRDgold, a gold producer with mines in South Africa, has issued a dividend each year since 2008. And as for more recent entrants to the dividend game, Nevsun has paid out two semiannual dividends since it began production last year at its Bisha copper-zinc-gold mine in Eritrea; and Semafo, a gold miner in Africa, started a semiannual dividend late last year and has by now shared the wealth twice.

Meanwhile the dividends on offer give attractive—or not insignificant—yields, assuming these miners can keep it up. Gold Resource comes out on top with just over four percent return. (As an aside, you can opt to get your Gold Resource dividend in gold and silver). Nevsun followed suit at 2.55 percent. The rest on the list were within the one- to two-percent range. Not peanuts in a low-interest rate world. Taken altogether these dividend policies prove the stereotype of small precious metals miners—stingy bastards who don't or more likely can't share the wealth—wrong.

Mark Twain, it is said, opined that a mine is "a hole in the ground owned by a liar." But dividends don't lie.

Kip Keen

Mineweb