The situation in the euro-zone remains dire, however, the euro strengthened when the European Council President Herman Van Rompuy said the euro zone reaffirms its commitment to use its bailout funds to calm markets, thus weakening the dollar, for now. However, should the positivity surrounding the euro dissipate then the dollar could resume its rally with the corresponding negative affect on gold prices.

The USD chart shows this rally ending as the RSI peaked, a little before the news emanated out of the eurozone. The MACD is still heading south so we don't expect the dollar to rise in the short term, rather a period of sideways consolidation. The dollar has rallied well in these times of great uncertainty and has acted as a safe haven of sorts, cash being a place of refuge for many investors.

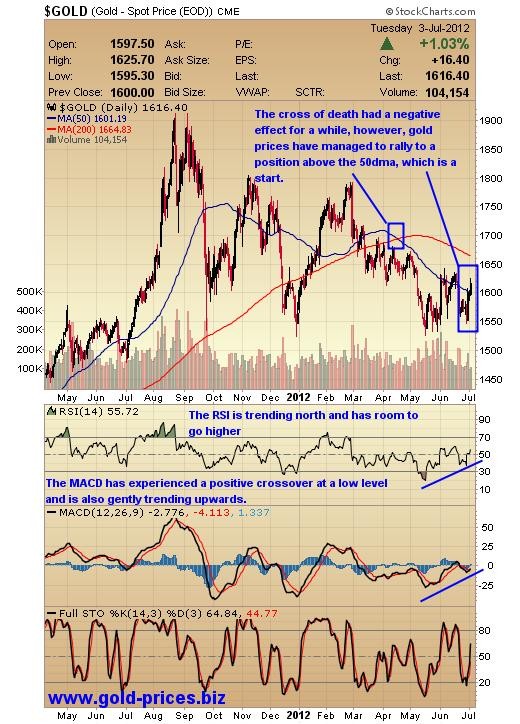

Taking a quick look at gold we can see that the cross of death had a negative effect for a while, however, gold prices have managed to rally to a position above the 50dma, which is positive news for gold prices. Also note that the RSI is trending north and has room to go higher. The MACD has experienced a positive crossover at a low level and is also gently trending upwards, so all in all the outlook is reasonably positive for higher gold prices. This comes as some relief to embattled gold bugs that the support for gold held and that it has been able to climb above the $1600/oz level, closing in a vacation mood at $1616.40/oz gold. A few days ago when gold was trading close to $1550.00/oz we wrote “Do not get carried away with this news, hold onto your holdings in the precious metals sector and don’t be pressured by what is little more than white noise. This initial bout of euphoria will fade faster than Germany's interest in the European Football competition, now that they are out of it. ” It is very important not to be panicked in these situations and keep a clear head when analyzing the markets.

Allowing ourselves to crystal ball for a moment, nothing has fundamentally changed in that the politicians haven’t got the back bone that they were born with and dare not grasp the nettle of debt reduction. The sovereign nations that make up the eurozone will continue to hold out their hands for more money in order to prop up their failing banks. It is as if the banks are the 'untouchables' and must be recapitalized on demand.

There is only one way forward for them and that is to print more money in the hope that something will come along and save their bacon shortly. Dream on politicians, the debasement of all fiat currencies continues unabated and they will all hit the wall sooner or later.

In terms of taking action in order to protect ourselves from this enforced devaluation of our personal wealth we moved out of paper money and into physical gold and silver many years ago. We also have a portfolio of precious metals mining stocks which out performed the metals in the early days of this bull market, however, that premium to gold prices has dissipated and we are therefore not actively seeking to add to our stock holdings at the moment.

Having recognized that the stocks were under performing the metals we switched our focus to trading options in order to get some leverage to the gyrations in the precious metals sector. This is not a strategy for the faint hearted, neither is it to be feared if you adopt a disciplined and conservative approach to each trade. The old adage still applies here that you should never fall in love with a trade, no matter how confident you are of it being a rip roaring success.

Stay positive, think precious metals, avoid the folding stuff.

Bob Kirtley

SK Options Trading