Greece, the tin pot tail of Europe appears to wagging the economic dog of Europe at will as their inability to appoint a pro-austerity government has failed. This situation is further exasperated by France, with its newly elected "no austerity" leader, stating that he will spend more now and not less in an attempt to boost economic activity if France. The German Chancellor, Angela Merkel, is now toast after suffering a significant blow as voters in Germany's largest state rejected her austerity policies.

Europe is fragmenting at an alarming rate with confidence being rocked on a daily basis and the Euro taking a drubbing. The main beneficiary appears to be the U.S. dollar, for no other reason than it is an alternative position to take.

The fallout from all this uncertainty is also taking its toll on both gold and silver prices, along with the associated producers as we watch them drift ever lower. For those of us who own these assets, it's hard to stomach, but for those who have yet to enter this tiny market sector or who wish to increase their exposure to it, it appears that a fabulous buying opportunity lies ahead.

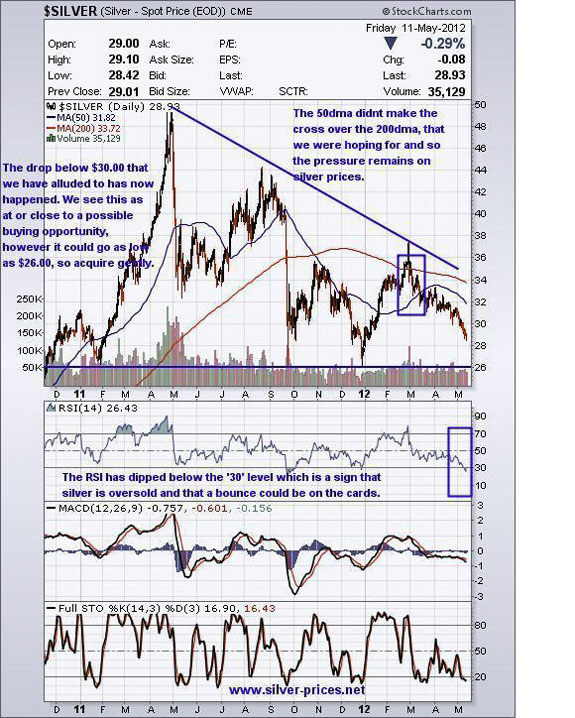

Taking a quick look at the chart we can see that the 50-day moving average (dma) didn't make the crossover of the 200 dma, that we were hoping for and so the pressure remains on silver prices. The drop below $30.00 that we have alluded to has now happened. We see this as at or close to a possible buying opportunity, however it could go as low as $26.00, so it could be worth the wait for slightly better prices.

Also note that the RSI has dipped below the "30" level which is usually a sign that silver is oversold and that a bounce could be on the cards. This is not always the case and it can't be relied totally, but it does suggest that the selling is overdone at this point.

In terms of actionable data, we are not too keen on the mining sector at the moment as they could well be sold off should there be a general sell off in the major market sectors, a case of the baby being thrown out with the bath water. However, if we do get to see lower silver prices then there should be an opportunity in the options arena for us to take advantage of, something that we are researching in an attempt to unearth some real value.

Stay tuned for further developments.

Bob Kirtley

Disclaimer: www.silver-prices.net or www.skoptionstrading.com makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level or risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success.