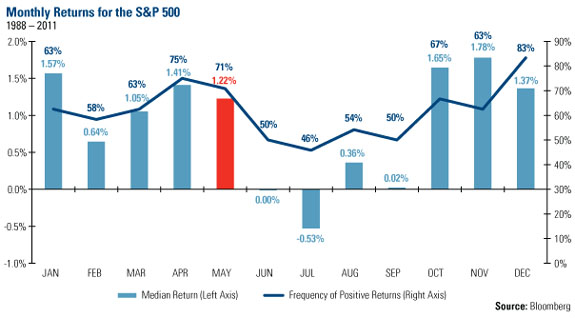

One catchy investing maxim that's popular this time of year is "sell in May and go away," the notion that investors should cash in their investments and take the summer off. Historically, this hasn't been a bad strategy. You can see from this chart that June, July, August and September have been the worst four months of the year for the S&P 500 Index since 1988.

Since 2000, the June-September period for the S&P 500 is split. Half of the years saw positive returns, while the other half were negative. Historically, you have only about a 50-50 chance for a positive gain during those months while your odds are roughly 10% better during the rest of the year.

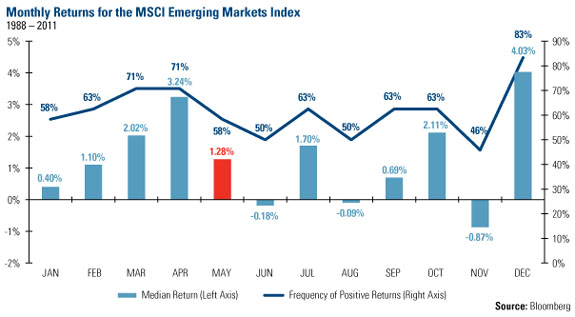

The trend is less consistent for emerging market stocks. You can see that the median monthly return for the MSCI Emerging Markets Index since 1988 is negative for June and August, but positive for July and September. The frequency of positive returns during the June-September period is roughly 6% lower than the rest of the year.

Last year, investors who employed the "sell in May" strategy averted an almost 17% drop in the S&P 500 and a nearly 25% drop in the MSCI Emerging Markets Index from June-September. Summer of 2010 was a similar experience.

With last year fresh on the minds of investors, should they take the summer off? We don't think so.

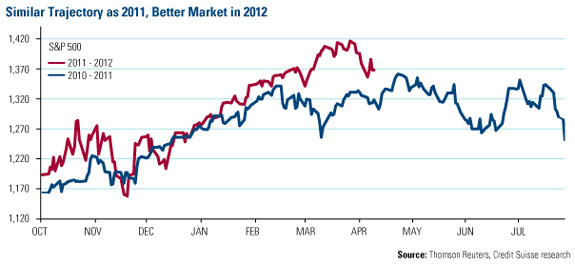

We believe it's a much better market this year. After following a similar trajectory as the previous year from October to the beginning of March, improving economic data pushed the S&P 500 over 3% higher in March 2012 after trending sideways during the same period last year.

Real GDP in the U.S. grew 2.2% during the first quarter of 2012 versus 0.4% during the first quarter of 2011, and several areas of the economy are much stronger than they were a year ago. Nonfarm payrolls (up 29%), ISM Manufacturing (up 2%) and auto sales (up 8%) have all improved from a year ago, according to J.P. Morgan. In fact, auto sales are currently at a four-year high.

More importantly, the U.S. housing sector continues to improve. The ISI Group's homebuilders survey is currently at 50.4, nearly 40% higher than a year ago.

Building permits are 35% higher and the number of housing starts is 3% higher than a year ago, according to Credit Suisse. Sales of existing homes are up 5% on a year-over-year basis. Credit Suisse says, "The supply of existing one-family homes has fallen from a peak of 11.5 months in July 2010 to 6.3 months in March (in line with the 20-year average)."

ISI Group says an improvement in housing is important because it lifts consumer net worth and employment, which leads to rising consumer confidence. Housing accounts for just over 2% of U.S. GDP, but roughly 27% of household wealth, according to Credit Suisse.

Earnings Season Off to a Record Start

The improving global economy is reflected in the 13th straight quarter of better-than-expected corporate earnings. As of Thursday, 80% of S&P 500 companies have reported earnings above analyst estimates. Earnings for the 260 companies reporting so far were up 11.4% year-over-year and beat the consensus estimate by 6.3%.

This is good news for shareholders. According to a Bloomberg story this week, "companies are increasing shareholder returns in the form of dividends and buybacks after the 2008 financial crisis led them to hoard cash to a record $1 trillion by the end of 2011." The number of S&P 500 companies paying out dividends now sits at 401, the largest number since January 2000. Corporations bought back roughly $543 billion worth of shares in 2011 and J.P. Morgan estimates companies will purchase another $679 billion worth in 2012.

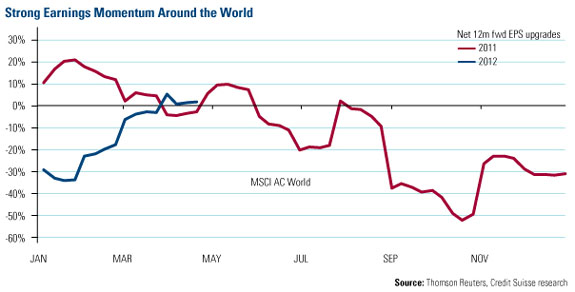

U.S. companies aren't the only ones reporting stronger results. This chart from Credit Suisse shows earnings momentum is strengthening around the world based on 12-month forward earnings per share estimates for the MSCI ACWI (All Company World Index). This is the opposite of what we experienced in 2011.

Buy in May?

May has historically been a strong one for markets. Since 1988, the median return for the S&P 500 and MSCI Emerging Markets during May has been 1.22% and 1.28%, respectively. In fact, May returns rank in the top half for both indices.

This is also a presidential election year in the U.S., which has historically produced positive returns. Since 1972, the stock market has rallied in five of the eight election years, according to J.P. Morgan, with market gains of 12–26%. Only during recession years (2000 and 2008) did the S&P 500 provide negative returns.

Last week, Bank of America-Merrill Lynch (BofA-ML) suggested "investors position for an economic upturn" by increasing their exposure to equities. The firm's Global Wave indicator, a compilation of seven global metrics designed to provide a comprehensive assessment of trends in global economic activity, was signaling a trough in the global cycle. According to BofA-ML's research, the MSCI ACWI (All Country World Index) averages a 14.2% increase for the 12 months following a trough in the Global Wave. Historically, the index has experienced a positive return 86% of the time.

Instead of "selling in May and going away" for the summer in 2012, we think investors should look to global stock markets and ride the global wave.

The New York Hard Assets Investment Conference May 14–15 provides a forum for U.S.-based individual and institutional investors and mining stakeholders to learn from top analysts, economists, and newsletter publishers on the most exciting opportunities in hard asset investments. Information on the free conference is available here.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors Inc., which manages a diversified family of mutual funds and hedge funds specializing in natural resources, emerging markets and infrastructure. The company's funds have earned many awards and honors during Holmes' tenure, including more than two dozen Lipper Fund Awards and certificates. He is also an adviser to the International Crisis Group, which works to resolve global conflict, and the William J. Clinton Foundation on sustainable development in nations with resource-based economies. Holmes co-authored The Goldwatcher: Demystifying Gold Investing (2008). Holmes is a former president and chairman of the Toronto Society of the Investment Dealers Association and served on the Toronto Stock Exchange's Listing Committee. A regular contributor to investor-education websites and a much-sought-after keynote speaker at national and international investment conferences, he is also a regular commentator on the financial television networks and has been profiled by Fortune, Barron's, The Financial Times and other publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.