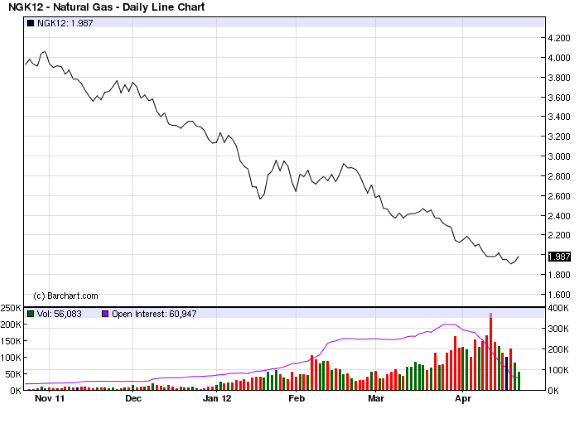

As natural gas has continued its massive decline, a number of investors (myself included) have hopped into short positions, allowing most to receive handsome profits in recent weeks. NG futures have been under a fair amount of pressure as this past winter was extremely mild curtailing demand for this commodity.

Adding to that, new advancements in fracking have led to even greater supply, depressing prices to levels that none could have predicted. But while a short position in this commodity has yielded strong results, its outlook is beginning to turn sour, as a seasonal trend is threatening natural gas [see also Why You Should Invest In Natural Gas: The Fuel of the Future].

Starting June 1st and lasting through September, the U.S. will enter hurricane season. These violent storms often hit the gulf area and the coast of the southeast. A large supply of natural gas and pipelines run through these areas (along with crude oil) and it is not uncommon to see temporary shut-downs during a storm. If a shutdown occurs, NG prices have a tendency to temporarily spike, which could wreak havoc on your NG position. Note that even with hurricane season approaching, NG may still have a ways to fall, but it will be a volatile path getting there. Because short positions are tagged with unlimited liability, maintaining one during these volatile months could mean bad news for you and your portfolio [see also 25 Ways To Invest In Natural Gas].

Unfortunately, taking a long position in NG would be equally dangerous, as the fossil fuel has zero momentum and shows no signs of recovering anytime soon. Instead, NG positions should be left for active traders during these months, as those unwilling or unable to constantly monitor their holdings can get burned in a hurry. Proceed with caution.

Ways To Play

For traders looking to profit from hurricane season, there are a wealth of NG options available. Perhaps the most direct method comes from NG Natural Gas futures contract offered on the NYMEX. The May contract is currently the most heavily-traded future and will offer the best liquidity, but longer dated months still offer nice liquidity and will be more relevant to this developing trend. Traders may also be interested in the ETF, United States Natural Gas Fund LP (NYSEARCA:UNG), as the product changes hands over 8.3 million times each day. Note that UNG recently hit its historic low. For those looking to establish a short position, the new 3x Inverse Natural Gas ETN (NYSEARCA:DGAZ) will allow investors to make a bearish bet on the battered commodity. Income investors may be interested in an MLP like Kinder Morgan Energy Partners (NYSE:KMP), as it will make an indirect play on natural gas while offering an enticing yield [see also Natural Gas ETPs Head-To-Head: GASZ vs. UNG].

Written By Jared Cummans From CommodityHQ Disclosure: Long DGAZ.