John LaForge: Gold is telling many stories at the same time. Recently, though, one of the main issues has been seasonality. Gold tends to do best toward the end of the fall, right around the Diwali wedding season in India, up until about now. Springtime through fall is a good time for accumulating, but not to expect big price rises.

The second factor impacting the price recently has been the new Indian taxation issue. India has a trade deficit, and one of the ways it is dealing with that is by trying to tax gold coming into the country. India has been the largest gold buyer for a long time, although China finally did surpass it last year. The two account for about 43–44% of all world gold demand. The Indian tax proposal was met with resistance and strikes. So there has been weaker demand for physical gold in the last few weeks from India.

The third piece is much more macro-oriented. Real interest rates affect the carrying cost of gold. Low real interest rates are very good. When they get up to around 3.5% on a real-rate basis, that's not good for gold because that's the carrying cost. Right now, we're between 0 and 50 basis points, which is very good for gold. But the rate of change in the real rate has slowed and has stopped becoming more negative.

TGR: How big a tax is India proposing?

JL: It's 2%, which doesn't sound like much, but it did cause dealers to strike for the whole week and shut up shop, which is a big deal. In the U.S., it would be something like Starbucks shutting up shop because coffee prices had risen too high. In the longer term the tax should have very little impact on the price of gold because gold is an integral part of the culture in India. Any type of tax eventually just gets worked into the price and the consumer just ends up buying a little bit less, but still buying.

TGR: Many gold bugs are predicting gold prices ranging up into the $5,000–10,000/ounce (oz) range in the coming years. How realistic do you feel those numbers are and what combination of circumstances would it take for gold to hit those prices?

JL: Both are truly out-of-the-air type numbers, but, in fact, we once published something on $5,000/oz that was based on time, since the 1970s. When Nixon went off the gold standard in 1971, gold rose from $35/oz to over $800 in 1980. If you apply the current cycle to the 1970s cycle, with gold starting this cycle at $250/oz, the same type of performance would equate to 5,000/oz. today. That's where the $5,000/oz comes from, but we've never actually predicted $5,000/oz.

The $10,000/oz scenario I've seen was equated to money supply. To back all the money out there today with some form of gold, even at just, say, 10% (or whatever percentage used), a $10,000/oz value was reached. If consumers and investors do not trust their governments to stop printing money and governments continue to do so, gold does have a shot at much higher levels than $1,700/oz or $1,900/oz, but I don't know about $5,000/oz and $10,000/oz.

The West is dealing with debt issues and the East is dealing with growth issues and trying to compete with countries that are devaluing their currencies. China doesn't want to increase the yuan too quickly because it makes exports less competitive.

From what we know about commodity cycles going back into the 1700s, the average bull cycle lasts about 17 years. This commodity cycle has now gone 11 years. Typically the first 10 years of those cycles is when a lot of that easy money is made. That's when things like gold go up seven times from $250/oz to $1,700/oz. If gold increased seven times from $1,600–1,700/oz, that would equate to $10,000/oz. To get another seven-fold increase from here would be tough.

TGR: Wouldn't it take some dramatically bad economic circumstances, panics or some combination for people to run it up to those prices in any shorter period of time?

JL: Yes. What you're describing is a fear-based environment with people coming to the realization that all of this paper money floating around is not worthy. History is littered with paper money that has gone bad, whether it's Germany's famous Weimar Republic in the 1920s, or more recently the Hungarian pengo, the Zimbabwean dollar and Argentina's peso. Most Westerners, particularly Americans, don't think much about the value of the currency in their pockets.

As more and more of this money is printed everywhere, not just in the U.S. but also in the Eurozone, Japan, China and elsewhere, there's going to be a realization sometime in the next three to five years that maybe the $20 sitting in a pocket isn't worth what it used to be. How do I protect myself? People are going to start looking more toward hard assets. Gold is one of those. Land could be another one. But gold is clearly something you can pick up and move. It's definitely a place to hold some value and protect wealth. It's not going to be the next Apple. You're not looking at a $15 stock that goes to $600. That's not what gold is for. It's there to protect wealth from this erosion of all of the paper money that's sitting out there.

TGR: From a trading standpoint, what do you see as a downside for gold in the near term?

JL: The major one would be if confidence comes back that governments are going to stop printing money and be held accountable. That will happen one day, which could be tomorrow or 10 years from now. One thing we do know is that secular cycles do end. Stocks will go through a 20-year bull market, and then they have a bear market. Commodities do the same thing. Gold will do the same thing. The gold cycle of people being fearful of all of this money being printed will end. That might be at $3,500/oz, and then it just fades for 10 years and settles around $2,500/oz. You still would have made money if you bought it today.

Confidence is the big factor. One way to track confidence is to look at gold in multiple currency terms: the euro, the yen, the rand—not just the dollar. Gold is rising against all currencies in the world. What would worry me is when that stops. As long as the current uptrend continues, I'm a happy camper.

TGR: It appears we're in the midst of a near-term correction or maybe on the upside of one that just occurred. Is there some more potential downside?

JL: Yes, there is. From our technical work, if gold can't hang in the $1,660–1,670/oz range, the next support level is $1,565/oz. Then there is another support level around $1,480/oz, and finally a big one around $1,300/oz. We don't think $1,300/oz is in the cards because we would need to see some pretty dramatic confidence come back in governments worldwide. But $1,565/oz is definitely a possibility. Gold currently sits below both its 200-day and 50-day moving averages, which is technically bad news. It's basically showing that the trend has slowed and gold is consolidating. That goes with one of the first points we talked about: seasonality. From a yearly perspective, this is one of those times where gold usually takes a breather every year.

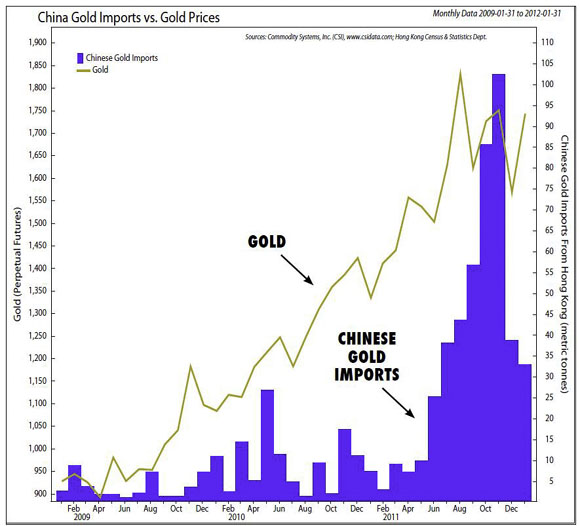

TGR: The Chinese seem to be pretty excited about gold. One of the charts in your research shows that Chinese imports of gold really took off dramatically last June and have continued doing so. Do you expect this to continue and what are the implications for the market if it does?

JL: It probably will. Everyone assumes that China is a big buyer of all commodities. China is also the largest producer of gold in the world and hasn't really tried to buy much gold outside of the country. Most has been produced and consumed internally, although it's hard to get data on what it owns. The chart you're referencing reflects Hong Kong import numbers I've been looking through and shows that the Chinese are now starting to buy gold in droves through Hong Kong. This tells me that it is basically consuming everything it can internally and now it's looking outside. That is a game changer.

A year ago China imported about 5 tons (t) gold a month through Hong Kong. That's been fairly consistent over time. We can track 5–15 t/month through Hong Kong. But around last June, it suddenly jumped to 25 t for the month. Then it went to 40 t. Then it went to 55 t. In November, it peaked at 100 t. If it kept up that pace, which it probably won't, that would be 1,200 t/year. That's about 45% of yearly mine supply in the world. So China is one of these wild cards because it hadn't really been out there in the market like this.

If China does with gold what it's been doing with other commodities, it could keep that 11-year positive cycle going by looking for gold outside its borders. We're going to get a better picture of how much it truly wants to buy. The numbers could be pretty staggering and could be multiples of what we saw last year and the year before.

TGR: Is there any way of knowing how much of that would be official government buying versus retail buying?

JL: Unfortunately, the numbers aren't broken out into how much is the People's Bank of China (PBOC) and how much is consumer. I think it's pretty safe to say, though, that to have such a big jump, from 5 t to 100 t/month, the PBOC is somehow buying some of that. It's hard to believe it's all consumer driven.

TGR: Most of our readers are mainly interested in the mining stocks that have really lagged metals price performance. It's a frustrating scenario that has been going on for some time now. What do you think are the main causes for this disconnect?

JL: One is production where a lot of the larger and mid-cap miners just don't have the production growth. If you're an investment manager running $1 billion and you see the price of gold going up, you have a couple of options. One is just to get long the price of gold through the SPDR Gold Trust Fund (GLD) or physical exchange-traded funds (ETFs) or just buying physical metal.

Gold miners have to worry about production and energy costs. They're not producing at the levels that they'd want because a lot of the ore grades are now much lower than they were 30 to 40 years ago. That's a classic example of a "peak" commodity. Peak oil or peak gold doesn't mean we've run out. It just means we've reached that point where the easy stuff has been found and now it's just going to be harder to find the rest, either in countries you don't want to be in or because the ore grades are down.

We've found that professional investors are more interested in just getting access to the price of the metal itself. When investors buy miners, unfortunately, they are dealing with the lack of production growth and, at the same time, rising energy costs. From about 1996 to 2008, the price of oil rose at a faster rate than the price of gold, which is very surprising to most people. They think that because gold's been up 11 years in a row, it's somehow beating every other commodity. That's just not the case. Gold mining is typically one big dirt-moving operation that's heavily tied to energy. Additionally, labor costs have also been killing them.

There is a positive side for anyone who owns miners. They are now about as cheap as they've been versus gold since the mid-1980s and may get cheaper still due to ETFs like the GLD. We're still telling people to stay allocated to the price through the GLDs, but it's getting to a point where some of these miners are very, very appealing from a bargain perspective.

TGR: Do you see any particular catalyst that could actually get people really interested in buying shares anytime soon?

JL: Unfortunately, no, unless we start seeing big production numbers out of these guys. If you can aggregate the group and get some decent production numbers, I think you'll start seeing people go back and be very interested. The other thing that could happen, which we haven't seen yet, is merger and acquisition (M&A) deals. If you start getting some bigger M&A deals, that could be a catalyst for people to realize how undervalued these names are compared to the price of gold. But because we haven't seen that, there is no premium in any of them for those types of buyouts.

TGR: Is it just going to take the price/earnings (P/E) ratios getting to such low levels that average investors are going to start buying them on the basis of P/Es rather than the business they're in?

JL: You also need a decent stock market. The last six months have been a little strange because the stock market has gone up, but gold miners have trailed gold, which is usually not the way it works. Historically speaking, there have been two drivers of gold stocks: gold and the stock market. Gold stocks don't seem to be winning under either scenario right now, unfortunately.

TGR: In reviewing all of your different research reports, you come up with some pretty interesting correlations between gold and various other prices and economic factors. Are there one or two that you'd like to particularly emphasize that you think might be the best indicators of what might lie ahead in the gold market?

JL: The No. 1 indicator for gold prices is real interest rates—the nominal interest rate minus the inflation rate. Below 3.5%, gold is usually good to go. Above 3.5%, it becomes a real issue. The other piece to that is the rate of change. In essence, the 10-year real interest rate is zero right now. If it starts moving from here toward that 3.5%, that's typically a headwind for gold.

The second one, which really has to be watched closely, is gold in all of these different currencies. Right now, the charts all look very similar. If gold continues to rise versus all these different currencies and there's still that fear factor over money printing, gold is still good to go. If it starts to fade, that's the signal I'd watch out for that maybe this 11-year run is due for a breather. We hope we'll have some time to give our clients some warning that it's rolling over and that the gold story is done for a little while. But we're not there yet, and it's all still positive.

TGR: Would you like to take a shot at predicting where gold might be going in the next year or so?

JL: I don't put out a formal prediction. My thoughts at the beginning of this year were that gold was going to be dead money in 2012 and just sit there after a good run. I didn't have anything to back that up other than time and the fact that gold was up each year for the past 11 years. Looking at the Dow Jones Industrial Average back into the late 1800s, its longest run up on a consecutive basis was nine years, and that was in the 1990s. Before then, the most the Dow had ever strung together was five consecutive positive years. Assets usually don't run up in straight lines as gold has done.

My prediction for the year was for sideways trading in that $1,600–1,700/oz range. I was looking a bit like a fool in February when we were approaching $1,800/oz again, but I still think that's the case. Europe is the big question and if Spain becomes a problem like Greece was last year, $1,700/oz is probably light and it will probably be closer to $1,800/oz or $1,900/oz. We'll probably look back on 2012 and say it was a good year to accumulate gold, but not one in which you made big money in gold.

TGR: Thanks for talking with us. We'll have to see whether you've been overly optimistic or overly pessimistic.

JL: That sounds good. Thanks.

John E. LaForge leads Ned Davis Research's Commodity Team, which provides research across the commodity spectrum, including equities. The team covers the most widely followed energy,

metal, agricultural and soft commodities and equities, providing both commentary and strategy. Commodities and commodity equities are global in nature and sensitive to economic realities, so LaForge works closely with all of NDR's other strategy teams. LaForge has over 17 years of investment experience, primarily in asset management. Almost eight of those years were spent managing $1.2 billion across seven mutual/hedge funds under multiple client platforms for Phoenix Investment Partners before he became chief investment officer of SRQ Capital Management in 2005. Over the course of his career, LaForge has been a frequent contributor to the media, including CNBC, Bloomberg and many print media publications. LaForge holds a Bachelor of Science in finance and Master of Business Administration from the University of Tampa.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1) Zig Lambo of The Gold Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: None. Streetwise Reports does not accept stock in exchange for services.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.