Today, investor apathy has grown to epidemic proportions because of a lack of political leadership, excessive regulations and market volatility. Some analysts believe volatility has resulted from excessive regulations. Matthew Bishop, the editor from The Economist, attracted a lot of attention last week—even appearing on CNBC—as its front page confronted today's "Over-regulated America. " Bishop argues the U.S. has strayed from its "laissez-faire" ideal to "be free to choose, for better or for worse" in favor of complicated regulations.

For several years, I've been discussing how government regulation has changed the formation of capital, which then affects job creation and entrepreneurship. Complicated and widespread use of layered-on rules acts as an injection of cholesterol, creating a blockage in the economy's bloodstream. Money is the lifeblood of an economy; to keep the arteries and heart of America beating strong and healthy, capital needs to circulate freely. But the cost to comply with new regulations, in terms of dollars, time and resources, has clogged the arteries of enterprise.

The magazine points to the Volcker Rule as one example of the unintended consequences of these new regulations. The rule began with the good intentions of limiting proprietary trading by banks. However, it includes more than 1,400 questions banks must answer to verify compliance. This means that it would take one full year to assure compliance if a firm answered 27 questions each week. The cost to comply with this rule causes CEOs and CFOs to be hesitant to hire workers or commit capital to their businesses or research & development departments.

Tax incentives act as a dose of Lipitor to help the heart of the economy. While previous presidents have raised taxes, they also streamlined and deregulated industries or provided tax incentives to inspire capital spending to create jobs. For example, in the 1990s, President Clinton streamlined and deregulated the telecommunications industries, unleashing the Internet, which was once considered to be a necessary tool to protect our nation.

We recently talked about how in 2011, corporate tax receipts as a share of profits were at the lowest level in 40 years because businesses were given a tax incentive to deduct investments in goods during the year they were bought, rather than over time. According to the Wall Street Journal, this tax incentive "saved companies roughly $55 billion in corporate income taxes over each of the past two years. " The billions that companies saved allowed them to spend the money elsewhere. And spend they did, as capital spending reached $150 billion in 2011. This multiplier effect acted as a successful treatment for the U.S. economy, as businesses expanded and created jobs for American citizens.

It’s about policies, not parties: The Economist says, "Republicans write rules to thwart terrorists. . .Democrats write rules to expand the welfare state. " This discussion is not intended to condemn either political party or claim that all regulation is bad. Business, like sports, needs rational refereeing to ensure a fair and exciting game is played. However, we need to be careful that we don't put more referees on the court than basketball players.

The Economist says America needs a smarter, simpler approach, recommending that the U.S. perform a "cost-benefit analysis by an independent watchdog" and "prescribe only what is strictly necessary to achieve" broad goals. What makes the U.S. special is its entrepreneurial spirit, and we must adopt policies that promote prosperity and efficiency to empower the world's most innovative companies.

A Cure for What Ails Investors

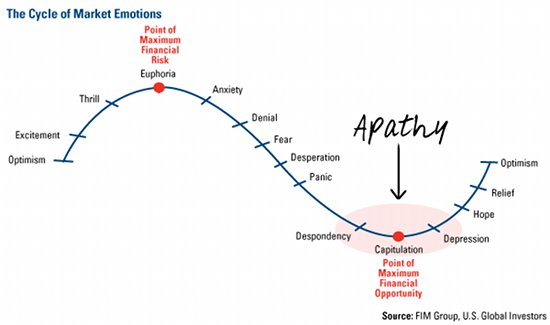

A lack of faith and trust has driven investors to the sidelines and halted the flow of capital in the U.S. According to the Investment Company Institute, investors pulled more than $130 billion from equity mutual funds during 2011. This is a common reaction in the cycle of market emotions where investors generally move from a fear of losing money, to becoming apathetic about the markets, to feeling confident about investments, and finally, to irrational exuberance. Right now, many investors appear to be stuck in an apathy sandpit.

However, just like you wouldn't be apathetic about spending all day on the golf course without sunblock to protect from skin cancer, investors should protect themselves in the stock market.

One way to be proactive is to make your political opinion known by contacting your Congressman.

Another approach is to think contrarian. It takes courage to combat apathy and put negativity in perspective, but as the famous growth investor Philip Fisher once said, "The stock market is inherently deceptive. Doing what everyone else is doing. . .is often the wrong thing to do. "

We believe opportunities are everywhere, as we focus on historical cycles to reveal the trends. As weekly readers of the Investor Alert know, we have mentioned several trends lately:

- The global liquidity boom that began in December has initiated the resurgence of markets around the globe. In total, 77 countries have instituted stimulative measures since late last year designed to inject money into the system to stimulate economic growth. As one example of this powerful momentum, China saw a record increase in money supply after its government switched its policy to easing mode in December.

- Investor attitudes improved, which tends to significantly affect market performance. Back in early October, we discussed how Citigroup's Panic/Euphoria model, which measures a combination of nine facets of investor beliefs and fund managers' actions, had been stuck in panic mode for months.

This was a signal to us that market sentiment was destined to improve and lift share prices with it. Since then, the S&P 500 has jumped 18% and is currently at levels not seen since before the credit crisis. Small caps have felt an even greater lift, rising 26% over the same time period. - Low interest rates have upped the attractiveness of equities, specifically dividend payers. Today, nearly 70% of the S&P 500 companies are paying dividends at an annualized rate greater than the yield on a 5-year Treasury. This number is even higher for the companies in the MSCI Emerging Markets Index. As shareholders, you get the double benefit of potential appreciation, along with regularly paid income.

- More companies are growing their revenues: Among the stocks in the S&P 1500 Index, about half have more than 10% revenue growth, faster than the U.S. 's overall GDP.

- Higher gas prices at the pump benefit certain natural resources companies. By investing in a natural resources fund, such as our Global Resources Fund (PSPFX) which earned a 5-star rating from Morningstar* for the past three years, you'll have access to energy and materials stocks that should profit from rising oil prices.

It is often said that great bull markets climb a wall of worry before stocks soar to higher highs. Although the economy will still be expected to run faster with clogged arteries, I believe investors who fight apathy while staying cognizant of the risks will participate in the historical long-term performance of the market.

Frank Holmes

U.S. Global Investors

*Among 124, 124, 87, and 38 natural resources funds, the Global Resources Fund earned 3 stars, 5 stars, 1 star and 4 stars for the overall, 3-, 5- and 10-year periods ending 12/31/11.

Please consider carefully a fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Morningstar Ratings are based on risk-adjusted return. The Overall Morningstar Rating for a fund is derived from a weighted-average of the performance figures associated with its three-, five- and ten-year (if applicable) Morningstar Rating metrics. Past performance does not guarantee future results. For each fund with at least a three-year history, Morningstar calculates a Morningstar Ratingä based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.)

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P 1500 Composite is a broad-based capitalization-weighted index of 1500 U.S. companies and is comprised of the S&P 400, S&P 500, and the S&P 600. The index was developed with a base value of 100 as of December 30, 1994. The MSCI Emerging Markets Total Net Return Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in emerging market countries on a net return basis (i.e., reflects the minimum possible dividend reinvestment after deduction of the maximum rate withholding tax).