So, there is a constant cycle that plays out in MLPs, buying leading up to distribution payments, selling afterwards to adjust for paid distributions, then slow build up again. I've written about at length, and you can read more about MLP seasonality here and here.

Distributions are paid to unitholders that own the MLP as of the record date, which is usually a few weeks before pay date. To be the unitholder of record, you need to buy the MLP before the ex-dividend date (ex-date for short), which is 2 trading days before the record date. So, on the ex-date, if you buy the MLP from someone, you are buying it without the dividend that will be paid a few weeks later. In theory, all else in the market being equal, the market will open trading on the ex-date at the closing price less the distribution.

Its hard to tell how efficient the market is as accounting for distribution ex-dates, because a lot of market noise can happen between close on the prior day to the opening print on the ex-date. It is possible there are trade-able patterns in MLP price as a result of the thinly traded nature of some MLPs, but any analysis of those patterns for longer than the specific ex-date increases the possibility that your pattern is the result of some other factor. For that reason, I've run some numbers that show how some MLPs trade from the prior close to the open and then to the close on the most recent ex-date and for the last 12 ex-dates.

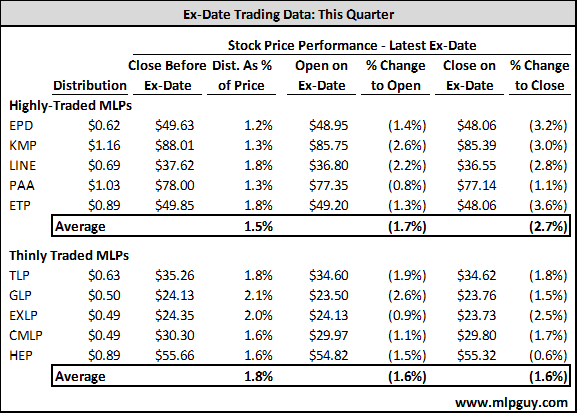

The table below shows that the 5 most actively-traded MLPs opened trading on their most recent ex-dates (all over the last few weeks) opened close to where they theoretically should have, and then traded continued lower throughout the day. For the 5 most thinly traded MLPs (that have paid distributions for 3 straight years), they opened slightly better than they should have, and on average ended the day flat.

So, small caps have held up better on ex-dates and appear to be priced correctly… this quarter. That makes sense, because we have been seeing seeing a rotation out of MLPs in general in favor of other stocks, which is hurting the large cap MLPs more than small caps that carry less weight in the index that the Alerian MLP ETF tracks. Also, small cap MLPs vastly underperformed in 2011, so they are seeing more buyers this year in the search for value in an MLP sector that had gone straight up from October through year end.

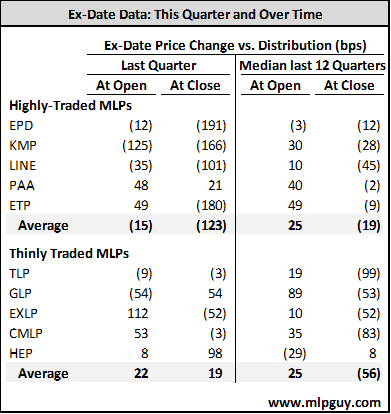

For the 3 year look back below, I highlight the difference between the distribution and the opening and closing prices. The table below shows the same data as above for this quarter, and you can see that the highly-traded MLPs have sold off more than the distribution this quarter. In the right half of the table below, the chart shows little difference between actively and thinly traded MLPs.

In general, it seems like the only noticeable pattern here is that MLPs tend to trade lower from the opening print to closing print on ex-dates. That makes some sense, in that investors may have wanted to sell, but were waiting to get one final distribution before selling, so they would add to the expected technical selling, driving the price down more than is reasonable. So, if you are a day-trader, maybe you short the open. If you are a long term investor, there appear to be opportunities to buy oversold MLPs on ex-dates.

Hinds Howard, MLP HINDSight