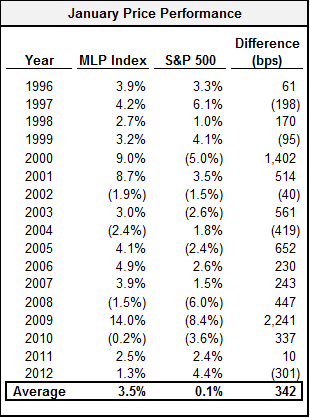

The outperformance for January relative to other months can be accounted for with two seasonal factors:

- First, the 4 best months for MLP prices have been the first month of each quarter (January: average return 3.5%, March: 2.4%, July: 2.4%, October: 1.5%). I believe this is a result of the distribution cycle. Most distributions are paid at the beginning of the second month of each quarter, so there is usually buying in advance of distribution payouts (and selling afterwards).

- Second, January specifically gets a boost from tax loss related selling in December and pent up buying from rebalancing at the beginning of each year.

While MLPs are up, it doesn't feel great when the S&P 500 is up 4.4% during the same time, when on average the MLP Index has outperformed the S&P 500 in January by an average of 342 basis points since 1996. However, 2012 at -301 basis points is not the weakest showing ever; in 2004 the S&P 500 beat the MLP Index by 419 basis points. MLPs finished 2004 with 16.7% total returns, which I think we'd take this year.

This year marks the 5th January out of 17 that MLP Index has under-performed the S&P 500 for January. Again, this is more a virtue of the MLP Index usually outperforming the S&P 500 on any given month than a January-specific issue. In 2 of the previous 4 instances (1999 and 2002), the MLP Index finished with negative total returns for the full year, so that doesn't tell us much.

Also of note, February has been the second worst month in terms of average price change over the years at -0.79%, so stay on your toes.

I'll have more on individual MLPs later this week, but Capital Products Partners (CPLP) is in the lead at the 1 month checkpoint with +28%, and Inergy (-22%) is being lapped by everyone. Those are two MLPs I don't have in my portfolio and probably won't this year, too volatile for me. The top performing MLPs each year tend to really hurt you stomach if you own them, because of how much they bounce around.

I think the smarter play in the MLP space is to have more winners than losers. So, it's nice to see CQP up 17%, EXLP up 16% and NKA up 15%, but I'm fine holding NGLS and ETE (each up 5% so far this year).

Disclosure: The information in this article is not meant to be financial advice, we are not your financial advisor and I am posting my comments for informational purposes only. Long ETE and NGLS.

Hinds Howard, MLP HINDSight