You may also be aware of my many writings and interviews on the supply-demand fundamentals of copper, the metal with a "Ph.D. in Economics." Copper is the one commodity that most directly reflects the near- and mid-term health of the world's economy.

The modern copper industry started in the early 1900s with advent of large, mechanized open pit mines that could mine lower grades through economies of scale. Development of these mines was coincident with the demand for and delivery of electricity to the industrialized world. Copper cable and wire is necessary for efficient transmission of electrical power and remains the main use of the metal.

Most of the easily exploited surface deposits of copper were discovered long ago. For many decades now, explorationists have depended on indirect surface geology clues, subsurface geophysics, geochemical sampling, and remote sensing to target and discover new economic deposits of copper that do not crop out. Increased exploration over the past eight years has resulted in discovery of major new resources, but long lead times to development and mining continue to hamper primary supply. The copper market will be "tight" for the foreseeable future.

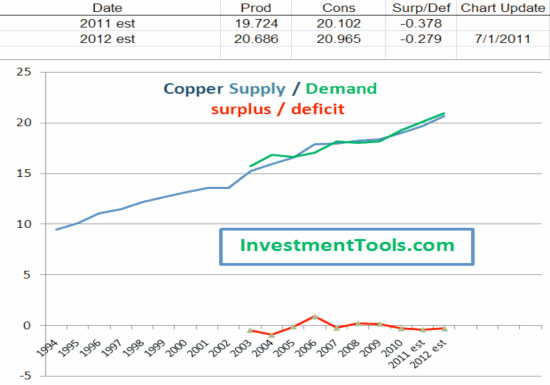

As geologists and engineers, we simply are not finding, developing, and mining enough copper to meet future projections of 4% growth year over year. The world currently uses about 20 million tonnes (Mmt) of copper a year, mine production is flat at about 16.5 Mmt, and the growing shortfall is made up by increased recycling of scrap. Most of the increased demand will come from rapidly growing middle classes in the BIIC countries, and this bodes well for the near-, mid-, and long-term price of copper.

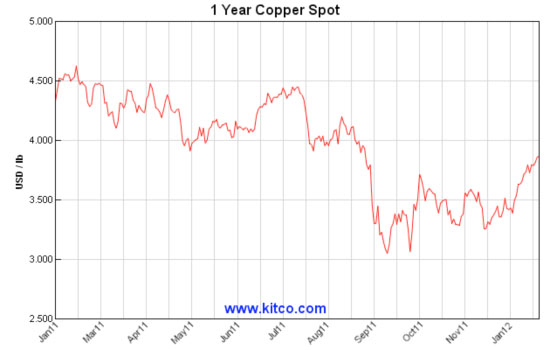

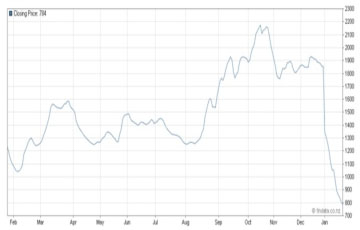

With worldwide economic uncertainty and uneasiness, Dr. Copper wasn't feeling so well during the last half of 2011; he was not really sick but certainly was a bit mixed up and had a lingering case of the blahs.

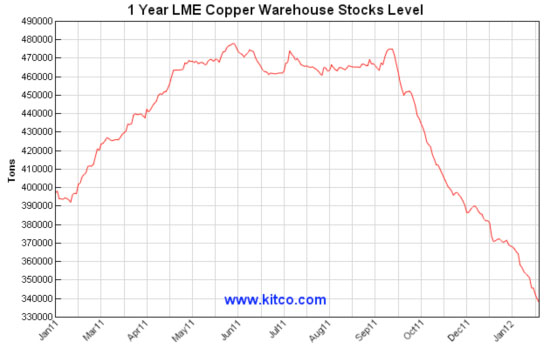

Despite less than robust supply and demand fundamentals, copper set all-time high price marks in the first half of 2011. I pointed to the dichotomy of rising inventory stocks and prices at the beginning of last year, commented that market fundamentals were unhealthy, and boldly predicted a correction.

We indeed saw some momentary dips in the mid-spring and mid-summer that shaved about 15% off an overbought market, but for the most part the red metal train kept rolling along. The much needed and long overdue correction finally came in early September for all resource commodities, when fears of the euro debt crisis resulted in a broad selloff in all speculative markets. Copper was predictably among the hardest hit with its persistently weak short-term fundamentals:

Since that precipitous four-week fall of nearly 30%, copper bounced off a low of $3.05/lb twice, hit a high spike of $3.75/lb, and until recently has been range-bound between $3.30 and $3.60/lb. It is showing renewed strength since the first of the year, with the latest spot copper close at a five-month high of $3.87/lb.

Let’s review the basics of copper supply and demand in 2011. Certain fundamentals supported copper’s all-time high prices, others reflected the Q3 correction and partial recovery, and a couple continue to confound the commodities crowd:

- Supply and demand have been essentially balanced for the past four years. As a result copper price has been sensitive to both supply disruptions (e.g., mine strikes, accidents, and infrastructure failures) and demand destruction (e.g., economic downturns and natural disasters). In 2011, we saw significant disruptions in copper supply, largely due to strikes at major mines in Indonesia, Chile and Peru.

Copper Production, Consumption and Balance in Millions of Tonnes

- Warehouse inventories represent surplus copper that is stored for want of an immediate buyer. In a normal supply-demand scenario, rising inventories are negative and falling stocks are positive for the near-term copper price.

However, for much of 2011 there was a disconnect in this key metric as copper prices rose from late November 2010 and into Q111, while London Metal Exchange (LME) inventories increased. High prices were maintained along with high inventories through the late summer. Subsequently, the 30% correction in September occurred along with rapidly falling LME inventories. This abnormal behavior has corrected recently as prices have rebounded while inventories continue to fall.

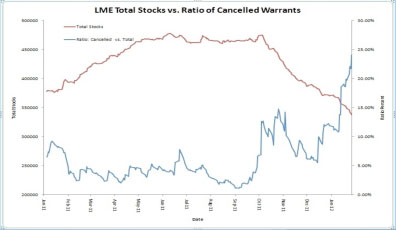

Concomitant with falling inventories, there has been a steep rise in cancelled warrants. Cancelled warrants represent copper that is scheduled for delivery and leaving warehouses. These have gone from yearly lows of 1-2% during the market correction to a current high of 24%:

The charts show persistently strong prices, high warehouse inventories and low cancelled warrants in the first eight months of 2011. It is now apparent that Chinese speculators and hoarders, including the infamous pig farmers, went on a massive selling spree during this time. As the correction came and went and the price stabilized, these same speculators were likely restocking their hoards.

This hypothesis is backed by recent jumps in Chinese demand for November and December. Additionally, recent Shanghai premiums to North American spot prices have been high.

However, plummeting prices for the Baltic Dry Index indicates that worldwide demand for industrial materials has been weak since the first of the year:

Baltic Dry Index One-Year Chart

Chinese tightening of monetary policy in 2011 was designed to cool off an overheated and speculative housing market and higher inflation, especially in foodstuffs. Food inflation is problematic for the country’s poor who spend up to 50% of annual incomes feeding their families. GDP growth slowed significantly in 2011 but still remained at a robust 9%.

According to the International Copper Study Group, Chinese imports were down 21% for the first 10 months of 2011. However, they bounced back significantly with December imports of refined copper reaching the second highest total on record at 344,000 tonnes. Although 2011 copper demand in China was off 5%, worldwide demand was up about 2%, and mine production was off 3%.

Increased recycling of scrap stimulated by record high prices satisfied the shortfall. The world copper market remains in a delicate supply/demand balance with mine production stagnating and scrap market supply satisfying increased world consumption.

January 23, 2012 marked the beginning of the 15-day Chinese Lunar New Year celebration, a period typically accompanied by much lower industrial activity and reflected in the abnormally low Baltic Dry Index. The strength of the copper price over the past week bodes well in the near-term as Asian traders and speculators return to markets in early February.

Despite 2011's mixed and conflicting signals, it appears that the copper market's fundamental indicators have largely returned to normalcy in early 2012. Lower warehouse inventories and increase in cancelled warrants are usual indicators for strong and rising near-term prices. On the other hand, the slowing Chinese economy and the plummeting Baltic Dry Index are negative indicators for industrial demand.

Taking all the various factors into account, I am bullish on the copper price in the near term. A general range of $3.50-4.00/lb in 2012 will provide high margins for producers and stimulate mine production, scrap sales and capital finance requirements for mine development. Prices near the recent bottom at $3.05/lb will result in supply destruction, particularly in the scrap market, while prices higher than $4.00/lb will lead once again to selling by speculators as we saw in the first half of last year.

The old adage "The cure for high prices is high prices" works equally well for low prices. Although copper is among the most speculative of commodities markets, it remains the best indicator of global economic sentiment and supply/demand fundamentals.

In the long run, we will continue to use more copper worldwide every year than we are discovering in new deposits and developing into new mines. Therefore, I remain a long-term secular bull for copper as the citizens of emerging market countries demand electricity, modern-day transportation, and the myriad of consumer goods and conveniences that we view as necessities in the developed world.

After a rough turn for the past few months, I think Dr. Copper is looking quite well and toward a very bright future.

Ciao for now,

Mickey Fulp, Mercenary Geologist

Acknowledgements: Erin Ostrom edits my writings. James Tabinsky compiled data on warehouse inventories and cancelled warrants.

The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a bachelor’s degree in earth sciences with honors from the University of Tulsa, and master’s degree in geology from the University of New Mexico. Fulp has over 30 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe and Asia.

Mickey has worked for junior explorers, major mining companies, private companies and investors as a consulting economic geologist for the past 24 years, specializing in geological mapping, property evaluation and business development. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile and British Columbia.

Mickey is well known and highly respected throughout the mining and exploration community due to his ongoing work as an analyst, writer, and speaker.

Contact: [email protected]

Disclaimer: I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a report, commentary, this website, interview, and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company’s website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview, and other content is subject to change without notice, may become outdated, and will not be updated. A report, commentary, this website, interview, and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.com LLC.

Copyright © 2012 MercenaryGeologist.com. LLC All Rights Reserved.