In 2011, junior miners were shunned, but Global Resources Fund (PSPFX) co-portfolio managers Evan Smith and Brian Hicks pointed out to me this week that we're beginning to see signs of small-cap strength.

This chart compares the performance of the S&P TSX Venture Index (TSX), which holds a basket of junior resources stocks, to the returns of the Morgan Stanley Commodity Related Index (CRX). You can see that the junior stocks began to outperform around July 2010 and carried that momentum over a period of six months, reaching a high in March 2011. That’s when investor took a turn for the worse and volatility began picking up, sending the TSX tumbling compared to the CRX.

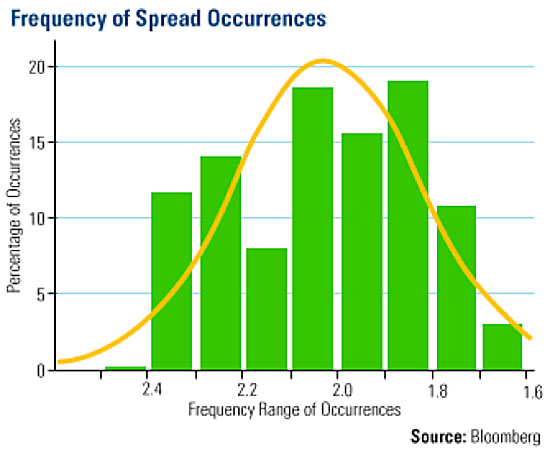

The TSX versus the CRX measure hit a low on Dec. 14, well below the historical average. In technical terms, the Dec. 14 level was 1.37 standard deviations below the two-year mean. Small caps have only received this level of punishment a little more than 10% of the time over the past two years.

If we assume a reversion to the mean—which means these junior stocks would return to the two-year normal range—small caps could outperform large caps by 20%. This bounce back could have a big impact on the Global Resources Fund because of its junior resources holdings.

Recent events have driven the outperformance of riskier investments—we've discussed two of the three recently. Emerging market countries including Brazil, India and China have switched from a tightening mode to an easing cycle, which generally has had a positive effect on the markets. For example, when China lowered its required reserve ratio, there was a record increase in M-2 money supply shortly after.

Also, the JPMorgan Global Manufacturing Purchasing Managers’ Index crossed above the three-month moving average. Going back to 1998, there have only been 20 times this event has occurred, and each time, it has been associated with higher prices for oil, copper, materials and energy.

In December, the European Central Bank began its Long-Term Refinancing Operation (LTRO) program, offering banks three-year loans at a discount. LTRO has helped to reassure markets and boost equities.

From a technical perspective, the TSX is now above its 50-day moving average, which may be self-fulfilling and could help attract money flows to this area of the market.

Frank Holmes, U.S. Global Investors

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in a specific industry, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

The Morgan Stanley Commodity Related Index (CRX) is an equal-dollar weighted index of 20 stocks involved in commodity related industries such as energy, non-ferrous metals, agriculture, and forest products. The index was developed with a base value of 200 as of March 15, 1996. The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index. The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

M2 Money Supply is a broad measure of money supply that includes M1 in addition to all time-related deposits, savings deposits, and non-institutional money-market funds.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.