This month we review a gold juniors merger in the making. It involves two Canadian-focused explorers we have mentioned in the past, and which we put in the same room for reasons outlined in the review. We are in an environment of high metal pricing, by historic standards, but weak risk appetite. Combinations like this that pool talent in a busy sector plus complimentary assets may become more common. They can lower risk in even early phase stories.

Generally speaking, we are a little less cautious and a little more optimistic. At a minimum, we expect gains to be more notable gains later in the year.

2012 has started out stronger than many were predicting. Granted, the year is only two weeks old but some bullets have already been dodged. Some credit for this should go to new European Central Bank (ECB) head Mario Draghi. He's been a calm hand on the tiller so far.

The ECB operates under many policy constraints. Germany's Bundesbank had heavy influence over the ECB's core mandate and it's a Teutonic one indeed, with inflation control and price stability as its sole remit.

Former ECB head Jean Claude Trichet followed the mandate closely until last year, when he became more proactive. Trichet still stuck to the script but became more creative in interpreting it. His frustration with the European political class also became more evident as he neared the end of his tenure.

Trichet was ahead of the curve in raising interest rates twice, and too slow to reverse the increases, but he recognized the danger of a liquidity crunch in the banking sector. Opening the lending window when he did in 2009 gave the Eurozone banking sector some breathing room. Unfortunately, that respite wasn’t taken advantage of to clean up balance sheets in any meaningful way.

Draghi took over the ECB on November 1 and started to make changes quickly. The first ECB governing meeting after he started the job marked the first cut in ECB rates in two years. The real impact of the rate cut was psychological. The message was sent that the new head of Europe's central bank would do as much as he could while still staying within ECB mandate.

Draghi has generally agreed with the party line when discussing things like Eurobonds, which Germany still flatly refuses to consider. He has gotten considerably more creative when it comes to dealing with bank liquidity issues however.

In December, Draghi introduced the first three-year refinancing operation for euro-area banks. The facility allowed qualified institutions (basically any euro-area bank) to borrow from the ECB at a zero interest rate for a three-year term. Banks are required to put up collateral, normally holdings of sufficiently high-grade sovereign bonds.

The facility was expected to total about 150-200 billion (B) euros. The market was shocked when the loan total came in at close to €500B.

Banks needed the funding. Euro-area banks hold large amounts of medium-term debt that has to be rolled over before the end of 2013 and many of the larger ones are being pressured to increase reserve ratios and tier one capital.

So is this the euro version of quantitative easing (QE)? Not exactly, though it looks like it if you squint. Quantitative easing is the creation of money out of thin air by a central bank for asset purchases. The ECB didn't (and probably won't) take that step, which would directly contravene its price stability mandate. Draghi gets around that by setting up loan facilities. When banks pay the loans back in three years (assuming they do) the ECB balance sheet would shrink again.

There would and should be some monetary expansion if the banks are taking these funds and relending them. Traders treating the lending facilities as money printing are one reason for the euro's recent weakness.

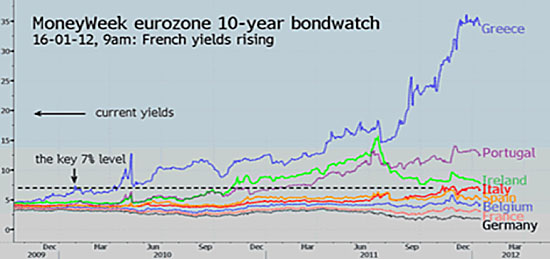

A more important side effect can be seen in the charts above and below. The chart above shows 10-year yields for the main Eurozone countries. The scale is exaggerated because of Greece, but even at this scale you can see rates, which were running higher start to peak and drop off after Draghi announced the credit facility in early December.

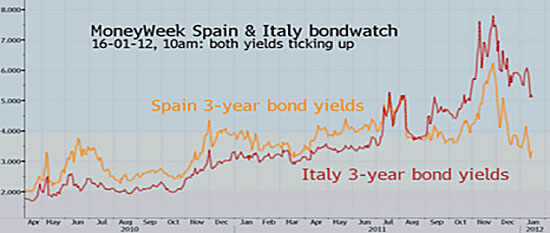

The chart below is shorter term and deals only with the three-year yields for Italy and Spain. The effects of the refinancing operations are much more obvious at this scale. By the end of November things had spun out of control. Yields were spiking higher and jawboning by politicians across the European Union (EU) was having exactly zero impact on the yield curves.

The impact of the credit facility, on the other hand, has been dramatic. It's helped to thaw the interbank lending market and some of it at least seems to be going into the sovereign debt market at well. Draghi has noted that there are drops in money on deposit with the ECB on days when member states were holding bond auctions.

The implication is that some of these funds are being used to buy new sovereign bond issues. These bonds can be used as collateral for the ECB credit facility. There is little doubt this is part of what Draghi was hoping would happen though the health of the interbank market itself was a major concern.

Spain and Italy both sold bonds last week at roughly half the yield they had to offer to attract funds in December. Bids to cover ratios were also significantly higher than later in 2011, indicating generally stronger demand.

None of this makes the debt and deficit issues go away, but lower rates can help buy time and that is really the name of the game right now. For most EU members and large European banks this is more a liquidity issue than a solvency issue. Being able to rollover debt and issue new paper at half the interest rate is a huge help.

Note that we said it's a liquidity issue for "most." For Greece it is very much about solvency and liquidity operations won't be much help. Greece needs a big debt write-off. Period. That was still being argued as this was written and there is real potential for it to end badly.

The biggest outlier on the chart above is actually Ireland. It too is indebted to the point that it became a solvency issue. Ireland's issue was a real estate bubble that wiped out its largest banks that the government felt obligated to rescue. Its fiscal situation was dire and it will take a long time to fix. Unlike Greece however, the government and people of Ireland have made a lot of tough decisions to cut spending and the markets are taking them seriously.

Ireland's yields have dropped 50% since midyear. While we're leery of the short-term economic impacts of hard austerity programs, there are several countries that need to undertake them. Ireland is proof the market will respond to a county's efforts if they are serious and focused.

In the mist of these market changes S&P announced debt downgrades to a large number of EU states, notably France, as well as a rating cut for the European Financial Stability Fund (EFSF). It's the last that was the largest concern.

S&P had telegraphed most of the other rating cuts, including France, and the markets took the changes in stride. All three major rating agencies have seen their market credibility diminished after the subprime crisis. They are viewed correctly as being behind the curve most of the time. The other two major bond raters, Moody and Fitch, haven’t said what they would do, though Fitch indicated it didn't plan on downgrading France.

Both France and the EFSF carried out bond issues right after the downgrades. France sold bills at better yields than last month and the short-term EFSF bills were little changed.

None of the foregoing is going to change the drive for greater government austerity by northern Europeans. That austerity will take its toll on this year's EU growth rate. How much of a toll will depend on how much slack gets picked up by the private sector and consumers to replace lost government expenditures.

The combination of ECB actions and market fears should help to ease things here too. Recent investor surveys in Germany have shown the largest one-month improvement in years and confidence surveys have also improved. Most economic stats have been better than expected in the EU, though few doubt there will be some contraction this year at least. It may be less severe that expected though if consumers in Europe continue to cheer up. One side benefit of the uncertainty is the large drop in the Euro. Germany is the world’s strongest export economy next to China. Getting a 10% discount on its currency is a good thing.

Gold and Copper

The euro discount is helping German exporters but didn't do the gold price any favors. Gold has seen a nice bounce in the past two weeks, aided by Iranian saber rattling.

The euro could see more weakness if the economy gets worse or traders convince themselves the ECB's ultimate aim really is printing euros. Draghi plans another lending facility in February and if it's another big one that might generate euro selling.

Notwithstanding the euro, gold has seen heavy physical buying with strong demand from Asia and from ETF buyers. Copper has also gotten an assist from China. Beijing announced above consensus growth numbers for Q4. It was sort of a Goldilocks number; strong enough to allay fears of a hard landing but weak enough to generate hope that Beijing would open its wallet and start spending heavily. Strike activity has kept copper warehouse stocks on a downtrend. LME stocks are sitting at the 350kt level they bottomed at in 2010. More drawdowns should be supportive of copper prices.

Gold managed not to enter a "bear market" and has seen a good bounce. More good news from Europe and stronger markets that generate more risk on trading can both help it. The amount of physical and ETF demand as gold prices neared a 20% drop was impressive. Traders are still very much "buying the dip," which is classic bull market behavior.

Stocks

Equity markets are looking less classic, but they have advanced much further than many seem to think. The bottom for U.S. markets followed the debt-ceiling debacle and they have been climbing by fits and starts since. Large U.S. indices have now reached levels they last saw in July.

Unscientific as this may sound this simply feels like a market that wants to go up. It's felt that way to us for over a month. Recent trading activity and economic numbers have simply strengthened that impression. It would not take a lot of good news to start the next leg up.

Things have been tougher in the junior space, but trading is constructive. We've been seeing strong volume on some of the most beaten down stocks. This may be tax-loss sellers repositioning, which is the first step to recovery. More high volume days are needed but a spring rally still looks like a strong possibility to us.

David Coffin and Eric Coffin, HRA Journal

HRA Advisories is pleased to host the inaugural Toronto Subscriber Investment Summit on March 3, 2012 in Toronto. This subscriber-only event is intended to provide you with expert insight into today's resource market, as well as some of the most active public companies in the industry today. Don’t miss out on this exclusive event! For more details please go to: http://www.hraadvisory.com/summit_2012.html

The HRA-Journal, HRA-Dispatch and HRA-Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

©2010 Stockwork Consulting Ltd. All Rights Reserved.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071; 1-877-528-3958

[email protected] / http://www.hraadvisory.com