Gold entered a bear market in late 2011, which was confirmed by gold's closing below its historically significant 30-week moving average. This doesn't happen very often, which indicates the technical significance of the event. The last time gold violated its 30-week MA was in 2008 during the credit crisis and it hasn't happened since then as you can see in the following chart.

A violation of the 30-week MA doesn't tell us how long the bear market will last or whether it will result in significantly lower lows. It only tell us that bear market conditions are underway and to be wary of market conditions as long as the gold price remains under this important moving average.

Gold and silver have both been under pressure ever since a series of margin requirement increases by the CME in 2011. This ran out the speculative element among retail traders and it also discouraged hedge funds from running the metal prices higher. Savvy market veterans saw this move coming. George Soros, the billionaire hedge fund guru, reduced by 99% his holdings of the yellow metal in the first quarter of 2011. Top hedge fund manager John Paulson also sold gold last year according to exchange data.

The rationale behind gold's slide in the last four months of 2011 is the ongoing concerns of investors concerning the financial crisis in Europe. This led to a large scale selling of assets, including gold and silver, in a concerted bid to raise cash. The demand for cash in the final months of 2011 was reflected by the rally in the U.S. dollar index, which established a short-term uptrend in the months of November and December.

As we saw most recently in 2008, credit panics always result in liquidation and even the traditional safe haven of gold isn't immune from such financial shocks. Cash is king in a deflationary crisis as everything that can be converted into dollars is sold. The European debt problem hasn't degenerated into a full-fledged collapse yet, however, so it's clear that investors have been premature in liquidating hard assets. Perhaps this is a case of investors remembering the pain of 2008 and avoiding the yellow metal on the assumption that the coming months will witness a repeat of the credit crisis of '08. Regardless of the reason, gold and silver haven't yet benefited from the problems in Europe and instead investors have bypassed the precious metals and have flocked to the dollar.

Geopolitical and economic concerns aside, the best chance for a metal and mining stock recovery in 2012 is for a rebound in monetary liquidity. Some analysts are optimistic about gold in 2012, in anticipation of a boost to the metal's demand from bond buying measures by the U.S. Federal Reserve and the European Central Bank. The median estimate in a Bloomberg survey of 44 traders and analysts is for gold to rally as much as 37% in 2012 to $2,140 an ounce. This may be an overly optimistic assessment, however, especially if the Eurozone crisis escalates in the months ahead.

Gold's best chance for success should occur when the European debt drama has been aggressively dealt with by Europe's central bank and political leaders. Once investors' nerves have been calmed over the eurozone debt drama we should see a reversal of the intermediate-term downtrend in gold and silver. This will occur when central bankers are finally able to coordinate a monetary stimulus designed to bolster the euro and stabilize the bonds of the major eurozone countries.

Short-term, whenever gold opens the New Year with a rally it tends to follow up that rally until around mid-month before pulling back and sometimes through the end of the month. This happened in the Januarys of 2002, 2003, 2004 (abortive), 2006, 2008 and 2010. In all the other years since the bull market in gold started in 2001, gold started the New Year on a down note and usually ended up following through with a down move until at least February.

Based on this historical pattern gold has started the New Year on a positive note and could follow up with a series of higher highs. Keep in mind, however, that in all the previous winning years just mentioned gold was in an interim bull market above its rising 150-day (30-week) moving average. Entering 2012 gold is below the 30-week MA as already discussed. This puts gold at a technical disadvantage as compared to previous years but the yellow metal is still probably oversold enough on a short-term basis to allow for a test of the 30-week MA. In the SPDR Gold Trust ETF (GLD), our proxy for gold, the 150-day/30-week moving average intersects the 163 level in the daily chart.

U.S. Economy

Looking beyond the yellow metal, the year 2012 is shaping up as a critical one for the U.S. retail economy. With the eurozone crisis still looming, there is a real possibility that U.S. domestic retailers could enter recession at some point during the year. Let's start by discussing the recent retail sales season.

The 2011 holiday sales season was saved by deep discounts by the retailers according to results released last Thursday. Although overall retail sales numbers were good for the Christmas shopping season, the bigger picture suggests retailers could have a tougher sales climate in 2012.

Sales at stores open at least a year at major retail chains rose 3.4% compared with December 2010, according to data compiled by Thomson Reuters, just above the 3.3% that analysts had expected.

The improved sales came at the cost of deep discounts, however. Profits "were a mess" for many retailers, said Paul Lejuez, an analyst at Nomura Equity Research. Consumers were buying less than retailers had expected, and stores had to mark down inventory to get it out the door by Christmas.

Writing in the New York Times, Stephanie Clifford observed, "The results show the American consumer has not bounced back from the recession." Consumer spending accounts for the largest portion of the economy but flat incomes and a soft job market pressured retailers in 2011.

"Retailers came in with pretty conservative assumptions, and they were hoping to blow them out of the water — they really didn't," said David L. Bassuk, managing director and head of the retail practice at AlixPartners, a consulting firm. Retailers were resorting to promotions like " '50% off our whole store,' '60% off our whole store,' which is when you can see times are tough," he said.

One analyst quoted by Clifford stated that "there's not enough room for all the retailers of old" and that the New Year would probably bring "closing of stores and, I think, closing of retailers," he said, adding, "It's a more dire situation than many had anticipated."

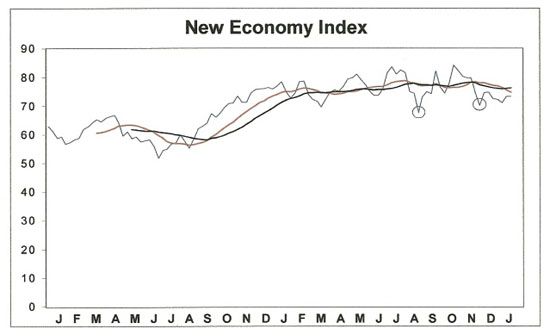

Now let's turn our attention to the New Economy Index (NEI). This is an important index to monitor since it is an excellent leadnig indicator for the U.S. retail economy. This index is simply an average of the weekly closing stock prices of five of the most economically sensitive stocks that also represent the main segments of the retail economy. The components are: Wal-Mart, Fed-Ex, Monster Worldwide, Ebay and Amazon.

NEI predicted that the November-December sales season would be a good one overall. As I wrote in early December, "NEI is still in a rising trend and confirms that the domestic retail economic outlook is positive through the balance of 2011. December should witness the best retail sales season the U.S. has seen since before the credit crisis began in 2007."

When the NEI is making lower lows with the 12-week (red line) and 20-week (black line) moving averages in decline, the intermediate-term (4-9 month) retail outlook is bearish and this means retail sales will eventually decline. Here's what the NEI looks like as of Friday, January 13.

The 12-week moving average has crossed below the 24-week MA as of Jan. 13 as you can see here. This is the first step on the path of a negative retail outlook but it won't be confirmed until the 24-week moving average turns down and the NEI price line falls under its nearest pivotal low (circled). The latest reading of the New Economy Index suggests that while the U.S. retail economy is hanging on by a proverbial thread it hasn't turned bearish just yet.

Gold & Gold Stock Trading Simplified

With the long-term bull market in gold and mining stocks in full swing, there exist several fantastic opportunities for capturing profits and maximizing gains in the precious metals arena. Yet a common complaint is that small-to-medium sized traders have a hard time knowing when to buy and when to take profits. It doesn't matter when so many pundits dispense conflicting advice in the financial media. This amounts to "analysis into paralysis" and results in the typical investor being unable to "pull the trigger" on a trade when the right time comes to buy.

Not surprisingly, many traders and investors are looking for a reliable and easy-to-follow system for participating in the precious metals bull market. They want a system that allows them to enter without guesswork and one that gets them out at the appropriate time and without any undue risks. They also want a system that automatically takes profits at precise points along the way while adjusting the stop loss continuously so as to lock in gains and minimize potential losses from whipsaws.

Clif Droke is the editor of Gold & Silver Stock Report, published each Tuesday and Thursday. He is also the author of numerous books, including most recently, Gold & Gold Stock Trading Simplified. For more information visit www.clifdroke.com.