January historically has been the best month for MLPs, with a median return of 3.5% over the last 15 years. On an individual retail investor level, you can understand why, beyond annual portfolio rebalancing. There is a tangible benefit to waiting to buy MLPs until the calendar year ends. If you buy an MLP or rotate from one MLP to another in mid-December, you have to fill out an additional K-1 for this year’s tax return. If you wait until January, that additional K-1 (and any tax impact from the sale) gets delayed an extra 12 months.

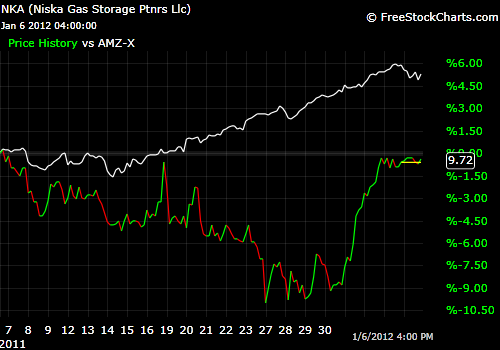

If you were watching MLPs trading the last few days of December, you could see the pent up demand building. It was easy to buy names like NKA, OXF and BWP as they stumbled into the end of the year, even as the MLP Index and leaders from 2011 marched higher. But all of a sudden this week, the laggards from the last month gapped up. See below 30 day chart for NKA, that looks very similar to the others above.

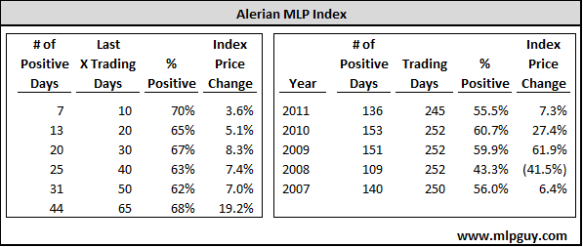

For the large cap MLPs (and therefore for the MLP Index), this first week was a continuation of the last 90 days (with the exception of Friday, more on that below). After bottoming on October 4th MLPs have been on fire, up nearly 20% as a sector. The chart below highlights how many days have been positive for the MLP Index across various time periods. It shows that in the 65 trading days since October 4th, MLPs have been up 68% of the days.

Above 65% over any substantial amount of time is unsustainably high when compared with the last few years. In 2010 and 2009, the MLP Index was positive around 60% of the trading days, during two very strong (and probably not repeatable) years. The bottom line is don’t expect this euphoric pace to continue for the next 12 months.

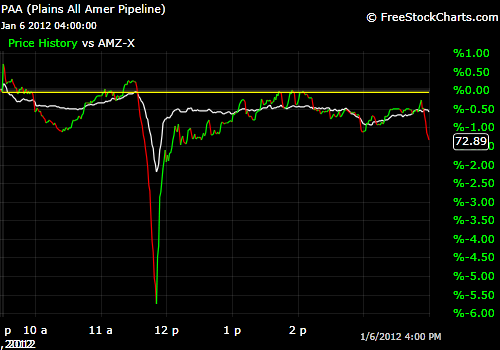

Drop and Pop—MLP Mini Crash

At around 11:30 am on Friday, several large cap MLPs began selling off on large volume. Can’t really be sure what happened, but it appears a massive (and possibly erroneous) sell order, potentially in Plains All American, triggered the selloff. PAA dropped more than the other significantly affected MLPs (like EPD, EEP, MMP). That massive sell order triggered stop losses and triggered program sell orders in related MLPs, sending other large caps down sharply for a half hour or so. PAA went from being up 0.2% on the day at 11:30 to down 6.0%, a drop of more than $4.50 per unit in a matter of a few minutes. PAA recovered and finished the day down only 1.3%.

The mini crash received a lot of press for something that happened in the MLP sector, including the two articles below.

- Article at Financial Times with a quote from me—Energy Security Sell-off Worries Traders

- Article at WSJ’s Market Beat - Curse These Sausage Fingers: Plains All American Pipeline Edition

It was fascinating to see the situation unfolding on Twitter and Stocktwits. More people are following the MLP sector than ever before, which becomes very clear when something like this happens, and all of a sudden for a few minutes, everyone is talking about MLPs (or at least more than I thought paid attention or cared). I welcome the ever growing awareness of MLPs in mainstream investing media, but am also wary of too much excitement pushing values up too high too fast. . .

Hinds Howard, MLP Hindsight